RESEARCH BY GLOBAL PALLADIUM FUND REVEALS BENEFITS OF USING BLOCKCHAIN FOR THE INVESTMENT MANAGEMENT SECTOR

The biggest impact of using blockchain in the investment management sector will be the improved security it brings.

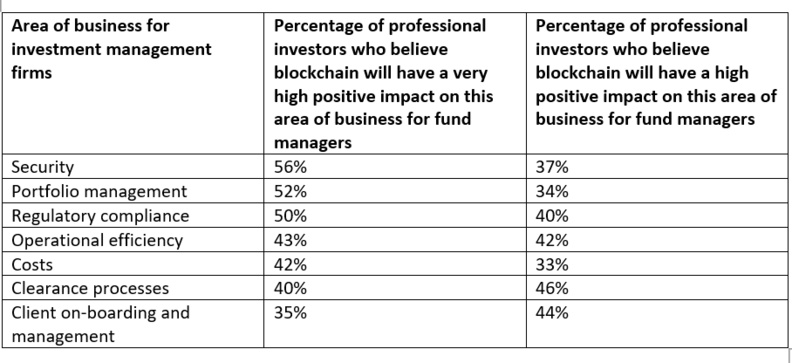

New research (1) with institutional investors and wealth managers reveals that 56% believe the impact of blockchain on improving security measures will be ‘very high’ and a further 37% say it will be high.

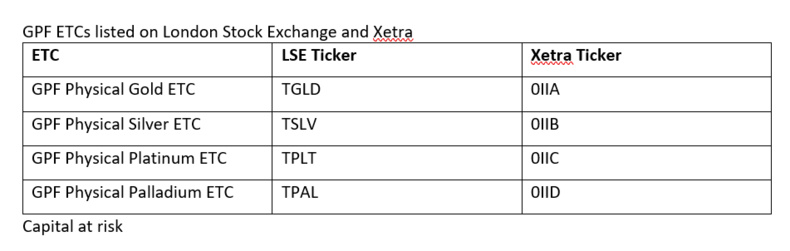

The study is from Global Palladium Fund (GPF), which recently listed four metal Exchange Traded Commodities (ETCs) and is the first ETC provider to use Blockchain technology to record bar information into Distributed Ledger Technology thereby providing an extra layer of security and proof of ownership to the Issuer. The use of Blockchain is in addition to the traditional recording processes used by the custodian.

When asked about the technology’s impact on other areas of the investment management sector, 52% of professional investors say it will be ‘very high’ on portfolio management, and this is followed by 50% who say this is about supporting regulatory compliance, and 43% who cite this when asked about improving operational efficiency. Overall, 42% say blockchain’s impact on reducing costs will be ‘very high.’

The biggest impact of using blockchain in the investment management sector will be the improved security it brings.

New research (1) with institutional investors and wealth managers reveals that 56% believe the impact of blockchain on improving security measures will be ‘very high’ and a further 37% say it will be high.

The study is from Global Palladium Fund (GPF), which recently listed four metal Exchange Traded Commodities (ETCs) and is the first ETC provider to use Blockchain technology to record bar information into Distributed Ledger Technology thereby providing an extra layer of security and proof of ownership to the Issuer. The use of Blockchain is in addition to the traditional recording processes used by the custodian.

When asked about the technology’s impact on other areas of the investment management sector, 52% of professional investors say it will be ‘very high’ on portfolio management, and this is followed by 50% who say this is about supporting regulatory compliance, and 43% who cite this when asked about improving operational efficiency. Overall, 42% say blockchain’s impact on reducing costs will be ‘very high.’

When it comes to automating sales through smart contacts, 63% of professional investors interviewed said the impact of blockchain will be very high, and a further 25% said it will be high.

Alexander Stoyanov, Chief Executive Officer of GPF said: “Blockchain can have a huge positive impact on every aspect of an asset manager’s business. Increasingly, having blockchain at the centre of their operations, will become as important for fund managers as the investment strategies they employ. For example, provenance is becoming the centre of attention in commodities markets, and we are proud to be the first ETC issuer to be using blockchain to record metal bar ownership thereby demonstrating its practical applications to investors.”

Timothy Harvey, Chief Executive Officer and Founder of NTree, said: “Blockchain will have a huge impact on the way asset managers run their businesses. It will be a source of competitive advantage for the early adopters, which means that is likely to be a feature of the industry landscape relatively quickly.”

Global Palladium Fund’s (GPF) has four new metal ETCs (gold, silver, palladium and platinum) listed on the Deutsche Börse and London Stock Exchange. They have the lowest charges with total expense ratios (TER) ranging from 0.145% to 0.20%. Targeting Family Offices, wealth managers, institutional and other professional investors, the new physically-backed gold, silver, platinum and palladium ETCs will track the spot price of the respective metals they cover.

GPF’s new ETCs have a strong focus on ESG. LBMA-approved metal will be sourced from producers and suppliers who support the Sustainable Development Goals of the UN 2030 Agenda and other global initiatives in sustainable development and responsible mining.

NTree International Ltd, a specialist in marketing, distribution and investor engagement, is leading the distribution and rollout of Global Palladium Fund’s new metal ETCs. NTree has set up a dedicated brand, Metal.Digital as an education resource for professional investors with a focus on metals.

Notes to editors:

(1) Global Palladium Fund commissioned the market research company Pureprofile to interview 100 professional investors – 50 institutional investors and 50 wealth managers – across the UK and Germany. The survey was conducted online in January 2021.

Sustainably sourced

Good Delivery Rules’ set by LBMA, LPPM, and LME for precious and base metals are universally acknowledged as the de facto international standard for due to the strict criteria that apply to responsible mining operations and protection of human rights.

LBMA established the Responsible Gold Guidance for Good Delivery Refiners that follows the five-step framework due diligence of the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals.

Global Palladium Fund

The Global Palladium Fund, set up by Norilsk Nickel in 2016, strives to advance the development of world-changing technologies in essential areas such as aerospace, electronics, and the automotive industries to help make the world a better place. In an industry first, GPF is enabling industrial consumers and investors access to a range of metals in a variety of formats, including the ETCs. GPF is proud to be supported by Norilsk Nickel. Its products are in high demand across the globe and it has operations in the Russian Far North, Finland and South Africa.

www.gpf.global

Norilsk Nickel

Norilsk Nickel is the world’s largest producer of palladium, high-grade nickel and a major producer of platinum, copper, precious metals and rare earths.

NTree

NTree provides professional investors with an education and distribution service to access commodities and China through active and passive fund solutions including Exchange Traded Products. It will promote the GPF ETCs, providing investor education and insights into the role and importance of the metals as well as their place in portfolios (please visit www.ntree.co.uk for more details)

(1) Global Palladium Fund commissioned the market research company Pureprofile to interview 100 professional investors – 50 institutional investors and 50 wealth managers – across the UK and Germany. The survey was conducted online in January 2021.

Sustainably sourced

Good Delivery Rules’ set by LBMA, LPPM, and LME for precious and base metals are universally acknowledged as the de facto international standard for due to the strict criteria that apply to responsible mining operations and protection of human rights.

LBMA established the Responsible Gold Guidance for Good Delivery Refiners that follows the five-step framework due diligence of the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals.

Global Palladium Fund

The Global Palladium Fund, set up by Norilsk Nickel in 2016, strives to advance the development of world-changing technologies in essential areas such as aerospace, electronics, and the automotive industries to help make the world a better place. In an industry first, GPF is enabling industrial consumers and investors access to a range of metals in a variety of formats, including the ETCs. GPF is proud to be supported by Norilsk Nickel. Its products are in high demand across the globe and it has operations in the Russian Far North, Finland and South Africa.

www.gpf.global

Norilsk Nickel

Norilsk Nickel is the world’s largest producer of palladium, high-grade nickel and a major producer of platinum, copper, precious metals and rare earths.

NTree

NTree provides professional investors with an education and distribution service to access commodities and China through active and passive fund solutions including Exchange Traded Products. It will promote the GPF ETCs, providing investor education and insights into the role and importance of the metals as well as their place in portfolios (please visit www.ntree.co.uk for more details)

Autres articles

-

CMA CGM adopte l’intelligence artificielle sur mesure de Mistral AI pour booster sa performance opérationnelle

-

Nominations | Ogletree Deakins promeut deux avocats seniors, Marie Paulin et Alexis Borestel, au rang d’Of Counsel

-

Quelles sont les meilleures stratégies de trading forex ?

-

Nomination | Mérieux Equity Partners accueille François Rosenfeld en tant que Partner au sein de l’équipe Innovation

-

Paris Blockchain Week | Dernier jour, le best of des interventions du jour