1. Insurance Technology Market Overview

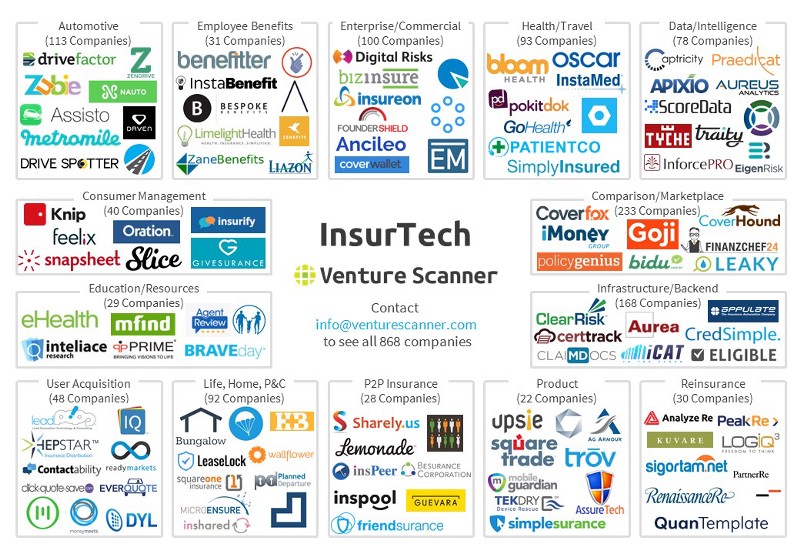

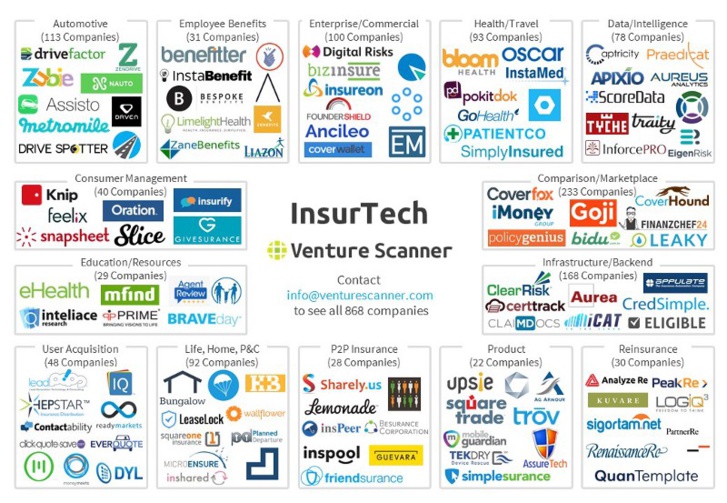

We organize Insurance Technology into the 14 categories listed below:

Auto Insurance: Companies that offer insurance for automobiles and motorcycles, as well as those that facilitate the process of auto insurance. Examples include car telematics products which detect your mileage and driving behavior to customize your insurance plan.

Consumer Insurance Management Platforms: Companies that enable consumers to manage their insurance and claims, usually through a mobile application. Examples include mobile apps that allow consumers to file claims right at the spot of the car accident, and to buy travel insurance on the go.

Employee Benefits Platforms: Companies that help enterprises build or utilize platforms that deliver healthcare and other insurance products to their employees. Examples include web portals through which enterprises can sign in and give their employees the option of buying several healthcare packages.

Enterprise/Commercial Insurance: Companies that offer insurance plans for large/medium/small-sized businesses and enterprises. Examples include insurance plans for startup founders and freelancers, insurance for large enterprises such as liability insurance, and workers compensation insurance.

Health/Travel Insurance: Companies that offer health and/or travel insurance, either for individuals or for businesses. Examples include health insurance plans that are customizable to your exact needs, and travel insurance that can be adjusted based on where you are.

Insurance Comparison/Marketplace: Companies that serve as a marketplace for consumers to buy insurance of any kind (car to home to health), or compare different insurance quotes. Examples include 3rd party companies that don’t offer insurance plans themselves, but act as a brokerage agent between insurance providers and consumers.

Insurance Data/Intelligence: Companies that collect, process, and analyze data analytics and business intelligence for the insurance industry. Examples include background checks on an individual’s history to determine insurance eligibility, or inspections on a real estate property for potential risks.

Insurance Education/Resources: Companies that offer educational material and resources that give information about how insurance works. Examples include news outlets focused on the insurance industry, and community forums that exchange knowledge of insurance between individuals.

Insurance Infrastructure/Backend: Companies that either underwrite insurance policies or help insurance companies with their day-to-day operations. Examples include insurance underwriters, CRM for agents and lawyers, communication tools, and claim filing tools.

Insurance User Acquisition: Companies that help insurance companies acquire and manage new leads and clients. Examples include platforms that are specifically designed for marketing insurance policies to potential customers, and those that record and manage insurance companies’ customers.

Life, Home, Property & Casualty Insurance: Companies that offer life, home, and property & casualty insurance, as well as other kinds of insurance such as renters, disability, and marriage insurance. Examples include websites that offer life, home, and P&C insurance in packages.

P2P Insurance: Companies that offer peer-to-peer insurance, in which a group of policyholders jointly pay for the insurance of an item that they mutually own, share, or rent (such as a car, house, or media equipment). Examples include P2P insurance platforms in which a group of bicyclists jointly buy insurance for all of their bikes.

Product Insurance: Companies that offer insurance and warranties for products that consumers purchase, from tech gadgets to diamonds. Examples include insurance plans for your smartphone in case it is stolen or is broken.

Reinsurance: Companies that provide insurance for other insurance companies. Examples include companies that offer insurers coverage to mitigate and manage their risks.

More:

https://medium.com/@VentureScanner/insurance-technology-q2-update-in-15-visuals-d3ce6864cdbf#.ps6egyw0g

Auto Insurance: Companies that offer insurance for automobiles and motorcycles, as well as those that facilitate the process of auto insurance. Examples include car telematics products which detect your mileage and driving behavior to customize your insurance plan.

Consumer Insurance Management Platforms: Companies that enable consumers to manage their insurance and claims, usually through a mobile application. Examples include mobile apps that allow consumers to file claims right at the spot of the car accident, and to buy travel insurance on the go.

Employee Benefits Platforms: Companies that help enterprises build or utilize platforms that deliver healthcare and other insurance products to their employees. Examples include web portals through which enterprises can sign in and give their employees the option of buying several healthcare packages.

Enterprise/Commercial Insurance: Companies that offer insurance plans for large/medium/small-sized businesses and enterprises. Examples include insurance plans for startup founders and freelancers, insurance for large enterprises such as liability insurance, and workers compensation insurance.

Health/Travel Insurance: Companies that offer health and/or travel insurance, either for individuals or for businesses. Examples include health insurance plans that are customizable to your exact needs, and travel insurance that can be adjusted based on where you are.

Insurance Comparison/Marketplace: Companies that serve as a marketplace for consumers to buy insurance of any kind (car to home to health), or compare different insurance quotes. Examples include 3rd party companies that don’t offer insurance plans themselves, but act as a brokerage agent between insurance providers and consumers.

Insurance Data/Intelligence: Companies that collect, process, and analyze data analytics and business intelligence for the insurance industry. Examples include background checks on an individual’s history to determine insurance eligibility, or inspections on a real estate property for potential risks.

Insurance Education/Resources: Companies that offer educational material and resources that give information about how insurance works. Examples include news outlets focused on the insurance industry, and community forums that exchange knowledge of insurance between individuals.

Insurance Infrastructure/Backend: Companies that either underwrite insurance policies or help insurance companies with their day-to-day operations. Examples include insurance underwriters, CRM for agents and lawyers, communication tools, and claim filing tools.

Insurance User Acquisition: Companies that help insurance companies acquire and manage new leads and clients. Examples include platforms that are specifically designed for marketing insurance policies to potential customers, and those that record and manage insurance companies’ customers.

Life, Home, Property & Casualty Insurance: Companies that offer life, home, and property & casualty insurance, as well as other kinds of insurance such as renters, disability, and marriage insurance. Examples include websites that offer life, home, and P&C insurance in packages.

P2P Insurance: Companies that offer peer-to-peer insurance, in which a group of policyholders jointly pay for the insurance of an item that they mutually own, share, or rent (such as a car, house, or media equipment). Examples include P2P insurance platforms in which a group of bicyclists jointly buy insurance for all of their bikes.

Product Insurance: Companies that offer insurance and warranties for products that consumers purchase, from tech gadgets to diamonds. Examples include insurance plans for your smartphone in case it is stolen or is broken.

Reinsurance: Companies that provide insurance for other insurance companies. Examples include companies that offer insurers coverage to mitigate and manage their risks.

More:

https://medium.com/@VentureScanner/insurance-technology-q2-update-in-15-visuals-d3ce6864cdbf#.ps6egyw0g

Les médias du groupe Finyear

Lisez gratuitement :

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en Finance innovation, Blockchain révolution & Digital transformation.

Les 6 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The Chief FinTech Officer

- The Chief Blockchain Officer

- The Chief Digital Officer

Le magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en Finance innovation, Blockchain révolution & Digital transformation.

Les 6 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The Chief FinTech Officer

- The Chief Blockchain Officer

- The Chief Digital Officer

Le magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres