Chainalysis, la plateforme des données des blockchains, dévoile aujourd’hui une étude sur les gains en cryptomonnaies par pays en 2021, disponible ci-dessous.

Voici quelques points clés :

• 2021 a été une année importante pour le marché des cryptomonnaies. Le bitcoin et l'Ether ont pu profiter de la dynamique positive débutée fin 2020 pour atteindre de nouveaux sommets historiques en 2021.

• L'Ether devance de peu le bitcoin dans le total des gains réalisés au niveau mondial, avec 76,3 milliards de dollars contre 74,7 milliards de dollars. Cela est notamment dû à l’essor de la finance décentralisée (DeFi). En effet la plupart des protocoles DeFi sont basés sur la blockchain Ethereum et utilisent l’Ether comme monnaie principale.

• Partout dans le monde, les gains réalisés en cryptomonnaies ont augmenté. La France se classe à la 8ème place des pays ayant réalisé le plus de gains avec 4 081 240 823 de dollars.

Ci-dessous l'étude en anglais :

2021 Cryptocurrency Gains by Country: Ether Leads as Gains Skyrocket Around the World

2021 was another strong year for cryptocurrency, as assets like bitcoin and Ether were able to build on positive momentum gained at the end of 2020 and hit new all-time highs in 2021. Who benefited the most from cryptocurrency price growth?

For the second straight year, we’re answering this question through the lens of geography, and comparing realized cryptocurrency gains by country. Unlike last year though, we’re expanding our analysis beyond Bitcoin, and will provide data on realized gains across all crypto assets Chainalysis tracks.

Calculating cryptocurrency gains by country: Our methodology

Geographic analysis in cryptocurrency is difficult due to the technology’s decentralized nature. However, we can make good estimates of which countries contribute to cryptocurrency activity using a combination of Chainalysis’ transaction data and web traffic data.

First, we measure the on-chain, macro-level flows of all crypto assets we track to every cryptocurrency business we track. Then, we estimate the total, collective gains made on each asset by measuring the differences between the U.S. dollar value of all withdrawals of the asset and the value of all deposits of the asset. We then distribute those gains (or losses) by country based on the share of web traffic each country accounts for on each exchange’s website. It’s not perfect — ideally, we’d be able to calculate gains at the individual or wallet level rather than at the service level, but this methodology still gives us a reasonable estimate of total gains for cryptocurrency users in a given country. This combination of transaction data and web traffic is also the same framework we use to calculate our yearly Global Crypto Adoption Index.

2021 Realized Cryptocurrency Gains by Country

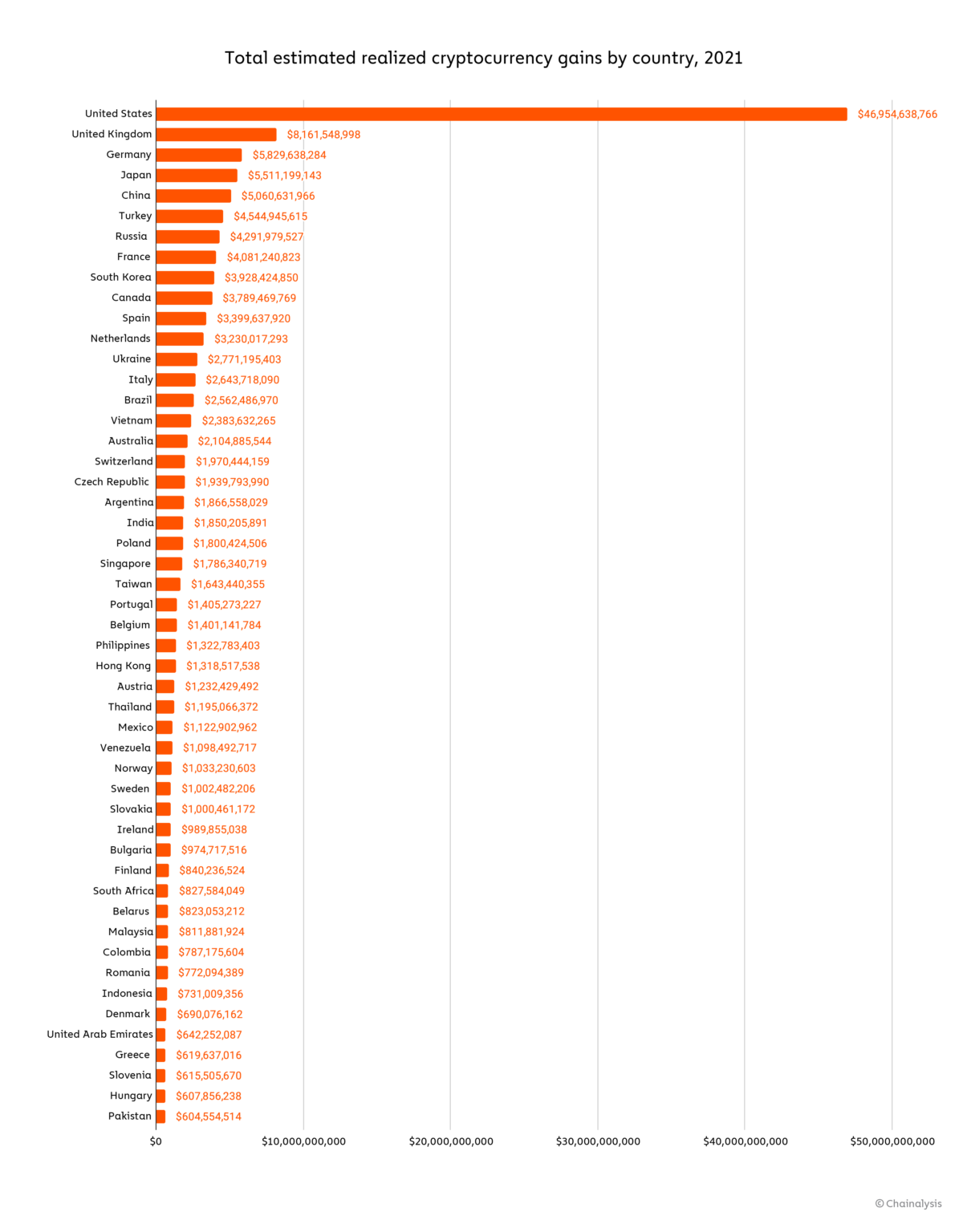

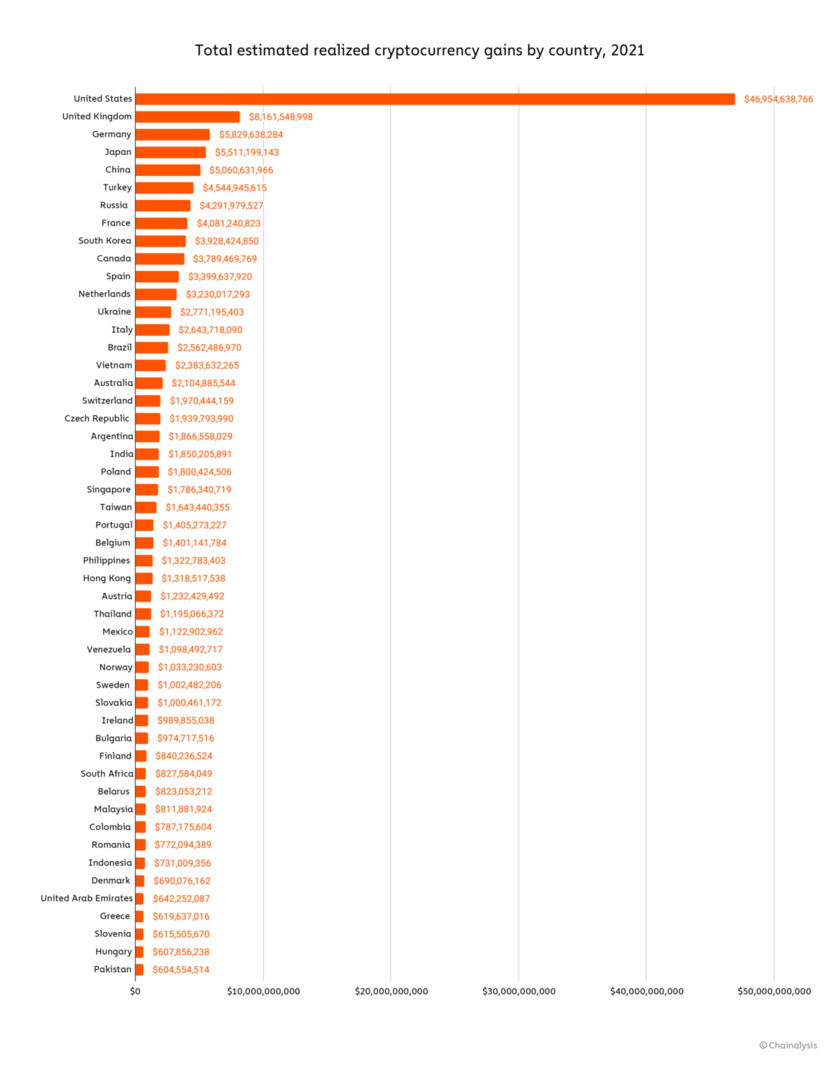

Overall, across all cryptocurrencies Chainalysis tracks, investors around the world realized total gains of $162.7 billion in 2021, compared to just $32.5 billion in 2020. The graph below shows the top 50 countries accounting for those gains.

Voici quelques points clés :

• 2021 a été une année importante pour le marché des cryptomonnaies. Le bitcoin et l'Ether ont pu profiter de la dynamique positive débutée fin 2020 pour atteindre de nouveaux sommets historiques en 2021.

• L'Ether devance de peu le bitcoin dans le total des gains réalisés au niveau mondial, avec 76,3 milliards de dollars contre 74,7 milliards de dollars. Cela est notamment dû à l’essor de la finance décentralisée (DeFi). En effet la plupart des protocoles DeFi sont basés sur la blockchain Ethereum et utilisent l’Ether comme monnaie principale.

• Partout dans le monde, les gains réalisés en cryptomonnaies ont augmenté. La France se classe à la 8ème place des pays ayant réalisé le plus de gains avec 4 081 240 823 de dollars.

Ci-dessous l'étude en anglais :

2021 Cryptocurrency Gains by Country: Ether Leads as Gains Skyrocket Around the World

2021 was another strong year for cryptocurrency, as assets like bitcoin and Ether were able to build on positive momentum gained at the end of 2020 and hit new all-time highs in 2021. Who benefited the most from cryptocurrency price growth?

For the second straight year, we’re answering this question through the lens of geography, and comparing realized cryptocurrency gains by country. Unlike last year though, we’re expanding our analysis beyond Bitcoin, and will provide data on realized gains across all crypto assets Chainalysis tracks.

Calculating cryptocurrency gains by country: Our methodology

Geographic analysis in cryptocurrency is difficult due to the technology’s decentralized nature. However, we can make good estimates of which countries contribute to cryptocurrency activity using a combination of Chainalysis’ transaction data and web traffic data.

First, we measure the on-chain, macro-level flows of all crypto assets we track to every cryptocurrency business we track. Then, we estimate the total, collective gains made on each asset by measuring the differences between the U.S. dollar value of all withdrawals of the asset and the value of all deposits of the asset. We then distribute those gains (or losses) by country based on the share of web traffic each country accounts for on each exchange’s website. It’s not perfect — ideally, we’d be able to calculate gains at the individual or wallet level rather than at the service level, but this methodology still gives us a reasonable estimate of total gains for cryptocurrency users in a given country. This combination of transaction data and web traffic is also the same framework we use to calculate our yearly Global Crypto Adoption Index.

2021 Realized Cryptocurrency Gains by Country

Overall, across all cryptocurrencies Chainalysis tracks, investors around the world realized total gains of $162.7 billion in 2021, compared to just $32.5 billion in 2020. The graph below shows the top 50 countries accounting for those gains.

The United States leads by a wide margin at an estimated $47.0 billion in realized cryptocurrency gains, followed by the UK, Germany, Japan, and China. However, like last year, we see many countries whose collective cryptocurrency investment performance seems to be outperforming their rankings in traditional measures of economic prosperity.

- Turkey ranks 11th in GDP at $2.7 trillion but sixth in realized cryptocurrency gains at $4.6 billion

- Vietnam ranks 25th in GDP at $1.1 trillion but 16th in realized cryptocurrency gains at $2.7 billion

- Ukraine ranks 40th in GDP at $576 billion but 13th in realized cryptocurrency gains at $2.8 billion

- The Czech Republic ranks 47th in GDP at $460 billion but 19th in realized cryptocurrency gains at $1.9 billion

- Venezuela ranks 78th in GDP at $144 billion but 33rd in realized cryptocurrency gains at $1.1 billion

This matches trends we analyzed in our Geography of Cryptocurrency Report, where we examined how many emerging market countries have embraced cryptocurrency for remittances and as a response to currency devaluation.

What also stands out is how much activity in China has declined relative to other countries. In 2021, China’s total estimated realized cryptocurrency gains were $5.1 billion, up from $1.7 billion in 2020, for a year-over-year growth rate of 194%. While that may sound substantial, it represents a lower growth rate than other countries’. The United States, for instance, saw estimated realized cryptocurrency gains grow 476%, from $8.1 billion to $47.0 billion. Other countries’ cryptocurrency gains grew at similar rates — the UK, for instance, saw a 431% increase, while Germany’s gains grew by 423%. China’s lower growth rate most likely reflects declines in the country’s cryptocurrency activity following government crackdowns.

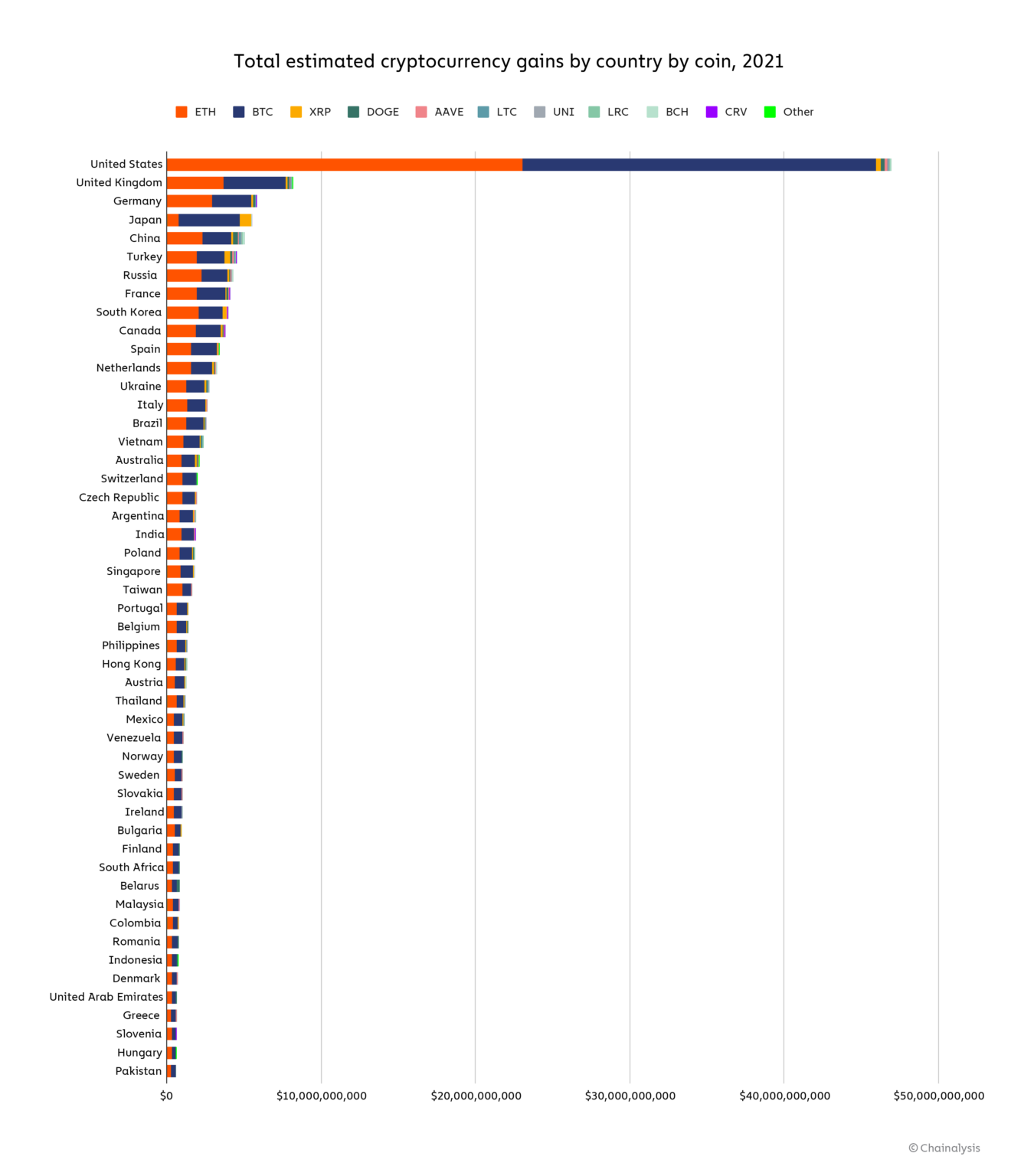

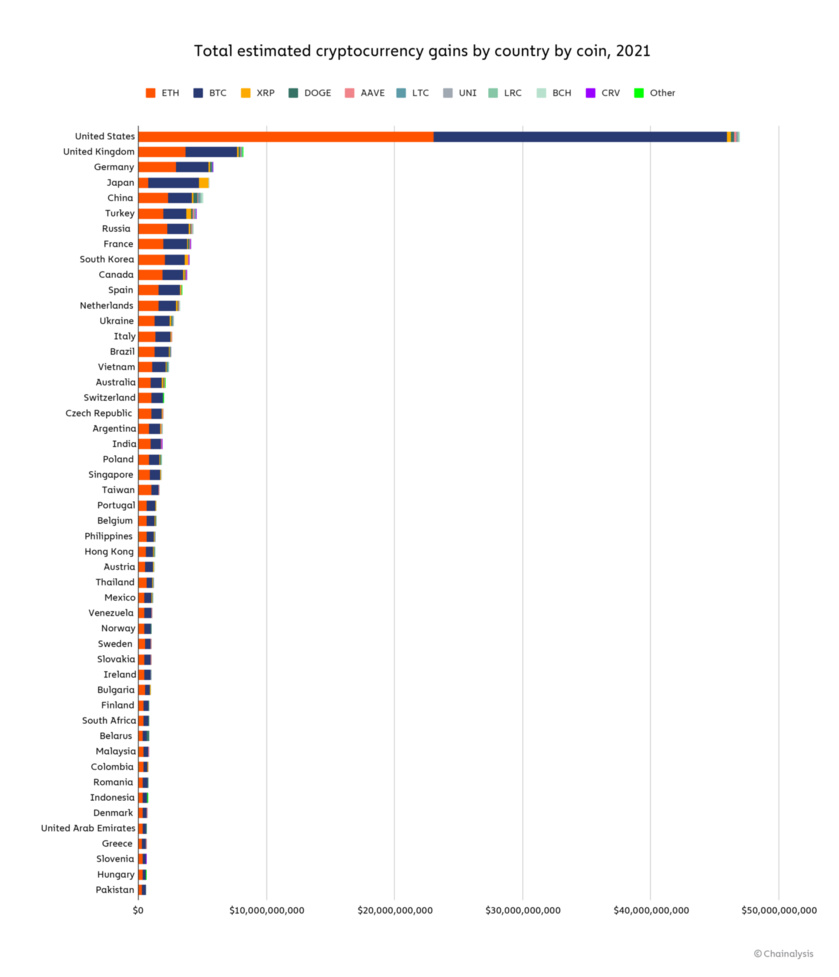

2021 Realized Cryptocurrency Gains by Country and Coin

What trends do we see when we break each country’s gains down by coin?

- Turkey ranks 11th in GDP at $2.7 trillion but sixth in realized cryptocurrency gains at $4.6 billion

- Vietnam ranks 25th in GDP at $1.1 trillion but 16th in realized cryptocurrency gains at $2.7 billion

- Ukraine ranks 40th in GDP at $576 billion but 13th in realized cryptocurrency gains at $2.8 billion

- The Czech Republic ranks 47th in GDP at $460 billion but 19th in realized cryptocurrency gains at $1.9 billion

- Venezuela ranks 78th in GDP at $144 billion but 33rd in realized cryptocurrency gains at $1.1 billion

This matches trends we analyzed in our Geography of Cryptocurrency Report, where we examined how many emerging market countries have embraced cryptocurrency for remittances and as a response to currency devaluation.

What also stands out is how much activity in China has declined relative to other countries. In 2021, China’s total estimated realized cryptocurrency gains were $5.1 billion, up from $1.7 billion in 2020, for a year-over-year growth rate of 194%. While that may sound substantial, it represents a lower growth rate than other countries’. The United States, for instance, saw estimated realized cryptocurrency gains grow 476%, from $8.1 billion to $47.0 billion. Other countries’ cryptocurrency gains grew at similar rates — the UK, for instance, saw a 431% increase, while Germany’s gains grew by 423%. China’s lower growth rate most likely reflects declines in the country’s cryptocurrency activity following government crackdowns.

2021 Realized Cryptocurrency Gains by Country and Coin

What trends do we see when we break each country’s gains down by coin?

The most notable trend here involves Ethereum gains. Ethereum just edged out Bitcoin in total realized gains globally at $76.3 billion to $74.7 billion. We believe this reflects increased demand for Ethereum as the result of DeFi’s rise in 2021, as most DeFi protocols are built on the Ethereum blockchain and use Ethereum as their primary currency. While most individual countries follow this pattern, there are some notable exceptions. Japan, for instance, received a much higher share of realized gains from Bitcoin at just under $4.0 billion, compared to just $790 million in realized Ethereum gains.

2021: A good year for cryptocurrency investors

Our analysis of cryptocurrency gains should be encouraging to the cryptocurrency world, and reflects the growth of the ecosystem in 2021 — especially in DeFi. While there are still risks the industry must work to mitigate, the data not only shows that crypto asset prices are growing, but also indicates that cryptocurrency remains a source of economic opportunity for users in emerging markets.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions.

Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.

2021: A good year for cryptocurrency investors

Our analysis of cryptocurrency gains should be encouraging to the cryptocurrency world, and reflects the growth of the ecosystem in 2021 — especially in DeFi. While there are still risks the industry must work to mitigate, the data not only shows that crypto asset prices are growing, but also indicates that cryptocurrency remains a source of economic opportunity for users in emerging markets.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions.

Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.

Laurent Leloup - Finyear

Advisor / Blockchain, DeFi, ICO, Finance 3.0

Auteur de Blockchain, la révolution de la confiance

"La blockchain n’est pas la révolution tant annoncée, elle n’est que l’outil d’un monde lui-même entré en révolution"

Advisor / Blockchain, DeFi, ICO, Finance 3.0

Auteur de Blockchain, la révolution de la confiance

"La blockchain n’est pas la révolution tant annoncée, elle n’est que l’outil d’un monde lui-même entré en révolution"

Autres articles

-

Mastercard Crypto Credential est lancé aux Émirats arabes unis et au Kazakhstan

-

Société Générale-Forge promeut les femmes dans la crypto

-

La confiance numérique, un principe qui se conjugue au futur ?

-

Dogizen libère le staking dans le cadre de l'intérêt croissant des investisseurs pour la France

-

Les meilleures cryptomonnaies à acheter en ce moment ? Comment la première ICO de Telegram a rapidement atteint 2,8 millions de dollars