There are 4 stages of tech driven innovation. These are not limited to Fintech or even to Internet; they could apply to any tech driven innovation in the past (eg Steam Engine, Railroads).

Stage 1: Cambrian explosion

This is the conceptual story phase. Seed stage Funding is based on a highly plausible conceptual story about where value will be created. A lot of new ventures are created. There is a lot of media hype. The story shows massive market opportunity enabled by disruptive technology. Both are real. It is possible for all companies formed in the Cambrian explosion to fail, but this is unusual. What is quite normal is for all companies formed in the Cambrian explosion to appear to fail temporarily. Sometimes the story is right, but the timing is off. For example, the Dot Com bubble and burst and eventual rebirth from 2003 to 2011 followed this trajectory. Once enough people had Internet connectivity (almost) all the conceptual story phase dreams of the Dot Com era did become true, but we had to go through a major slough of despond first.

Stage 2: Product Market Fit

A few companies deliver real products/services with real value and so become real companies with real revenues and profits, but most ventures created during the Cambrian explosion stage fail to get to Product Market Fit. That is why there is normally a slough of despond between Stage 1 & 2. So many companies fail to get to Product Market Fit – lemons ripen early is the VC mantra. These stories of failure dominate the media and nobody likes having dreams crushed, so the concept story behind the Cambrian explosion stage is thoroughly debunked. No new similar ventures get funded during this phase. During loose money periods, companies take longer to fail as they are sustained by lots of VC cash. This changes fast when the macro cycle changes.

Stage 3: ScaleUp

A few companies that get to Product Market Fit enter the ScaleUp stage based on network effects. Momentum Capital rushes in during the ScaleUp stage in two ways:

- Backing seasoned “brand name” entrepreneurs by giving them massive amounts of capital to enter the market late. For example, SOFI entered the Lending Marketplace business much later than pioneers such as Lending Club and Prosper. Some of these ventures do work, but this is clearly high risk and requires deep pockets. It can work simply because a market in the ScaleUp stage offers such massive opportunity.

- Investing in the Series C to IPO rounds. This is where Corporate Venture Capital, Sovereign Wealth, Crossover & Hedge Funds enter the market. This is tied to the macro cycle (which we will get to because this macro cycle is related to Fintech). This is very risky in “winner takes most” network effects markets because investing in the #2 or 3 player can be a disaster (eg MySpace) and the bets are big. This Momentum Capital is deeply impacted by the macro cycle because these investors have a short-term horizon for liquidity. Translation, they are betting on a healthy IPO market.

Now that software is eating the world (aka the fourth industrial revolution, which is the language being used at this years World Economic Forum), the transition from Stage 2 (Product Market Fit) to Stage 3 (ScaleUp) is too rapid for normal attempts to enter the market by investors. As soon as a digital service gets to Product Market Fit there is an almost instant transition to ScaleUp. There is no long smooth transition during which investors can coolly decide when and how to get on board. Investors can no longer time their entry unless they are one of the very few real top tier VC firms (maybe 10) who great entrepreneurs still want on board and will wait for. Outside that permanent aristocracy of VC, investors have to either get in at Stage 1 (Cambrian explosion) or pay top valuation during the Stage 3 (ScaleUp).

Stage 4: Consolidation

Companies go public and crush competition. They deliver on all fronts – to customers, users, investors and employees. By crushing competition they get pricing power. For example, Facebook is doing this today and in earlier generations Microsoft and Google did this. It is possible for existing incumbents to crush the startups by adapting, embracing and extending. This has not happened in earlier waves of disruption (eg in Media and eCommerce) but banks are hoping it will play out differently in the Fintech wave.

This Consolidation stage has not yet happened within Fintech, with the exception of consumer payments (1) (where the incumbents are winning). A few Fintech companies have gone public, but they have not yet been tested through the macro cycle. It is clearly debatable what will happen when the macro cycle turns. This is complicated by the fact that the current macro cycle is a credit boom and will therefore impact the Fin part of FinTech. However, the Tech part of FinTech is exogenous (e.g what happens to Bitcoin is not driven by macro cycles even if macro cycles temporarily impact everything).

What a lot of people want to know is, will existing Financial Services incumbents crush the Fintech startups during the next market crash? Or will the macro cycle ramp up the disruption that gave birth to Fintech in 2009? This is where we need to look at the intersection of tech innovation stages with the macro cycle.

Looking for bubbles in all the wrong places

Market crashes are like putting your hand on a hot stove, so searing that you don’t forget it. So, it is natural to look to history to see what the next crash will be like (“don’t do that again, it hurt”). This can be misleading because history seldom repeats exactly.

History may not repeat, but it does rhyme, so lets look at the last two crashes within a Fintech context:

One crash was Tech and one was Fin:

- The Dot Com crash in 2001 was a Tech crash. In this case the Cambrian explosion story greatly amplified the macro cycle. Since that searing event that we call the tech nuclear winter, all of us in the tech business have been nervously looking for the next tech bubble. Possibly because of that nervousness, there is not much of a tech bubble, despite years of easy money. Public tech valuations are mostly reasonable. Private tech valuations have some froth, but few people lose in these private deals (our qui amisit = who loses analysis here).

- The global financial crisis in 2008 was a Fin crash. It was driven by overleveraged banks and the overleveraged consumers whom they lent to. The impact on Tech was minor – a mere blip – but because it hammered Fin it created the fertile soil for FinTech to germinate.

Who is over leveraged this time?

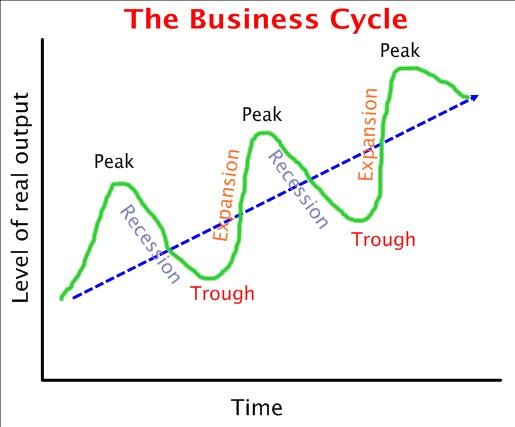

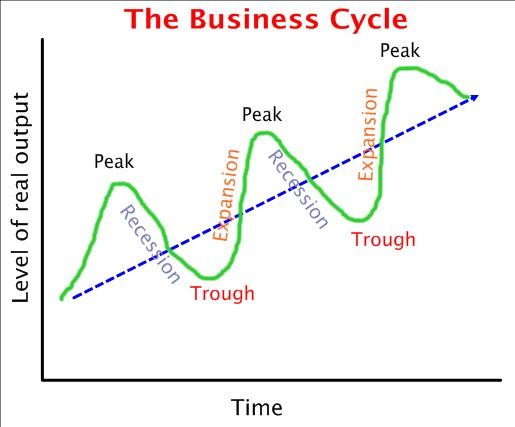

Macro cycles are almost all about monetary policy aka credit aka leverage.

So lets look at the macro cycle with this perspective, to see who was over-leveraged in the last two crashes:

- The Dot Com crash in 2001.It was equity investors who over-leveraged (believing that stocks can only go up so they can borrow to buy tech stocks). This included some consumers who became day traders thanks to the arrival of e-broking.

- The global financial crisis in 2008. It was banks and the consumers who borrowed from them who over-leveraged (believing that property prices can only go up so they can borrow a lot to buy property).

In the current cycle we can see who is not over-leveraged:

- Corporates have fortress balance sheets. Even Banks have deleveraged (more so in America than Europe).

- Consumers made great progress deleveraging in the West and were never that leveraged in the Rest of the World.

In this cycle it is Governments who are over-leveraged. We have not had a cycle like this in modern times. The idea that lending to governments could be more risky than lending to companies will take a long time to be accepted.

So the crash and the recovery won’t follow a trajectory that we have got used to. It might not be a U or a V shaped recovery. It might be a long slow grind it out recession like the 1970s without any sharp crashes or quick recoveries.

There is no single Fintech market

This means there is no Fintech bubble.

There are overheated valuations in individual ventures and in some sectors, but you have to look at the market segments within Fintech individually:

- Bitcoin (as a currency): this went from Cambrian to Consolidation without going through Product Market Fit or ScaleUp.

- Blockchain (without Bitcoin): Cambrian

- Lending Marketplaces: ScaleUp

- Small Business Finance: ScaleUp

- InsureTech: Cambrian moving to Product Market Fit

- Underbanked (never had a Cambrian phase, maybe still to come).

- XBRL: Slough of despond but now moving to Product Market Fit.

- Consumer Payments: Consolidation.

Qui Bono & Qui Amisit in a bear market

Losers (Qui Amisit):

- High burn rate ventures. Fintech ventures that rely on advertising for growth need VCs to keep funding that growth. There will be down rounds, layoffs, and high profile names going to the deadpool.

- Momentum Investors. VCs and Angels who invested later in the cycle and did not get a liquidity event in this cycle are left holding stock that will decline sharply in value.

Winners (Qui Bono):

- Last man standing in consolidation. These will be companies that are not dependent on investors to fund growth. They fund growth from internal accruals (and because of that investors will be ready to fund more rapid growth if needed). Incumbents are in this position, but they still move too slowly. The Fintech ScaleUps (great revenue growth and profitable but still think and act like a startup) have the right combo of agility and scale to prosper in this environment.

- Low cost capital efficient early stage ventures. They don’t rely on investors too much because the cost to get to Product Market Fit is so low. They may grow slowly in a bear market because bootstrapped growth is always slower , but they will be well positioned when the next bull appears. The decentralized applications built on Blockchain are so capital efficient that it gives investors agita (when your product is capital you need companies that need your product). You can develop the Blockchain Minimum Viable Product (MVP) at very low cost; the tools on a platform such as Ethereum are now very powerful. More importantly, when you get to Product Market Fit and then ScaleUp, you don’t need to fund a massive data center. Users will pay via low cost transaction fees using an internal currency for the platform (eg Ether).

- Ventures offering much lower cost for consumers. During a recession, consumers mind every penny. This is where, for example, a decentralized Blockchain based sharing economy venture that takes 2% rather than 20% may thrive.

- Ventures offering Radical Cost Take Out in Enterprise. During a recession, enterprises know they cannot grow the top line, so they cut costs. Blockchain based systems promise a radical rather than an incremental cost take out. Don’t shave 10% costs from processes such as Compliance, take out 90% of the costs.

During the 2009 downturn, when I was tracking early stage ventures for ReadWrite, I noticed only a blip in the financing. The late stage stuff got hammered but early stage funding recovered very quickly. It maybe the same in this cycle. it is certainly logical. When you invest early you plan for liquidity in the 7-10 year range during which the macro cycle will probably turn positive again.

(1) http://dailyfintech.com/2016/01/13/daily-fintech-index-shows-market-does-not-buy-payment-disruption-story/

Stage 1: Cambrian explosion

This is the conceptual story phase. Seed stage Funding is based on a highly plausible conceptual story about where value will be created. A lot of new ventures are created. There is a lot of media hype. The story shows massive market opportunity enabled by disruptive technology. Both are real. It is possible for all companies formed in the Cambrian explosion to fail, but this is unusual. What is quite normal is for all companies formed in the Cambrian explosion to appear to fail temporarily. Sometimes the story is right, but the timing is off. For example, the Dot Com bubble and burst and eventual rebirth from 2003 to 2011 followed this trajectory. Once enough people had Internet connectivity (almost) all the conceptual story phase dreams of the Dot Com era did become true, but we had to go through a major slough of despond first.

Stage 2: Product Market Fit

A few companies deliver real products/services with real value and so become real companies with real revenues and profits, but most ventures created during the Cambrian explosion stage fail to get to Product Market Fit. That is why there is normally a slough of despond between Stage 1 & 2. So many companies fail to get to Product Market Fit – lemons ripen early is the VC mantra. These stories of failure dominate the media and nobody likes having dreams crushed, so the concept story behind the Cambrian explosion stage is thoroughly debunked. No new similar ventures get funded during this phase. During loose money periods, companies take longer to fail as they are sustained by lots of VC cash. This changes fast when the macro cycle changes.

Stage 3: ScaleUp

A few companies that get to Product Market Fit enter the ScaleUp stage based on network effects. Momentum Capital rushes in during the ScaleUp stage in two ways:

- Backing seasoned “brand name” entrepreneurs by giving them massive amounts of capital to enter the market late. For example, SOFI entered the Lending Marketplace business much later than pioneers such as Lending Club and Prosper. Some of these ventures do work, but this is clearly high risk and requires deep pockets. It can work simply because a market in the ScaleUp stage offers such massive opportunity.

- Investing in the Series C to IPO rounds. This is where Corporate Venture Capital, Sovereign Wealth, Crossover & Hedge Funds enter the market. This is tied to the macro cycle (which we will get to because this macro cycle is related to Fintech). This is very risky in “winner takes most” network effects markets because investing in the #2 or 3 player can be a disaster (eg MySpace) and the bets are big. This Momentum Capital is deeply impacted by the macro cycle because these investors have a short-term horizon for liquidity. Translation, they are betting on a healthy IPO market.

Now that software is eating the world (aka the fourth industrial revolution, which is the language being used at this years World Economic Forum), the transition from Stage 2 (Product Market Fit) to Stage 3 (ScaleUp) is too rapid for normal attempts to enter the market by investors. As soon as a digital service gets to Product Market Fit there is an almost instant transition to ScaleUp. There is no long smooth transition during which investors can coolly decide when and how to get on board. Investors can no longer time their entry unless they are one of the very few real top tier VC firms (maybe 10) who great entrepreneurs still want on board and will wait for. Outside that permanent aristocracy of VC, investors have to either get in at Stage 1 (Cambrian explosion) or pay top valuation during the Stage 3 (ScaleUp).

Stage 4: Consolidation

Companies go public and crush competition. They deliver on all fronts – to customers, users, investors and employees. By crushing competition they get pricing power. For example, Facebook is doing this today and in earlier generations Microsoft and Google did this. It is possible for existing incumbents to crush the startups by adapting, embracing and extending. This has not happened in earlier waves of disruption (eg in Media and eCommerce) but banks are hoping it will play out differently in the Fintech wave.

This Consolidation stage has not yet happened within Fintech, with the exception of consumer payments (1) (where the incumbents are winning). A few Fintech companies have gone public, but they have not yet been tested through the macro cycle. It is clearly debatable what will happen when the macro cycle turns. This is complicated by the fact that the current macro cycle is a credit boom and will therefore impact the Fin part of FinTech. However, the Tech part of FinTech is exogenous (e.g what happens to Bitcoin is not driven by macro cycles even if macro cycles temporarily impact everything).

What a lot of people want to know is, will existing Financial Services incumbents crush the Fintech startups during the next market crash? Or will the macro cycle ramp up the disruption that gave birth to Fintech in 2009? This is where we need to look at the intersection of tech innovation stages with the macro cycle.

Looking for bubbles in all the wrong places

Market crashes are like putting your hand on a hot stove, so searing that you don’t forget it. So, it is natural to look to history to see what the next crash will be like (“don’t do that again, it hurt”). This can be misleading because history seldom repeats exactly.

History may not repeat, but it does rhyme, so lets look at the last two crashes within a Fintech context:

One crash was Tech and one was Fin:

- The Dot Com crash in 2001 was a Tech crash. In this case the Cambrian explosion story greatly amplified the macro cycle. Since that searing event that we call the tech nuclear winter, all of us in the tech business have been nervously looking for the next tech bubble. Possibly because of that nervousness, there is not much of a tech bubble, despite years of easy money. Public tech valuations are mostly reasonable. Private tech valuations have some froth, but few people lose in these private deals (our qui amisit = who loses analysis here).

- The global financial crisis in 2008 was a Fin crash. It was driven by overleveraged banks and the overleveraged consumers whom they lent to. The impact on Tech was minor – a mere blip – but because it hammered Fin it created the fertile soil for FinTech to germinate.

Who is over leveraged this time?

Macro cycles are almost all about monetary policy aka credit aka leverage.

So lets look at the macro cycle with this perspective, to see who was over-leveraged in the last two crashes:

- The Dot Com crash in 2001.It was equity investors who over-leveraged (believing that stocks can only go up so they can borrow to buy tech stocks). This included some consumers who became day traders thanks to the arrival of e-broking.

- The global financial crisis in 2008. It was banks and the consumers who borrowed from them who over-leveraged (believing that property prices can only go up so they can borrow a lot to buy property).

In the current cycle we can see who is not over-leveraged:

- Corporates have fortress balance sheets. Even Banks have deleveraged (more so in America than Europe).

- Consumers made great progress deleveraging in the West and were never that leveraged in the Rest of the World.

In this cycle it is Governments who are over-leveraged. We have not had a cycle like this in modern times. The idea that lending to governments could be more risky than lending to companies will take a long time to be accepted.

So the crash and the recovery won’t follow a trajectory that we have got used to. It might not be a U or a V shaped recovery. It might be a long slow grind it out recession like the 1970s without any sharp crashes or quick recoveries.

There is no single Fintech market

This means there is no Fintech bubble.

There are overheated valuations in individual ventures and in some sectors, but you have to look at the market segments within Fintech individually:

- Bitcoin (as a currency): this went from Cambrian to Consolidation without going through Product Market Fit or ScaleUp.

- Blockchain (without Bitcoin): Cambrian

- Lending Marketplaces: ScaleUp

- Small Business Finance: ScaleUp

- InsureTech: Cambrian moving to Product Market Fit

- Underbanked (never had a Cambrian phase, maybe still to come).

- XBRL: Slough of despond but now moving to Product Market Fit.

- Consumer Payments: Consolidation.

Qui Bono & Qui Amisit in a bear market

Losers (Qui Amisit):

- High burn rate ventures. Fintech ventures that rely on advertising for growth need VCs to keep funding that growth. There will be down rounds, layoffs, and high profile names going to the deadpool.

- Momentum Investors. VCs and Angels who invested later in the cycle and did not get a liquidity event in this cycle are left holding stock that will decline sharply in value.

Winners (Qui Bono):

- Last man standing in consolidation. These will be companies that are not dependent on investors to fund growth. They fund growth from internal accruals (and because of that investors will be ready to fund more rapid growth if needed). Incumbents are in this position, but they still move too slowly. The Fintech ScaleUps (great revenue growth and profitable but still think and act like a startup) have the right combo of agility and scale to prosper in this environment.

- Low cost capital efficient early stage ventures. They don’t rely on investors too much because the cost to get to Product Market Fit is so low. They may grow slowly in a bear market because bootstrapped growth is always slower , but they will be well positioned when the next bull appears. The decentralized applications built on Blockchain are so capital efficient that it gives investors agita (when your product is capital you need companies that need your product). You can develop the Blockchain Minimum Viable Product (MVP) at very low cost; the tools on a platform such as Ethereum are now very powerful. More importantly, when you get to Product Market Fit and then ScaleUp, you don’t need to fund a massive data center. Users will pay via low cost transaction fees using an internal currency for the platform (eg Ether).

- Ventures offering much lower cost for consumers. During a recession, consumers mind every penny. This is where, for example, a decentralized Blockchain based sharing economy venture that takes 2% rather than 20% may thrive.

- Ventures offering Radical Cost Take Out in Enterprise. During a recession, enterprises know they cannot grow the top line, so they cut costs. Blockchain based systems promise a radical rather than an incremental cost take out. Don’t shave 10% costs from processes such as Compliance, take out 90% of the costs.

During the 2009 downturn, when I was tracking early stage ventures for ReadWrite, I noticed only a blip in the financing. The late stage stuff got hammered but early stage funding recovered very quickly. It maybe the same in this cycle. it is certainly logical. When you invest early you plan for liquidity in the 7-10 year range during which the macro cycle will probably turn positive again.

(1) http://dailyfintech.com/2016/01/13/daily-fintech-index-shows-market-does-not-buy-payment-disruption-story/

Bernard Lunn

Founding Partner, Daily Fintech Advisers

www.dailyfintech.com

Bernard Lunn is a serial entrepreneur, senior executive, adviser and a strategic dealmaker. He worked in Fintech before it was called that with startups, growth stage and turnaround ventures (incl. Misys, Temenos, IMS, ITRS). He has lived and worked in America, India, UK & Switzerland and is adept at cross border deals.

Founding Partner, Daily Fintech Advisers

www.dailyfintech.com

Bernard Lunn is a serial entrepreneur, senior executive, adviser and a strategic dealmaker. He worked in Fintech before it was called that with startups, growth stage and turnaround ventures (incl. Misys, Temenos, IMS, ITRS). He has lived and worked in America, India, UK & Switzerland and is adept at cross border deals.

Les médias du groupe Finyear

Lisez gratuitement :

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d'affaires.

Les 6 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The FinTecher

- The Blockchainer

- Le Capital Investisseur

Le magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d'affaires.

Les 6 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The FinTecher

- The Blockchainer

- Le Capital Investisseur

Le magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Autres articles

-

Coinbase et Visa, un partenariat pour des transferts en temps réel

-

Brilliantcrypto, la nouvelle aventure play-to-earn basée sur la blockchain Polygon, arrive sur Epic Game Store

-

Nomination | Truffle Capital promeut Alexis Le Portz en qualité de Partner

-

IPEM Paris 2024 : 5500 participants au Palais des congrès

-

Pomelo annonce une Série A à 35 millions de dollars menée par Vy Capital