A “Meta” World Built on Blockchain

02/11/2021

If you weren’t familiar with the term “metaverse”, I am sure you are now after Facebook announced that it’s changing its name to “Meta”. On Thursday, Mark Zuckerberg announced that Facebook’s parent company was changing its name to Meta to emphasize its focus on metaverse. Metaverse is defined slightly differently by futurists, but at its core, the idea is basically the same: the metaverse is where the physical and digital worlds come together, and digital representations of people can interact with each other for work or play. Some, including Mark Zuckerberg, take the idea even further and add a virtual reality element to the metaverse, where two people on opposite sides of the world meet in a virtual room and interact. The metaverse represents a huge financial opportunity, as digital objects will have to be represented, ownable, sellable, and transferable within the metaverse. Blockchain and NFTs grant holders true ownership over digital items, and have already become a critical building block for emerging metaverses.

The “metaverse,” was coined by Neal Stephenson in his 1992 novel “Snow Crash,” where a pizza delivery guy by day and a VR superhero by night, lives in an online universe called the “Metaverse”.

The best-known metaverse is Second Life, an online virtual world that was launched in 2003. But there is no single truth to what a metaverse really is and games that offer their own versions of an immersive world may also be considered metaverses: Fortnite, Everquest, War of Warcraft. For most people, the idea of “virtual” does not necessarily involve a VR headset. Zoom, Clubhouse, Twitter Spaces have allowed us to carve out a virtual existence. In some ways, due to the pandemic, many would argue that the metaverse has already arrived.

The money is pouring in to the space and for good reason.

While it’s not apparent what shape the metaverse will take, the industry is growing. According to research firm Strategy Analytics, the global metaverse could be worth $280 billion by 2025 and likely grow from there. That’s more than sixfold compared to the $46 billion in 2020.

Earlier this year in April, Epic Games, the maker of Fortnite, announced that it completed a $1 billion funding round to support its long-term vision for the metaverse. Galaxy Interactive announced it raised $325 million venture capital fund to invest in the metaverse and next-gen games. Recently, Recur raised $50 million, the largest Series A round in NFT history, to help brands and companies design and develop experiences that allow fans to buy, collect, and resell digital products. Mojito raised $20 million to power Sotheby’s metaverse.

Projects like Decentraland, Cryptovoxels, and Somnium Space are combining virtual reality and several crypto primitives, such as smart contracts and NFTs in order to create virtual worlds with digital scarcity.

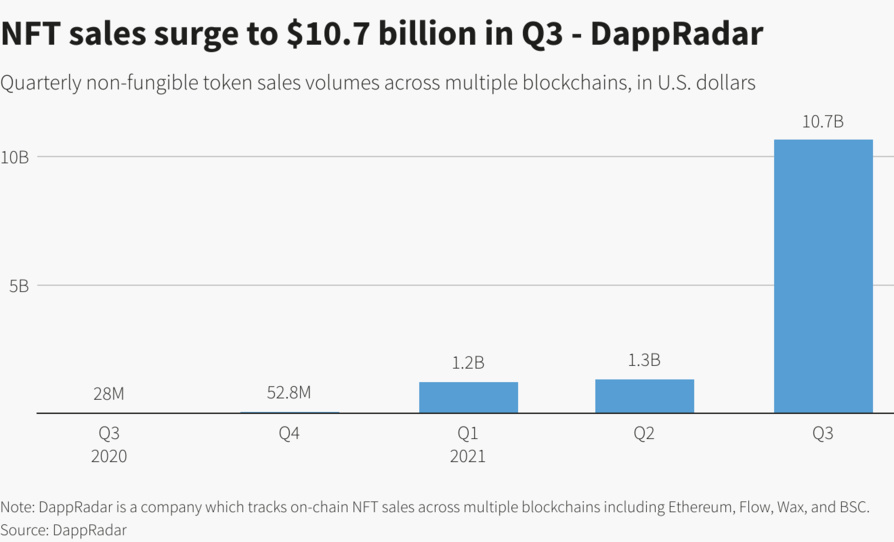

At the center of all this activity are non-fungible tokens, which are a lot more than a speculative frenzy. NFTs use blockchain to record the ownership for any kind of asset. They can be used to provide fractional ownership of physical assets such as real estate, art, and diamonds, and they can also be used for virtual assets like virtual real estate or for collectible digital cats. In the third quarter of 2021, sales of NFTs reached $10.7 billion, 8x the sales volume of the previous quarter.

Social media video sharing platform TikTok entered the market, letting people buy NFTs from top creators on the platform. Traditional auction house Sotheby announced its NFT marketplace, Sotheby’s Metaverse. Visa is launching an NFT support program to help artists join the digital art space.

Metaverses have the potential to create enormous economic value from the combination of social interaction and digital asset ownership. Everything will have to be represented in the metaverse. I can imagine companies like Amazon, Netflix, and Robinhood all rolling out their own contributions to a shared metaverse. NFT technology is critical to the development of an open metaverse because it provides the financial architecture needed to standardize the value of digital assets that generally lack provenance and traceability.

To frame the potential opportunity, just look at Fortnite, Epic Games’ metaverse platform that generated $1.2 billion in the first 10 months of launch. Dolce & Gabbana unveiled an NFT collection of dresses, suits, jackets, tiaras, and crowns that can be worn by digital avatars and ended up selling 9 NFTs for $5.65 million. Cryptopunks, a collection of 10,000 pixel art pictures of punks, passed $1 billion in sales. The Russian State Hermitage Museum, the largest museum in the world, raised $440,500 by auctioning NFTs of masterpieces from artists like Leonardo da Vinci and Vincent van Gogh.

Across the entire crypto ecosystem, we’ve seen more companies jump into NFTs. TikTok, Coinbase, Visa, and Sotheby’s are the latest entrants. Coinbase caused a stir with the announcement of its NFT marketplace. Brain Armstrong, Coinbase’s CEO, posted that over one million people are on the waiting list.

Ilias Louis Hatzis is the founder and CEO at Kryptonio wallet. Create your wallet in less than a minute, without seed phrases, private keys, passwords or documents. Keep your bitcoin and digital assets always secure and recoverable: https://kryptonio.com

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.