While not quite ready for primetime yet, blockchain is getting closer to its breakout moment with every passing day.

Momentum is shifting from a focus on learning and exploring the potential of the technology to identifying and building practical business applications. It just may not be happening when and where we expected.

The global executives with excellent-to-expert knowledge of the technology we surveyed hold more pragmatic views and look poised to make some major moves over the next year. They see great value in blockchain’s potential to reinvent processes across the business value chain—and there is interest and investment in a wide range of use cases.

For example, 74 percent of all respondents report that their organizations see a “compelling business case” for the use of blockchain—and many of these companies are moving forward with the technology. About half of that number (34 percent) say their company already has some blockchain system in production, while another 41 percent of respondents say they expect their organizations to deploy a blockchain application within the next 12 months. In addition, nearly 40 percent of respondents reported that their organization will invest $5 million or more in blockchain technology in the coming year.

As more organizations put their resources behind this emerging technology, we expect blockchain to gain significant traction as its potential for greater efficiency, support for new business models and revenue sources, and enhanced security are demonstrated in real-world situations.

The survey report also contains various industry and regional perspectives covering the following specific areas:

Industries

. Financial Services

. Health Care and Life Sciences

. Public Sector

. Technology, Media & Telecommunications

Country/Regions

. Asia Pacific

. Canada

. Europe, Middle East, and Africa (EMEA)

*Note: Much of the executive summary is based on the United States perspective.

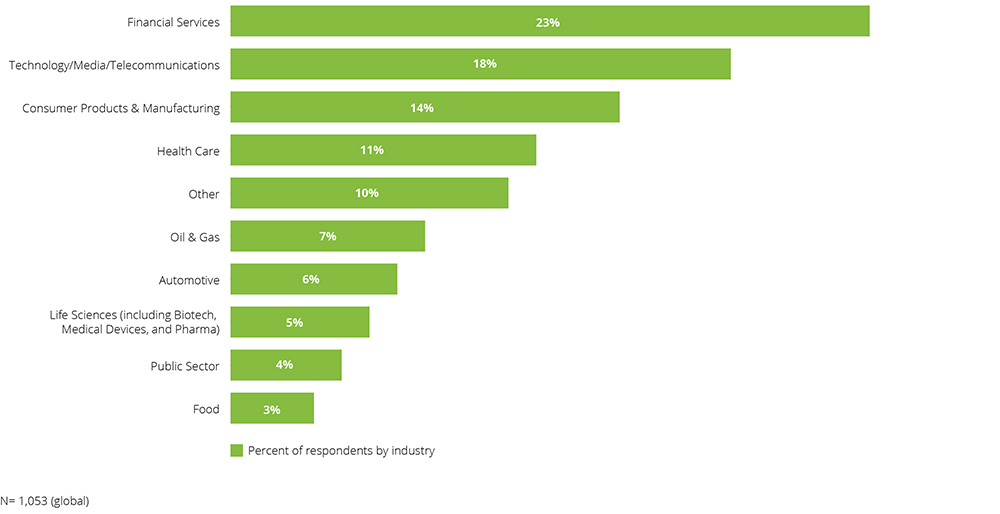

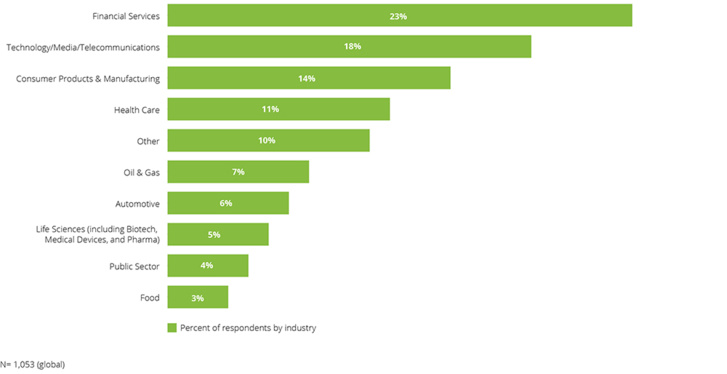

Primary operations of organizations by industry

Survey respondents hail from 10 different industries--the majority from financial services, technology/media/telecommunications, and consumer products and manufacturing.

Q: In which of the following industries does the organization you work primarily operate?

Momentum is shifting from a focus on learning and exploring the potential of the technology to identifying and building practical business applications. It just may not be happening when and where we expected.

The global executives with excellent-to-expert knowledge of the technology we surveyed hold more pragmatic views and look poised to make some major moves over the next year. They see great value in blockchain’s potential to reinvent processes across the business value chain—and there is interest and investment in a wide range of use cases.

For example, 74 percent of all respondents report that their organizations see a “compelling business case” for the use of blockchain—and many of these companies are moving forward with the technology. About half of that number (34 percent) say their company already has some blockchain system in production, while another 41 percent of respondents say they expect their organizations to deploy a blockchain application within the next 12 months. In addition, nearly 40 percent of respondents reported that their organization will invest $5 million or more in blockchain technology in the coming year.

As more organizations put their resources behind this emerging technology, we expect blockchain to gain significant traction as its potential for greater efficiency, support for new business models and revenue sources, and enhanced security are demonstrated in real-world situations.

The survey report also contains various industry and regional perspectives covering the following specific areas:

Industries

. Financial Services

. Health Care and Life Sciences

. Public Sector

. Technology, Media & Telecommunications

Country/Regions

. Asia Pacific

. Canada

. Europe, Middle East, and Africa (EMEA)

*Note: Much of the executive summary is based on the United States perspective.

Primary operations of organizations by industry

Survey respondents hail from 10 different industries--the majority from financial services, technology/media/telecommunications, and consumer products and manufacturing.

Q: In which of the following industries does the organization you work primarily operate?

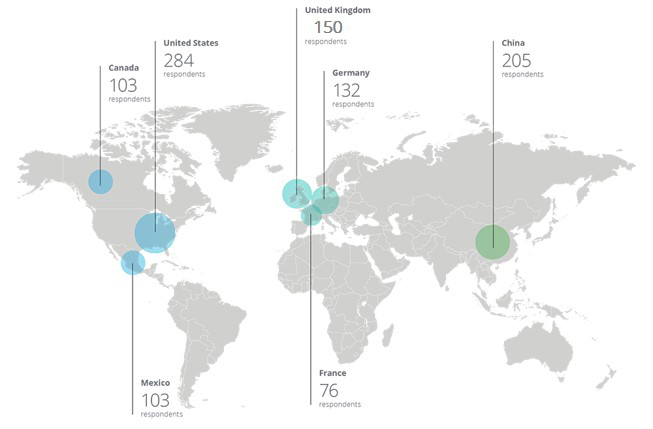

Deloitte's 2018 global blockchain survey

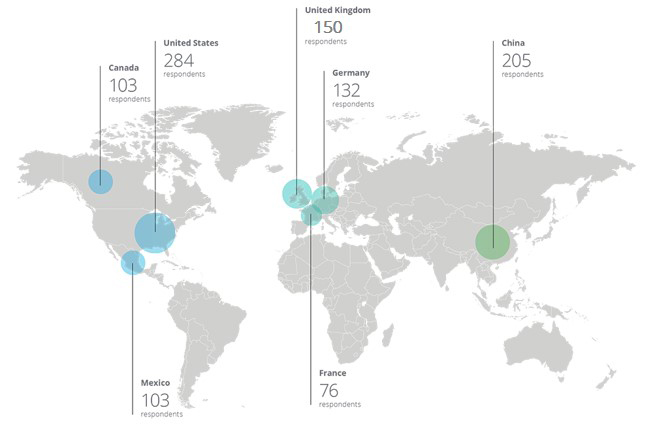

To summarize, the survey was fielded across seven countries (Total number of respondents=1,053):

To summarize, the survey was fielded across seven countries (Total number of respondents=1,053):

Blockchain today

Blockchain is at an inflection point, with momentum shifting from “blockchain tourism” and exploration of the technology’s potential to the building of practical business applications. This is particularly true among “digital enterprise” organizations, rather than in more traditional enterprises that are still working on how to incorporate digital into their existing operations and protocols. While our survey shows that these traditional enterprise organizations may be lagging their fully digital brethren in this endeavor, the fact is, traditional enterprises are putting more resources behind blockchain than they had been, in an effort to achieve greater efficiency and to develop new business models and revenue sources.

Despite traditional enterprise respondents' interest in blockchain's capabilities, nearly 39 percent of the broad global sample said they believe blockchain is "overhyped." In the United States, meanwhile, this number is higher: 44 percent of respondents view blockchain as overhyped, up from 34 percent in a 2016 survey by Deloitte.

On their own, these numbers seem to indicate that blockchain is moving in the wrong direction. However, we believe this change in attitude is more reflective of the shift toward the pragmatists in the blockchain community.

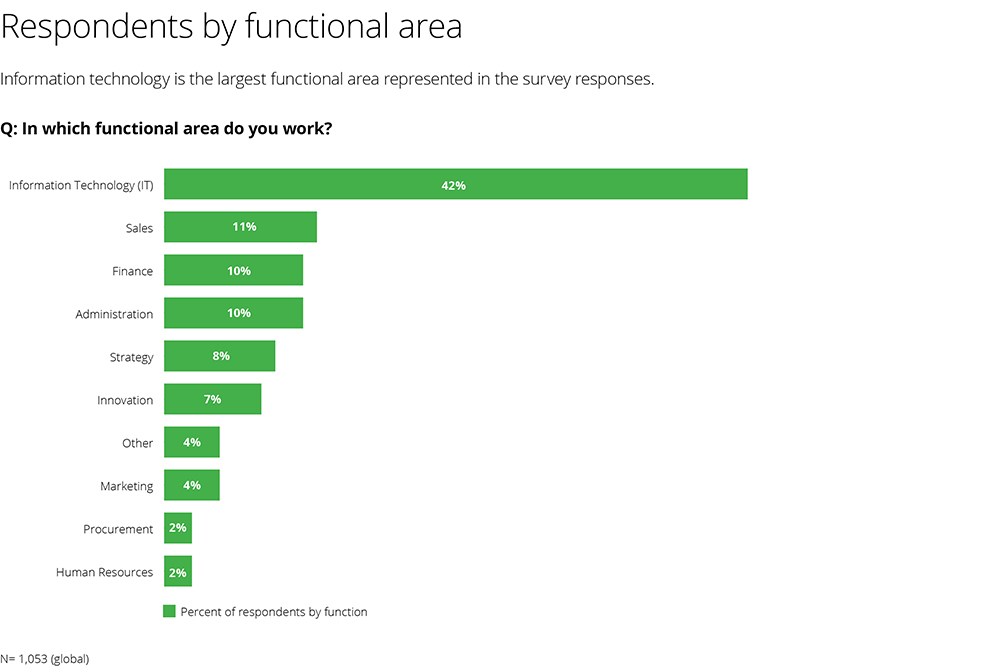

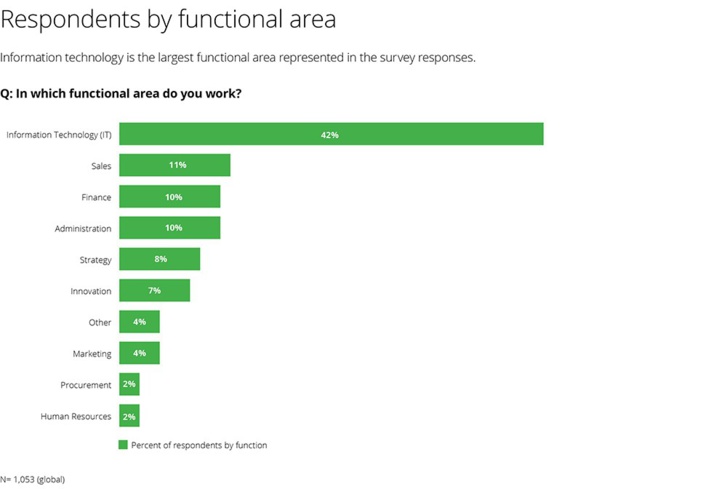

Respondents by functional area

Information technology is the largest functional area represented in the survey responses.

Q: In which functional area do you work?

Blockchain is at an inflection point, with momentum shifting from “blockchain tourism” and exploration of the technology’s potential to the building of practical business applications. This is particularly true among “digital enterprise” organizations, rather than in more traditional enterprises that are still working on how to incorporate digital into their existing operations and protocols. While our survey shows that these traditional enterprise organizations may be lagging their fully digital brethren in this endeavor, the fact is, traditional enterprises are putting more resources behind blockchain than they had been, in an effort to achieve greater efficiency and to develop new business models and revenue sources.

Despite traditional enterprise respondents' interest in blockchain's capabilities, nearly 39 percent of the broad global sample said they believe blockchain is "overhyped." In the United States, meanwhile, this number is higher: 44 percent of respondents view blockchain as overhyped, up from 34 percent in a 2016 survey by Deloitte.

On their own, these numbers seem to indicate that blockchain is moving in the wrong direction. However, we believe this change in attitude is more reflective of the shift toward the pragmatists in the blockchain community.

Respondents by functional area

Information technology is the largest functional area represented in the survey responses.

Q: In which functional area do you work?

Theoretical vs. practical

Blockchain is a versatile technology that can record financial transactions, store medical records, or even track the flow of goods, information, and payments through a supply chain. Ultimately, it’s more of a business model enabler, than a technology.

That understanding is key to discerning the difference in how traditional enterprise (legacy) organizations view blockchain in comparison to their digital enterprise (emerging disruptors) compatriots. For legacy organizations like well-established financial institutions and traditional brick-and-mortar retailers, we’re starting to see a change in approach toward blockchain – i.e., development of more sensible, pragmatic business ecosystem disruption.

What many enterprise executives are still struggling to see, however, is that blockchain represents a fundamental change to their business. This helps explain that while a majority (74 percent) of our survey respondents report that their organizations see a “compelling business case” for the use of blockchain technology, only 34 percent say their company has initiated deployment in some way.

Adding to the uncertain state of blockchain adoption is the fact that while more than 41 percent of respondents say they expect their organizations to bring blockchain into production within the next year, only 21 percent of global respondents—and 30 percent of US respondents—say they still lack a compelling application to justify its implementation.

Enterprises vs. ‘emerging disruptors’

Findings from the survey represent the perspectives of enterprises, but it is also important to understand what’s happening in the digital space. Most of these digital companies could be described as startups, however, we prefer to call them emerging disruptors. We define emerging disruptors as those companies that entered their respective industry segments as startups, but have grown rapidly to the point where they are currently or will soon be disrupting the larger players in their markets. And since the survey focused only on enterprise organizations implementing legacy-constrained solutions, and not on the startups or emerging disruptors, the results don’t necessarily tell the whole story and don’t adequately reflect the incredible level of innovation infiltrating each industry sector.

The established companies face a host of legacy concerns and are trying to make blockchain fit into an already existing business paradigm that may or may not benefit from the introduction of this technology. The emerging disruptors, on the other hand, have business models inspired by blockchain. They are experimenting and building without the constraints of legacy business processes. They focus energy on what is possible and then deal with any challenges as they rise. Based on our experience with the emerging disruptors, we believe blockchain adoption is far more advanced in the United States than the Deloitte global survey indicates.

Current vs. future state

Among the general public, early adopters, such as crypto-currency traders, have helped to bring mainstream notoriety to blockchain. For all this advocacy, however, there remain a significant number of skeptics who view blockchain as the overhyped engine behind a volatile and unregulated financial market.

According our survey, stagnant perceptions about blockchain’s capabilities appear to be more entrenched outside of the United States. When asked if they believed that blockchain was just “a database for money” with little application outside of financial services, just 18 percent of US respondents agreed with that statement versus 61 percent of respondents in France and the UK.

Like their compatriots leading the crypto-currency revolution, our survey data shows that a significant percentage of early adopters in the business community (59 percent) believe in blockchain’s potential to disrupt and revolutionize their industries, and the overall economy. The problem, respondents say, is that for all the talk about blockchain’s promise, there are very few active use cases they can currently employ to advance their beliefs.

As a result, a certain “blockchain fatigue” is beginning to set in among those who feel its potential has been over-communicated, while its real-world benefits remain elusive. Based on our view of where blockchain is today and, more importantly, it’s likely adoption rate within the next three years, we strongly believe that organizations need to evolve their thinking around the technology.

While 78 percent of our survey respondents believe they stand to lose competitive advantage if they do not eventually implement blockchain, they see a variety of obstacles moving forward, with a full one-third saying they believe their current return on investment (ROI) in blockchain technology remains “uncertain.” However, the only real mistake we believe organizations can make regarding blockchain right now is to do nothing. Even without a completely solid business case to implement, we believe that organizations should at the very least, keep an eye on blockchain so that they can take advantage of opportunities when they present themselves.

The bottom line

When looking at the insights developed from our 2016 survey, the data suggested that blockchain adoption – and its move into production – would have happened at a faster pace than we have seen so far in 2018. Still, even though blockchain is rolling out in a more moderated fashion than expected, its adoption remains promising.

As more organizations put their human and financial resources behind blockchain and come to better realize how it can improve their business processes and their bottom lines, we expect the technology to gain significant traction, as its cost savings, competitive advantages, and ROI benefits become more pronounced.

The view further down the road is an inspiring one. We see blockchain enabling a completely new level of information exchange both within—and across—industries. As connections are made between blockchain and other emerging technologies, particularly the cloud and automation, we see the potential for blockchain to help organizations create and realize new value for businesses beyond anything we can imagine with existing technologies.

Download below the survey (PDF 48 pages)

Blockchain is a versatile technology that can record financial transactions, store medical records, or even track the flow of goods, information, and payments through a supply chain. Ultimately, it’s more of a business model enabler, than a technology.

That understanding is key to discerning the difference in how traditional enterprise (legacy) organizations view blockchain in comparison to their digital enterprise (emerging disruptors) compatriots. For legacy organizations like well-established financial institutions and traditional brick-and-mortar retailers, we’re starting to see a change in approach toward blockchain – i.e., development of more sensible, pragmatic business ecosystem disruption.

What many enterprise executives are still struggling to see, however, is that blockchain represents a fundamental change to their business. This helps explain that while a majority (74 percent) of our survey respondents report that their organizations see a “compelling business case” for the use of blockchain technology, only 34 percent say their company has initiated deployment in some way.

Adding to the uncertain state of blockchain adoption is the fact that while more than 41 percent of respondents say they expect their organizations to bring blockchain into production within the next year, only 21 percent of global respondents—and 30 percent of US respondents—say they still lack a compelling application to justify its implementation.

Enterprises vs. ‘emerging disruptors’

Findings from the survey represent the perspectives of enterprises, but it is also important to understand what’s happening in the digital space. Most of these digital companies could be described as startups, however, we prefer to call them emerging disruptors. We define emerging disruptors as those companies that entered their respective industry segments as startups, but have grown rapidly to the point where they are currently or will soon be disrupting the larger players in their markets. And since the survey focused only on enterprise organizations implementing legacy-constrained solutions, and not on the startups or emerging disruptors, the results don’t necessarily tell the whole story and don’t adequately reflect the incredible level of innovation infiltrating each industry sector.

The established companies face a host of legacy concerns and are trying to make blockchain fit into an already existing business paradigm that may or may not benefit from the introduction of this technology. The emerging disruptors, on the other hand, have business models inspired by blockchain. They are experimenting and building without the constraints of legacy business processes. They focus energy on what is possible and then deal with any challenges as they rise. Based on our experience with the emerging disruptors, we believe blockchain adoption is far more advanced in the United States than the Deloitte global survey indicates.

Current vs. future state

Among the general public, early adopters, such as crypto-currency traders, have helped to bring mainstream notoriety to blockchain. For all this advocacy, however, there remain a significant number of skeptics who view blockchain as the overhyped engine behind a volatile and unregulated financial market.

According our survey, stagnant perceptions about blockchain’s capabilities appear to be more entrenched outside of the United States. When asked if they believed that blockchain was just “a database for money” with little application outside of financial services, just 18 percent of US respondents agreed with that statement versus 61 percent of respondents in France and the UK.

Like their compatriots leading the crypto-currency revolution, our survey data shows that a significant percentage of early adopters in the business community (59 percent) believe in blockchain’s potential to disrupt and revolutionize their industries, and the overall economy. The problem, respondents say, is that for all the talk about blockchain’s promise, there are very few active use cases they can currently employ to advance their beliefs.

As a result, a certain “blockchain fatigue” is beginning to set in among those who feel its potential has been over-communicated, while its real-world benefits remain elusive. Based on our view of where blockchain is today and, more importantly, it’s likely adoption rate within the next three years, we strongly believe that organizations need to evolve their thinking around the technology.

While 78 percent of our survey respondents believe they stand to lose competitive advantage if they do not eventually implement blockchain, they see a variety of obstacles moving forward, with a full one-third saying they believe their current return on investment (ROI) in blockchain technology remains “uncertain.” However, the only real mistake we believe organizations can make regarding blockchain right now is to do nothing. Even without a completely solid business case to implement, we believe that organizations should at the very least, keep an eye on blockchain so that they can take advantage of opportunities when they present themselves.

The bottom line

When looking at the insights developed from our 2016 survey, the data suggested that blockchain adoption – and its move into production – would have happened at a faster pace than we have seen so far in 2018. Still, even though blockchain is rolling out in a more moderated fashion than expected, its adoption remains promising.

As more organizations put their human and financial resources behind blockchain and come to better realize how it can improve their business processes and their bottom lines, we expect the technology to gain significant traction, as its cost savings, competitive advantages, and ROI benefits become more pronounced.

The view further down the road is an inspiring one. We see blockchain enabling a completely new level of information exchange both within—and across—industries. As connections are made between blockchain and other emerging technologies, particularly the cloud and automation, we see the potential for blockchain to help organizations create and realize new value for businesses beyond anything we can imagine with existing technologies.

Download below the survey (PDF 48 pages)

Laurent Leloup

Fondateur Finyear

Fondateur Chaineum (Conseil, stratégie blockchain et Crypto Finance)

Auteur de "Blockchain, la révolution de la confiance"

Traducteur, conférencier.

Fondateur Finyear

Fondateur Chaineum (Conseil, stratégie blockchain et Crypto Finance)

Auteur de "Blockchain, la révolution de la confiance"

Traducteur, conférencier.

Finyear - Daily News

Lisez gratuitement :

Le quotidien Finyear

- Sa newsletter quotidienne :

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en Finance innovation, Finance Digitale, Cryptofinance.

- Sa lettre mensuelle Le Trésorier

Le quotidien Finyear

- Sa newsletter quotidienne :

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en Finance innovation, Finance Digitale, Cryptofinance.

- Sa lettre mensuelle Le Trésorier

Autres articles

-

France Fintech : un bilan 2024, pas si mal !

-

Réglementation MiCA : l'AMF crée une rubrique dédiée aux Fintech-crypto

-

ZBD, première entreprise en lice pour la licence MiCA de l'UE

-

Tether investit dans StablR pour promouvoir l'adoption du stablecoin en Europe

-

Chainalysis acquiert Hexagate, fournisseur de solutions de sécurité WEB3