British-based Revolut is trying to raise $1.5 billion from investors on its quest to become the one bank for all your money. In the coming months, the startup is planning to raise $500 million in equity and $1 billion as convertible loan. This would bring its valuation anywhere between $5 billion to $10 billion. Since it was founded in 2015, Revolut initially launched a free app-based bank account and prepaid debit card, and has expanded its offerings to include premium accounts, insurance products, cryptocurrencues and stock trading, and business accounts, including loans.

Ilias Louis Hatzis is the Founder at Mercato Blockchain Corporation AG and Weekly Columnist at Daily Fintech.

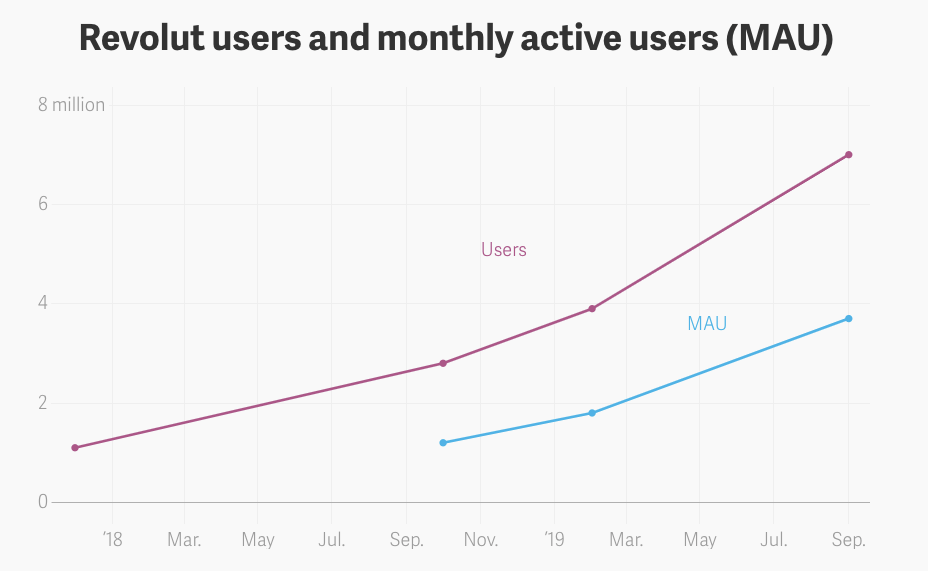

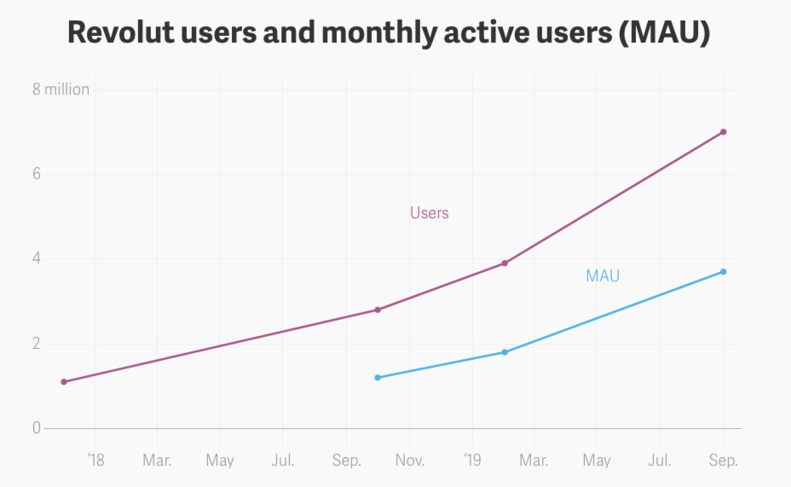

In April 2018, when Revolut raised $250 million in a Series C round, it made a bold statement. that it would reach 100 million customers by 2023.

At that time the company had a little over 1.5 million. By the end of 2018, eight months later, Revolut’s user base doubled, reaching 3 million. This year, both in August and September 800,000 new users joined Revolut and today the company numbers 8 million strong, across UK and Europe. The company has an average monthly active users are 3.7 million and the total transaction volume, since Revolut’s launch in 2015, is now more than $85 billion.

Ilias Louis Hatzis is the Founder at Mercato Blockchain Corporation AG and Weekly Columnist at Daily Fintech.

In April 2018, when Revolut raised $250 million in a Series C round, it made a bold statement. that it would reach 100 million customers by 2023.

At that time the company had a little over 1.5 million. By the end of 2018, eight months later, Revolut’s user base doubled, reaching 3 million. This year, both in August and September 800,000 new users joined Revolut and today the company numbers 8 million strong, across UK and Europe. The company has an average monthly active users are 3.7 million and the total transaction volume, since Revolut’s launch in 2015, is now more than $85 billion.

When you look at the numbers, Revolut has had some impressive growth. Three years ago, customer numbers were at 450,000, with 1,000 new accounts opened every day. Today Revolut has attracted over 8 million users, all in just over 4 years and without any large marketing spend. Whether or not Gandhi ever said, “First they ignore you, then they laugh at you, then they fight you, then you win”. The antibodies of traditional banks are not strong enough any more to fight off the innovation virus that Revolut has unleashed.

Mobile banking has exploded, stirring in the financial services community. Millenniums today prefer digital banking. They don’t believe they benefit going to a branch and they want it done fast. More than 76% of US consumers check their balance or last transaction on a mobile device. In Australia, the same percentage is 68% and the European average for checking bank balances is at 65%, with 32% on desktop and 3% making bank visits.

With its initial focus on the international transactions market, Revolut disrupted the market by removing the hefty hidden fees customers paid. Bank customers still pay their banks 3%-6% in fees. Revolut created a frictionless payment platform that cut hidden fees and offered interbank currency rates in 150 currencies.

But how does a company like Revolut continue its hockey stick growth? Well, you skate to where the puck is going, not where it has been. The smartest companies in the world invest in tomorrow’s technology, today.

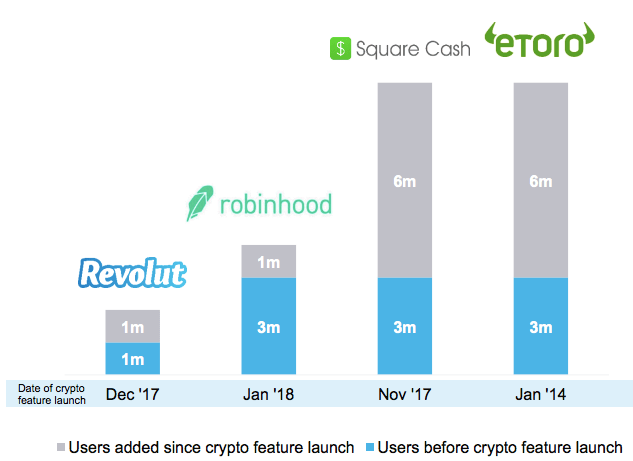

Fintech companies that added a cryptocurrency feature (such as enabling investment in Bitcoin), have seen user numbers double or even triple. Their user numbers shoot up in a non-linear fashion, following the launch of a crypto feature.

Mobile banking has exploded, stirring in the financial services community. Millenniums today prefer digital banking. They don’t believe they benefit going to a branch and they want it done fast. More than 76% of US consumers check their balance or last transaction on a mobile device. In Australia, the same percentage is 68% and the European average for checking bank balances is at 65%, with 32% on desktop and 3% making bank visits.

With its initial focus on the international transactions market, Revolut disrupted the market by removing the hefty hidden fees customers paid. Bank customers still pay their banks 3%-6% in fees. Revolut created a frictionless payment platform that cut hidden fees and offered interbank currency rates in 150 currencies.

But how does a company like Revolut continue its hockey stick growth? Well, you skate to where the puck is going, not where it has been. The smartest companies in the world invest in tomorrow’s technology, today.

Fintech companies that added a cryptocurrency feature (such as enabling investment in Bitcoin), have seen user numbers double or even triple. Their user numbers shoot up in a non-linear fashion, following the launch of a crypto feature.

In December 2017, Revolut rolled out a new feature which allowed users to buy, sell, and hold cryptocurrency from within their mobile app. This represented a fast, simple, and easy way to buy, sell, and hold cryptocurrencies.

For Revolut, cryptocurrencies was the most viral product it has launched to-date. The impact of cryptocurrencies was enormous for Revolut and proved a huge hit with Revolut prospective users, resulting in a huge growth in user acquisition. Revolut’s valuation soared to $1.7 billion, three months after the company launched the crypto trading service and its user base has increased by 70%.

The primary reason for these surges, is the fact that cryptocurrency exchanges are complicated to use. Typical crypto trading platforms have clunky interfaces and inefficient methods for trading cryptocurrencies, they are not very user friendly and do not provide a simple fiat to crypto on/off ramps.

People are looking for an easy and fluid way to invest in cryptocurrencies.

There are pros and cons in the way Revolut implemented it’s crypto feature. On one hand, it is very convenient. Users do not need to signup or do KYC again. It’s very simple. Users can start purchasing cryptocurrencies immediately, using fiat money in the bank account they hold with Revolut. But, there are also some of the major constraints. Users cannot transfer cryptocurrencies, outside of Revolut and they can’t actually use the cryptocurrency, since this feature is purely a speculation vehicle. The fact is that users do not actually own the cryptocurrencies, they merely enjoying exposure to the cryptocurrency market. Overall Revolut solved a very major problem. It let people easily access the cryptocurrency market.

Cryptocurrencies have gained immense traction as a new-age investment. Coinbase has amassed more than 30 million users. You can understand that companies that leverage the viral nature of the digital assets will see huge growth. Crypto can be an important multiplier.

For long-term success, digital banks must have more than their marketplace model and cutting-edge technology. Technology is merely a commodity. The key differentiator that determines success or failure is banks’ strategy for acquiring customers.

Consider Uber’s impact on the taxi industry. Airbnb on the hotel industry. Amazon on brick and mortar retail. All three are reminders that huge industries and players should never presume longevity. They are reminders that disruption happens regardless of turning a profit. To this day, many of these tech giants put their revenue right back into their operations, focusing on acquiring customers, instead of touting fat bottom lines.

The point isn’t whether banks like Revolut are turning a profit. Revolut’s focus has been on growth rather than profitability. The point is that it’s slashing traditional banking profits. Revolut may not make a dent in the high street banks’ market share of current accounts yet, but it is fragmenting the bank-customer relationship irrevocably. Its product diversification strategy is a way to keep customers engaged in its ecosystem, and to generate referrals.

What will it take for Revolut to achieve the goal of 100 million customers?

Heavily monetize the data. As we’ve learnt from Facebook and Cambridge Analytica, if you’re a customer receiving a product for free, then you are the product. Put another way, Revolut’s plan is to aggregate a large group of users, charge fees to a small portion of them and monetize the data on everyone else, who get the services for free.

Leverage OpenBanking. Can Revolut provide a better gateway to a suite of financial products than the banks? If Revolut could pull the funds straight out of a user’s bank account without a user leaving the app, a whole barrier to adoption is knocked down.

Use cryptocurrencies as a customer acquisition strategy. It should be apparent that Bitcoin and cryptocurrencies are not going away. Revolut’s foray into cryptocurrencies was motivated by customer acquisition. Cryptocurrencies are an opportunity to expand customer base and give customers more access to functionality. If cryptocurrencies continue to grow at their current pace, and start replacing parts of the traditional financial system, companies that have not adapted will risk going the way of the dinosaurs.

For Revolut, cryptocurrencies was the most viral product it has launched to-date. The impact of cryptocurrencies was enormous for Revolut and proved a huge hit with Revolut prospective users, resulting in a huge growth in user acquisition. Revolut’s valuation soared to $1.7 billion, three months after the company launched the crypto trading service and its user base has increased by 70%.

The primary reason for these surges, is the fact that cryptocurrency exchanges are complicated to use. Typical crypto trading platforms have clunky interfaces and inefficient methods for trading cryptocurrencies, they are not very user friendly and do not provide a simple fiat to crypto on/off ramps.

People are looking for an easy and fluid way to invest in cryptocurrencies.

There are pros and cons in the way Revolut implemented it’s crypto feature. On one hand, it is very convenient. Users do not need to signup or do KYC again. It’s very simple. Users can start purchasing cryptocurrencies immediately, using fiat money in the bank account they hold with Revolut. But, there are also some of the major constraints. Users cannot transfer cryptocurrencies, outside of Revolut and they can’t actually use the cryptocurrency, since this feature is purely a speculation vehicle. The fact is that users do not actually own the cryptocurrencies, they merely enjoying exposure to the cryptocurrency market. Overall Revolut solved a very major problem. It let people easily access the cryptocurrency market.

Cryptocurrencies have gained immense traction as a new-age investment. Coinbase has amassed more than 30 million users. You can understand that companies that leverage the viral nature of the digital assets will see huge growth. Crypto can be an important multiplier.

For long-term success, digital banks must have more than their marketplace model and cutting-edge technology. Technology is merely a commodity. The key differentiator that determines success or failure is banks’ strategy for acquiring customers.

Consider Uber’s impact on the taxi industry. Airbnb on the hotel industry. Amazon on brick and mortar retail. All three are reminders that huge industries and players should never presume longevity. They are reminders that disruption happens regardless of turning a profit. To this day, many of these tech giants put their revenue right back into their operations, focusing on acquiring customers, instead of touting fat bottom lines.

The point isn’t whether banks like Revolut are turning a profit. Revolut’s focus has been on growth rather than profitability. The point is that it’s slashing traditional banking profits. Revolut may not make a dent in the high street banks’ market share of current accounts yet, but it is fragmenting the bank-customer relationship irrevocably. Its product diversification strategy is a way to keep customers engaged in its ecosystem, and to generate referrals.

What will it take for Revolut to achieve the goal of 100 million customers?

Heavily monetize the data. As we’ve learnt from Facebook and Cambridge Analytica, if you’re a customer receiving a product for free, then you are the product. Put another way, Revolut’s plan is to aggregate a large group of users, charge fees to a small portion of them and monetize the data on everyone else, who get the services for free.

Leverage OpenBanking. Can Revolut provide a better gateway to a suite of financial products than the banks? If Revolut could pull the funds straight out of a user’s bank account without a user leaving the app, a whole barrier to adoption is knocked down.

Use cryptocurrencies as a customer acquisition strategy. It should be apparent that Bitcoin and cryptocurrencies are not going away. Revolut’s foray into cryptocurrencies was motivated by customer acquisition. Cryptocurrencies are an opportunity to expand customer base and give customers more access to functionality. If cryptocurrencies continue to grow at their current pace, and start replacing parts of the traditional financial system, companies that have not adapted will risk going the way of the dinosaurs.

Ilias Louis Hatzis

Ilias Louis Hatzis is the Founder & CEO at Mercato Blockchain Corporation AG.

He writes the Blockchain Weekly Front Page each Monday.I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Subscribe by email to join the 25,000 other Fintech leaders who read our research daily to stay ahead of the curve.

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

http://dailyfintech.com

He writes the Blockchain Weekly Front Page each Monday.I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Subscribe by email to join the 25,000 other Fintech leaders who read our research daily to stay ahead of the curve.

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

http://dailyfintech.com

Finyear & Chaineum

Lisez gratuitement le quotidien Finyear & sa newsletter quotidienne.

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

------------------------

Chaineum :

Fondée en 2015, Chaineum est un cabinet de conseil en opérations de haut de bilan offrant une expertise de premier plan en matière d’ICO et STO, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

La division services blockchain de Chaineum, développe la technologie Chaineum Segment, une blockchain privée orientée objets.

About Chaineum:

Founded in 2015, Chaineum is a leading corporate finance advisory firm with a strong expertise in ICO and STO, and a strategic focus on both its clients' business and blockchain technology. As such, Chaineum paved the way in the implementation of certain best practices in this sector (ICO Charter, Security Token Network).

Chaineum's blockchain services division, is developing Chaineum Segment technology, an object-oriented private blockchain.

-------------------------

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

------------------------

Chaineum :

Fondée en 2015, Chaineum est un cabinet de conseil en opérations de haut de bilan offrant une expertise de premier plan en matière d’ICO et STO, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

La division services blockchain de Chaineum, développe la technologie Chaineum Segment, une blockchain privée orientée objets.

About Chaineum:

Founded in 2015, Chaineum is a leading corporate finance advisory firm with a strong expertise in ICO and STO, and a strategic focus on both its clients' business and blockchain technology. As such, Chaineum paved the way in the implementation of certain best practices in this sector (ICO Charter, Security Token Network).

Chaineum's blockchain services division, is developing Chaineum Segment technology, an object-oriented private blockchain.

-------------------------

No Offer, Solicitation, Investment Advice, or Recommendations

This website is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, nor does it constitute an offer to provide investment advisory or other services by FINYEAR.

No reference to any specific security constitutes a recommendation to buy, sell or hold that security or any other security.

Nothing on this website shall be considered a solicitation or offer to buy or sell any security, future, option or other financial instrument or to offer or provide any investment advice or service to any person in any jurisdiction.

Nothing contained on the website constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed on this website should not be taken as advice to buy, sell or hold any security. In preparing the information contained in this website, we have not taken into account the investment needs, objectives and financial circumstances of any particular investor.

This information has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient of this information and investments discussed may not be suitable for all investors.

Any views expressed on this website by us were prepared based upon the information available to us at the time such views were written. Changed or additional information could cause such views to change.

All information is subject to possible correction. Information may quickly become unreliable for various reasons, including changes in market conditions or economic circumstances.

No reference to any specific security constitutes a recommendation to buy, sell or hold that security or any other security.

Nothing on this website shall be considered a solicitation or offer to buy or sell any security, future, option or other financial instrument or to offer or provide any investment advice or service to any person in any jurisdiction.

Nothing contained on the website constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed on this website should not be taken as advice to buy, sell or hold any security. In preparing the information contained in this website, we have not taken into account the investment needs, objectives and financial circumstances of any particular investor.

This information has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient of this information and investments discussed may not be suitable for all investors.

Any views expressed on this website by us were prepared based upon the information available to us at the time such views were written. Changed or additional information could cause such views to change.

All information is subject to possible correction. Information may quickly become unreliable for various reasons, including changes in market conditions or economic circumstances.

Autres articles

-

Paris Blockchain Week 2025, en avant-première, la short list des premiers speakers

-

Opinion | Simon Peters, eToro "Bitcoin : où va-t-il maintenant ?"

-

Société Générale-Forge : bientôt l'intégration de son stablecoin EURCV sur le réseau Stellar

-

La BCE étend ses projets blockchain pour les MNBC

-

Nomination | Kiln accueille Dan Biton en tant que VP en charge des projets spéciaux