Ten years ago, when Satoshi Nakamoto published Bitcoin’s whitepaper, he described a “peer-to-peer version of electronic cash.” The idea was for Bitcoin to be digital cash. To provide a borderless means for payments, without intermediates. Since then, while Bitcoin has become a household name, it has yet to realize its true potential. It’s primarily used for speculation, instead of an everyday means of exchange.

Major retailers have become very receptive to the idea of accepting Bitcoin as means of payment. Now you can pay your AT&T bills using Bitcoin. Satellite television and Internet service provider Dish Network accepts Bitcoin as a payment option. You can fund your Microsoft account with Bitcoin, to purchase games, movies, and apps in the Windows and Xbox stores. Who accepts Bitcoin? Here’s a list with a few of the major companies accepting Bitcoin.

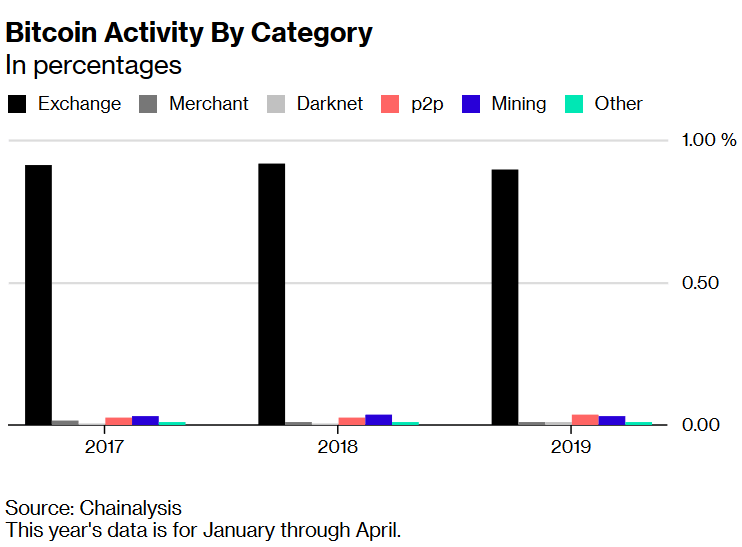

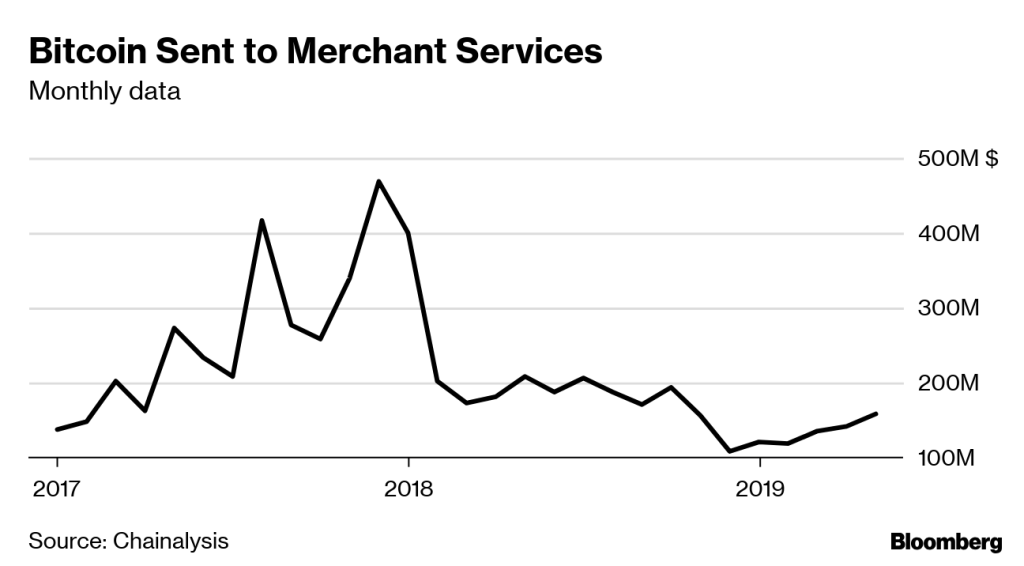

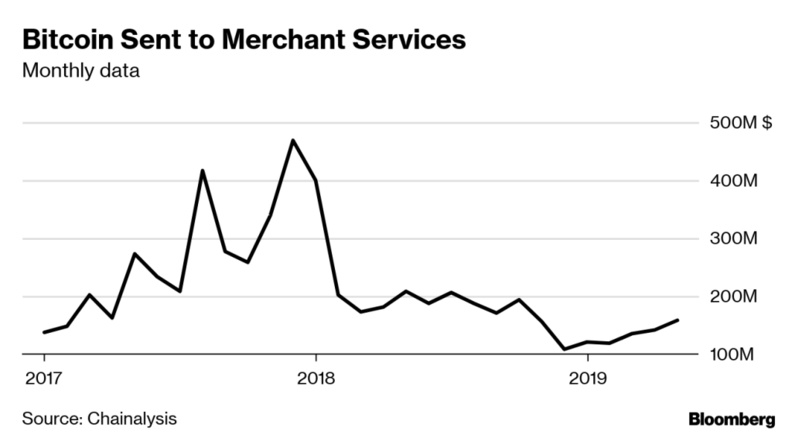

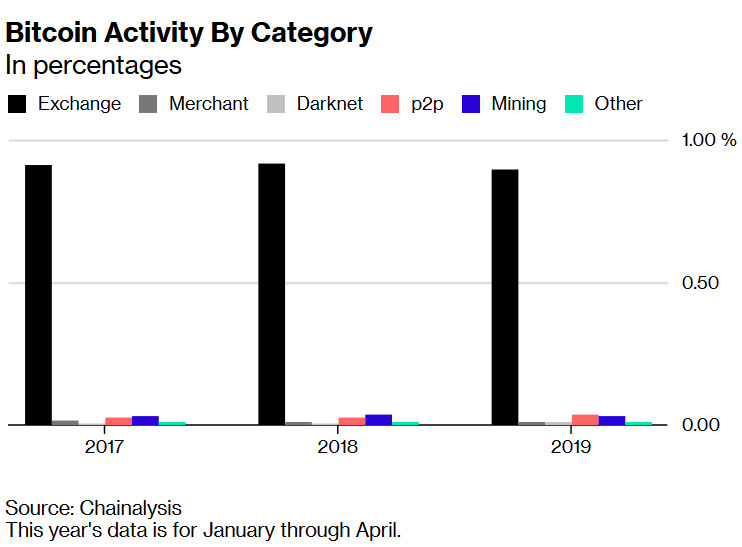

Yet, research from Chainalysis shows that just 1% of Bitcoin transactions were payments to merchants. Almost no one is using Bitcoin to buy things. Speculation was the primary use for Bitcoin.

Major retailers have become very receptive to the idea of accepting Bitcoin as means of payment. Now you can pay your AT&T bills using Bitcoin. Satellite television and Internet service provider Dish Network accepts Bitcoin as a payment option. You can fund your Microsoft account with Bitcoin, to purchase games, movies, and apps in the Windows and Xbox stores. Who accepts Bitcoin? Here’s a list with a few of the major companies accepting Bitcoin.

Yet, research from Chainalysis shows that just 1% of Bitcoin transactions were payments to merchants. Almost no one is using Bitcoin to buy things. Speculation was the primary use for Bitcoin.

In the first four months of 2019, the proportion of merchant related transactions remained low. Only 1.3% of Bitcoin (BTC) transactions were purchases from merchants. The most extensive use is speculation on exchanges. The increase in price has to do with what we are willing to pay for Bitcoin and cryptocurrencies, instead of what we can actually do with them.

Bitcoin’s volatile nature discourages people from using it to buy things. People prefer to HODL and make huge profits in the future, instead of using Bitcoin to pay for things.

Bitcoin’s volatile nature discourages people from using it to buy things. People prefer to HODL and make huge profits in the future, instead of using Bitcoin to pay for things.

Five years ago, criminal activity was behind about 90 percent of cryptocurrency transactions. Now, illegal activity has shrunk to about 10 percent and speculation has become the dominant driver.

Speculation is important for new technologies. Whether you are dealing with emerging technology, a new business or idea, speculation is one of reasons that something will cross the chasm, to become widely adopted or a complete failure. But speculation can also be bad, when its not backed by growing usage.

Today, usage for Bitcoin and cryptocurrencies is still very low. About 85% of Bitcoin’s value is the result of speculation. Investors are heavily speculating on the future usage and adoption for cryptocurrencies and blockchain, but today utility is just a small component of the current price.

Use cases are what will drive Bitcoin’s growth, not speculation.

During a conference in Korea, Andreas Antonopoulos said “Crypto doesn’t have a use-case in the ‘developed’ world… yet“. The reality is that until scalable use cases are fully deployed, cryptocurrency markets will remain a highly speculative and volatile.

Many attribute this to block size, Lightning Network, or user experience.

We are starting to see some real use cases around the world. Projects like Facebook’s upcoming stablecoin, JPMorgan’s JPM Coin and Fidelity’s recent announcement that it will start buying and selling BTC for its clients. These are all important and constitute stepping stones in mass-adoption for cryptocurrency, but I am not sure if they are the Bitcoin’s killer app.

If we want to predict where it might go, we need to look beyond price and follow how its used and who is using it. Lack of real-world use is the biggest challenge for Bitcoin. Maybe Bitcoin will never become a payment currency and will only be a stored value just like gold. But it’s only by using Bitcoin we give it “real”, intrinsic value. Either way, with serious money now coming into the market, we are still at the beginning of everything.

Speculation is important for new technologies. Whether you are dealing with emerging technology, a new business or idea, speculation is one of reasons that something will cross the chasm, to become widely adopted or a complete failure. But speculation can also be bad, when its not backed by growing usage.

Today, usage for Bitcoin and cryptocurrencies is still very low. About 85% of Bitcoin’s value is the result of speculation. Investors are heavily speculating on the future usage and adoption for cryptocurrencies and blockchain, but today utility is just a small component of the current price.

Use cases are what will drive Bitcoin’s growth, not speculation.

During a conference in Korea, Andreas Antonopoulos said “Crypto doesn’t have a use-case in the ‘developed’ world… yet“. The reality is that until scalable use cases are fully deployed, cryptocurrency markets will remain a highly speculative and volatile.

Many attribute this to block size, Lightning Network, or user experience.

We are starting to see some real use cases around the world. Projects like Facebook’s upcoming stablecoin, JPMorgan’s JPM Coin and Fidelity’s recent announcement that it will start buying and selling BTC for its clients. These are all important and constitute stepping stones in mass-adoption for cryptocurrency, but I am not sure if they are the Bitcoin’s killer app.

If we want to predict where it might go, we need to look beyond price and follow how its used and who is using it. Lack of real-world use is the biggest challenge for Bitcoin. Maybe Bitcoin will never become a payment currency and will only be a stored value just like gold. But it’s only by using Bitcoin we give it “real”, intrinsic value. Either way, with serious money now coming into the market, we are still at the beginning of everything.

Ilias Louis Hatzis

Ilias Louis Hatzis is the Founder & CEO at Mercato Blockchain Corporation AG.

He writes the Blockchain Weekly Front Page each Monday.I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Subscribe by email to join the 25,000 other Fintech leaders who read our research daily to stay ahead of the curve.

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

http://dailyfintech.com

He writes the Blockchain Weekly Front Page each Monday.I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Subscribe by email to join the 25,000 other Fintech leaders who read our research daily to stay ahead of the curve.

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

http://dailyfintech.com

Finyear & Chaineum

Lisez gratuitement le quotidien Finyear & sa newsletter quotidienne.

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

----------------

Chaineum - Conseil haut de bilan & stratégie blockchain

Fondée en 2015, Chaineum est un cabinet de conseil en opérations de haut de bilan offrant une expertise de premier plan en matière d’ICOs et STOs, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

Besançon - Paris + réseau international de partenaires.

About Chaineum

Founded in 2015, Chaineum is a leading corporate finance advisory firm with a strong expertise in ICOs and STOs, and a strategic focus on both its clients' business and blockchain technology. As such, Chaineum paved the way in the implementation of certain best practices in this sector (ICO Charter, Security Token Network).

Chaineum Segment, Chaineum's blockchain services division, is developing Chaineum Segment technology, an object-oriented private blockchain.

https://www.chaineum.com

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

----------------

Chaineum - Conseil haut de bilan & stratégie blockchain

Fondée en 2015, Chaineum est un cabinet de conseil en opérations de haut de bilan offrant une expertise de premier plan en matière d’ICOs et STOs, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

Besançon - Paris + réseau international de partenaires.

About Chaineum

Founded in 2015, Chaineum is a leading corporate finance advisory firm with a strong expertise in ICOs and STOs, and a strategic focus on both its clients' business and blockchain technology. As such, Chaineum paved the way in the implementation of certain best practices in this sector (ICO Charter, Security Token Network).

Chaineum Segment, Chaineum's blockchain services division, is developing Chaineum Segment technology, an object-oriented private blockchain.

https://www.chaineum.com

Autres articles

-

Coinbase et Visa, un partenariat pour des transferts en temps réel

-

Brilliantcrypto, la nouvelle aventure play-to-earn basée sur la blockchain Polygon, arrive sur Epic Game Store

-

Nomination | Truffle Capital promeut Alexis Le Portz en qualité de Partner

-

IPEM Paris 2024 : 5500 participants au Palais des congrès

-

Pomelo annonce une Série A à 35 millions de dollars menée par Vy Capital