IMAGE SOURCE

Last week I read a tweet that Israel was going to ban cash payments.

Israel introduced a law banning the use of cash for large transactions. The new law limits cash payments in one business transaction to 6,000 shekels ($1,785), as the country wants to fight organized crime, money laundering, and tax evasion. It also announced its intent to limit personal cash savings, to reduce overall cash usage.

Israel is not alone. Earlier this year Italy limited cash payments to €1,000 and for any payment above this limit, you need to use a bank card, a cheque, or make a bank transfer. In Greece, the limit is €500, except for the purchase of a vehicle.

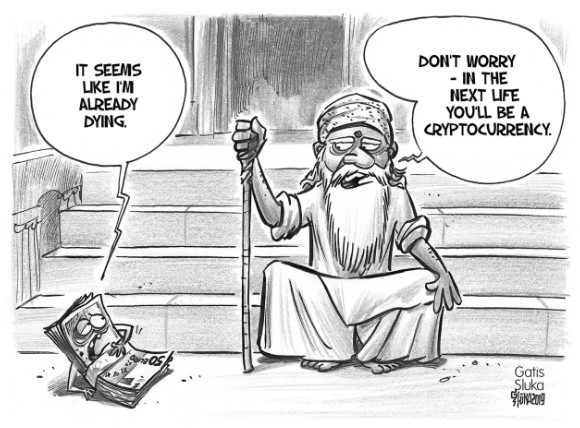

Cash is being used less and less each year. A generational shift in consumer behavior coupled with factors like the Covid pandemic has expedited this process.

Cash is on its way out.

A study by the European Central Bank (ECB) released in 2020 showed that the Netherlands, closely followed by Finland, is the country in the Eurozone which uses cash the least, with less than 35% of transactions being completed in cash. This is a rather small percentage in comparison to neighboring Belgium and Germany with 58% and 77% of cash transactions respectively, and countries like France at 59%, Spain at 83%, and Italy at 82%.

Governments everywhere are planning to track everything we do with our money. Worst of all they are planning to use the data to exercise control.

There are currently over 90 countries worldwide that are examining, developing or implementing some form of programmable money, central bank digital currencies (CBDCs) — digital versions of national fiat money updated for use in today’s increasingly online world.

The most notable and troubling CBDC in development is the Chinese digital yuan. The pinnacle of digital authoritarianism, this digital currency would be linked to a “social credit” score that gives the Chinese government instant knowledge and control over its people’s finances.

China already monitors what people do with their money, whether people pay bills on time, much like financial credit trackers — but also ascribes a moral dimension. Their social credit system links each person’s identity to their bank account and lets the government see and control everything someone does with their money. While the exact scoring methodology is a secret, infractions can be both related to money and non-money activities — bad driving, smoking in non-smoking zones, buying too many video games, debt, not paying bills, wasting money on frivolous purchases, and posting fake news online, specifically about terrorist attacks or airport security.

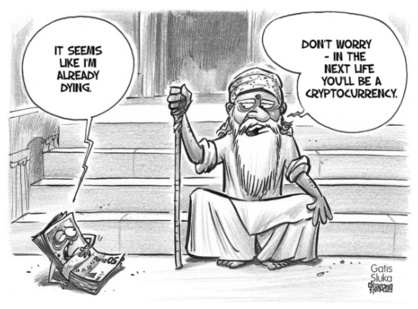

While most CBDCs propose using blockchain technology similar to that of cryptocurrencies like Bitcoin and Ethereum, they differ with regard to decentralization and privacy. The Bitcoin and Ethereum networks are designed so no one entity can exert control and all transactions have a degree of anonymity, while CBDCs are exclusively controlled by governments and are expected to provide limited or no privacy.

No matter where you live in the world, this technology is close to becoming a reality. Governments are planning to replace cash with CBDCs. In Europe, the ECB expects to release the digital Euro by the end of 2025 or early 2026.

With CBDC everything you do will be tracked and analyzed.

Did you take too many car trips this month? Did you buy too much meat? Did you buy cheap synthetic-fiber clothing? Well, then you’ll get a bill from your government to pay the price of your indulgence. And since central banks will hold the keys to your money, they won’t even have to send you a bill, they’ll just withdraw the fines directly from your bank account.

The Canadian government’s response regarding donations to the trucker protests this year is a good indication of this phenomenon. These were frozen after the use of an emergency law and the donors were exposed to prosecution.

While a cash-free world that runs on CBDCs may increase financial inclusion, it’s clear they will have a lasting impact on our financial privacy and freedom.

The greatest attribute of cash is that it carries only the information of value, protecting purchaser privacy. Cash is the only established payment system that offers “full anonymity.” Even central banks, the issuer of legal tender fiat currency, do know who possesses cash. Eliminating cash would undermine the privacy of individuals.

Central banks are looking for ways to get rid of cash and gain more control. The risks of financial censorship are rising and with a CBDC, central banks could easily block the use of funds of individuals or groups who fall out of favor with their government.

Our freedom is threatened in a world where banks and governments get rid of cash and replace it with CBDC while maintaining the possibility to freeze anyone’s bank account. This opens the door to a dark reality in which we may not be able to participate in society because we voiced the “wrong” opinion on Twitter, resulting in the locking of our bank accounts and the denial of our freedom to transact.

The use of money and how it is saved, sent, spent, and secured, should be free. A survey conducted by the European Central Bank has found that both citizens and businesses consider privacy the most important feature of a CBDC. For CBDCs to be benecial they are open, permissionless, and private.

Last week I read a tweet that Israel was going to ban cash payments.

Israel introduced a law banning the use of cash for large transactions. The new law limits cash payments in one business transaction to 6,000 shekels ($1,785), as the country wants to fight organized crime, money laundering, and tax evasion. It also announced its intent to limit personal cash savings, to reduce overall cash usage.

Israel is not alone. Earlier this year Italy limited cash payments to €1,000 and for any payment above this limit, you need to use a bank card, a cheque, or make a bank transfer. In Greece, the limit is €500, except for the purchase of a vehicle.

Cash is being used less and less each year. A generational shift in consumer behavior coupled with factors like the Covid pandemic has expedited this process.

Cash is on its way out.

A study by the European Central Bank (ECB) released in 2020 showed that the Netherlands, closely followed by Finland, is the country in the Eurozone which uses cash the least, with less than 35% of transactions being completed in cash. This is a rather small percentage in comparison to neighboring Belgium and Germany with 58% and 77% of cash transactions respectively, and countries like France at 59%, Spain at 83%, and Italy at 82%.

Governments everywhere are planning to track everything we do with our money. Worst of all they are planning to use the data to exercise control.

There are currently over 90 countries worldwide that are examining, developing or implementing some form of programmable money, central bank digital currencies (CBDCs) — digital versions of national fiat money updated for use in today’s increasingly online world.

The most notable and troubling CBDC in development is the Chinese digital yuan. The pinnacle of digital authoritarianism, this digital currency would be linked to a “social credit” score that gives the Chinese government instant knowledge and control over its people’s finances.

China already monitors what people do with their money, whether people pay bills on time, much like financial credit trackers — but also ascribes a moral dimension. Their social credit system links each person’s identity to their bank account and lets the government see and control everything someone does with their money. While the exact scoring methodology is a secret, infractions can be both related to money and non-money activities — bad driving, smoking in non-smoking zones, buying too many video games, debt, not paying bills, wasting money on frivolous purchases, and posting fake news online, specifically about terrorist attacks or airport security.

While most CBDCs propose using blockchain technology similar to that of cryptocurrencies like Bitcoin and Ethereum, they differ with regard to decentralization and privacy. The Bitcoin and Ethereum networks are designed so no one entity can exert control and all transactions have a degree of anonymity, while CBDCs are exclusively controlled by governments and are expected to provide limited or no privacy.

No matter where you live in the world, this technology is close to becoming a reality. Governments are planning to replace cash with CBDCs. In Europe, the ECB expects to release the digital Euro by the end of 2025 or early 2026.

With CBDC everything you do will be tracked and analyzed.

Did you take too many car trips this month? Did you buy too much meat? Did you buy cheap synthetic-fiber clothing? Well, then you’ll get a bill from your government to pay the price of your indulgence. And since central banks will hold the keys to your money, they won’t even have to send you a bill, they’ll just withdraw the fines directly from your bank account.

The Canadian government’s response regarding donations to the trucker protests this year is a good indication of this phenomenon. These were frozen after the use of an emergency law and the donors were exposed to prosecution.

While a cash-free world that runs on CBDCs may increase financial inclusion, it’s clear they will have a lasting impact on our financial privacy and freedom.

The greatest attribute of cash is that it carries only the information of value, protecting purchaser privacy. Cash is the only established payment system that offers “full anonymity.” Even central banks, the issuer of legal tender fiat currency, do know who possesses cash. Eliminating cash would undermine the privacy of individuals.

Central banks are looking for ways to get rid of cash and gain more control. The risks of financial censorship are rising and with a CBDC, central banks could easily block the use of funds of individuals or groups who fall out of favor with their government.

Our freedom is threatened in a world where banks and governments get rid of cash and replace it with CBDC while maintaining the possibility to freeze anyone’s bank account. This opens the door to a dark reality in which we may not be able to participate in society because we voiced the “wrong” opinion on Twitter, resulting in the locking of our bank accounts and the denial of our freedom to transact.

The use of money and how it is saved, sent, spent, and secured, should be free. A survey conducted by the European Central Bank has found that both citizens and businesses consider privacy the most important feature of a CBDC. For CBDCs to be benecial they are open, permissionless, and private.

Ilias Louis Hatzis

Ilias Louis Hatzis is the Founder & CEO at Mercato Blockchain Corporation AG.

Ilias Louis Hatzis is the founder and CEO at Kryptonio wallet. Create your wallet in less than a minute, without seed phrases, private keys, passwords or documents. Keep your bitcoin and digital assets always secure and recoverable: https://kryptonio.com

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Ilias Louis Hatzis is the founder and CEO at Kryptonio wallet. Create your wallet in less than a minute, without seed phrases, private keys, passwords or documents. Keep your bitcoin and digital assets always secure and recoverable: https://kryptonio.com

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Autres articles

-

Spendesk complète son offre en devenant établissement de paiement

-

Nomination | Swan structure sa direction avec l'arrivée de Camille Tyan au poste de Directeur Général

-

Dogizen, la première ICO sur Telegram, séduit les experts avec une augmentation de 1,4 million de dollars.

-

Klarna affiche sa pleine forme, avant son IPO en 2025 ?

-

Revolut : ses quatre grands projets pour 2025