NFTs have exploded in 2021, with tens of billions of dollars’ worth of cryptocurrency invested in the asset class this year. But what kinds of traders are driving this activity? What platforms are they using? And what kinds of returns are they getting? These are the questions we seek to answer in our latest report analyzing the NFT market. Inside, you’ll find data and research on:

- The most popular collections as NFT investment has grown

- Strategies of the most successful NFT traders

- The impact of failed transaction fees during minting events

--------------------------------

Non-fungible tokens (NFTs) have skyrocketed in popularity over the last year. NFTs are blockchain-based digital items whose units are designed to be unique, unlike traditional cryptocurrencies whose units are meant to be interchangeable. NFTs can store data on blockchains — with most NFT projects built on the Ethereum blockchain — and that data can be associated with files containing media such as images, videos, and audio, or even in some cases physical objects. NFTs typically give the holder ownership over the data, media, or object the token is associated with, and are commonly bought and sold on specialized marketplaces, which we’ll explore in more detail later on in the report.

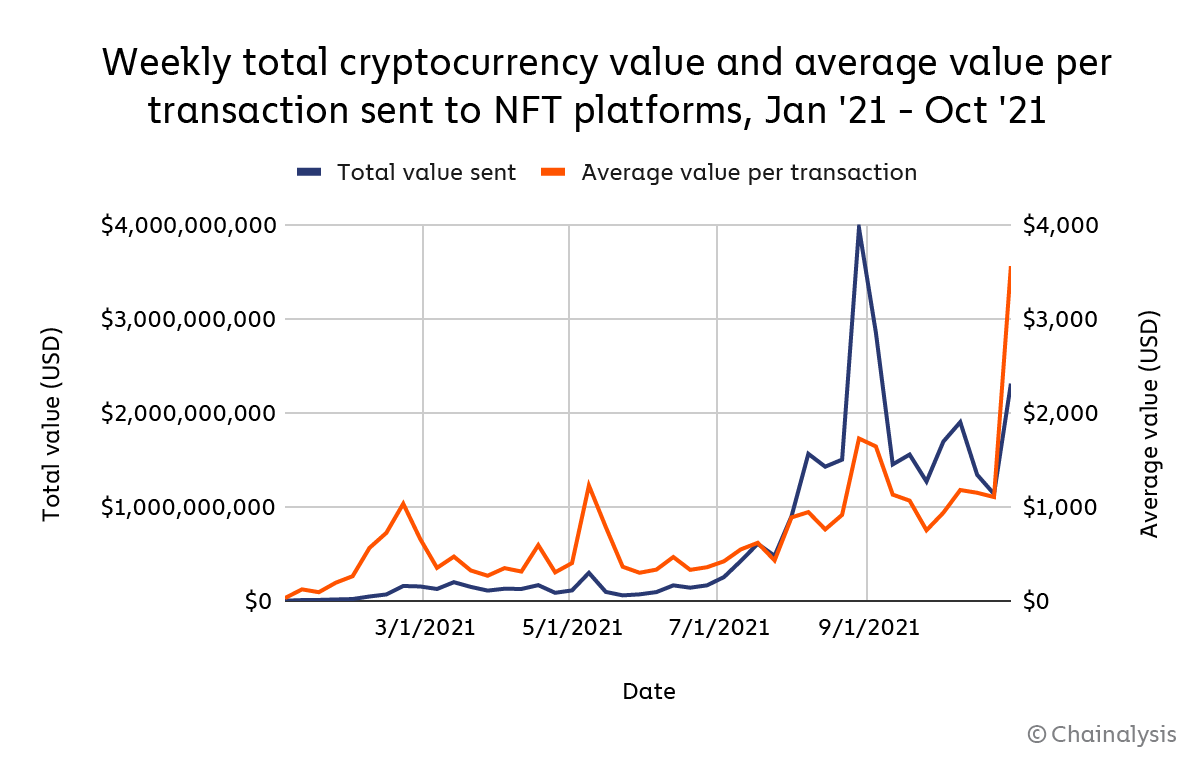

So far in 2021, users have sent at least $26.9 billion worth of cryptocurrency to ERC-721 and ERC-1155 contracts, the two types of Ethereum smart contracts associated with NFT marketplaces and collections.

- The most popular collections as NFT investment has grown

- Strategies of the most successful NFT traders

- The impact of failed transaction fees during minting events

--------------------------------

Non-fungible tokens (NFTs) have skyrocketed in popularity over the last year. NFTs are blockchain-based digital items whose units are designed to be unique, unlike traditional cryptocurrencies whose units are meant to be interchangeable. NFTs can store data on blockchains — with most NFT projects built on the Ethereum blockchain — and that data can be associated with files containing media such as images, videos, and audio, or even in some cases physical objects. NFTs typically give the holder ownership over the data, media, or object the token is associated with, and are commonly bought and sold on specialized marketplaces, which we’ll explore in more detail later on in the report.

So far in 2021, users have sent at least $26.9 billion worth of cryptocurrency to ERC-721 and ERC-1155 contracts, the two types of Ethereum smart contracts associated with NFT marketplaces and collections.

Notably, we see significant increases in both total value sent and average transaction size, suggesting that NFTs as an asset category are gaining value as they attract new users. There’s also a noticeable spike beginning in the last week of August, which appears to have been largely driven by the release of a new collection from the popular NFT creator group Bored Ape Yacht Club. We’ll explore the rising value of NFT investments in more detail later in this report.

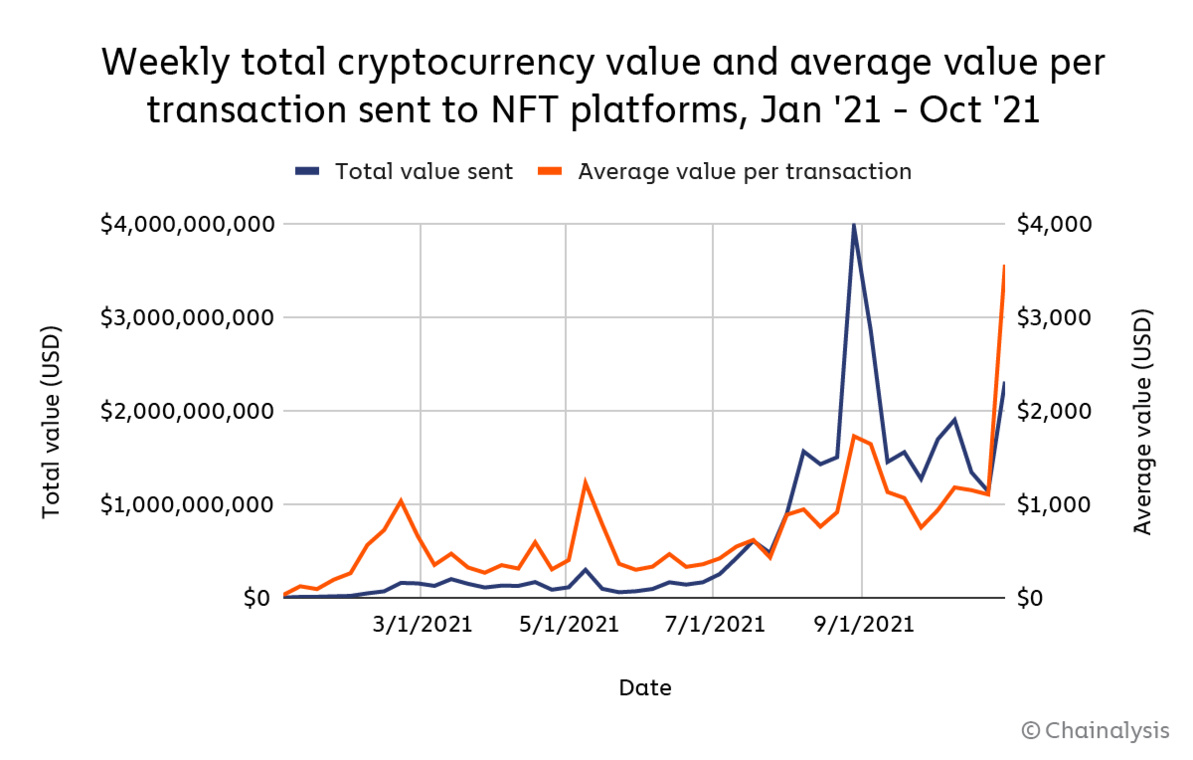

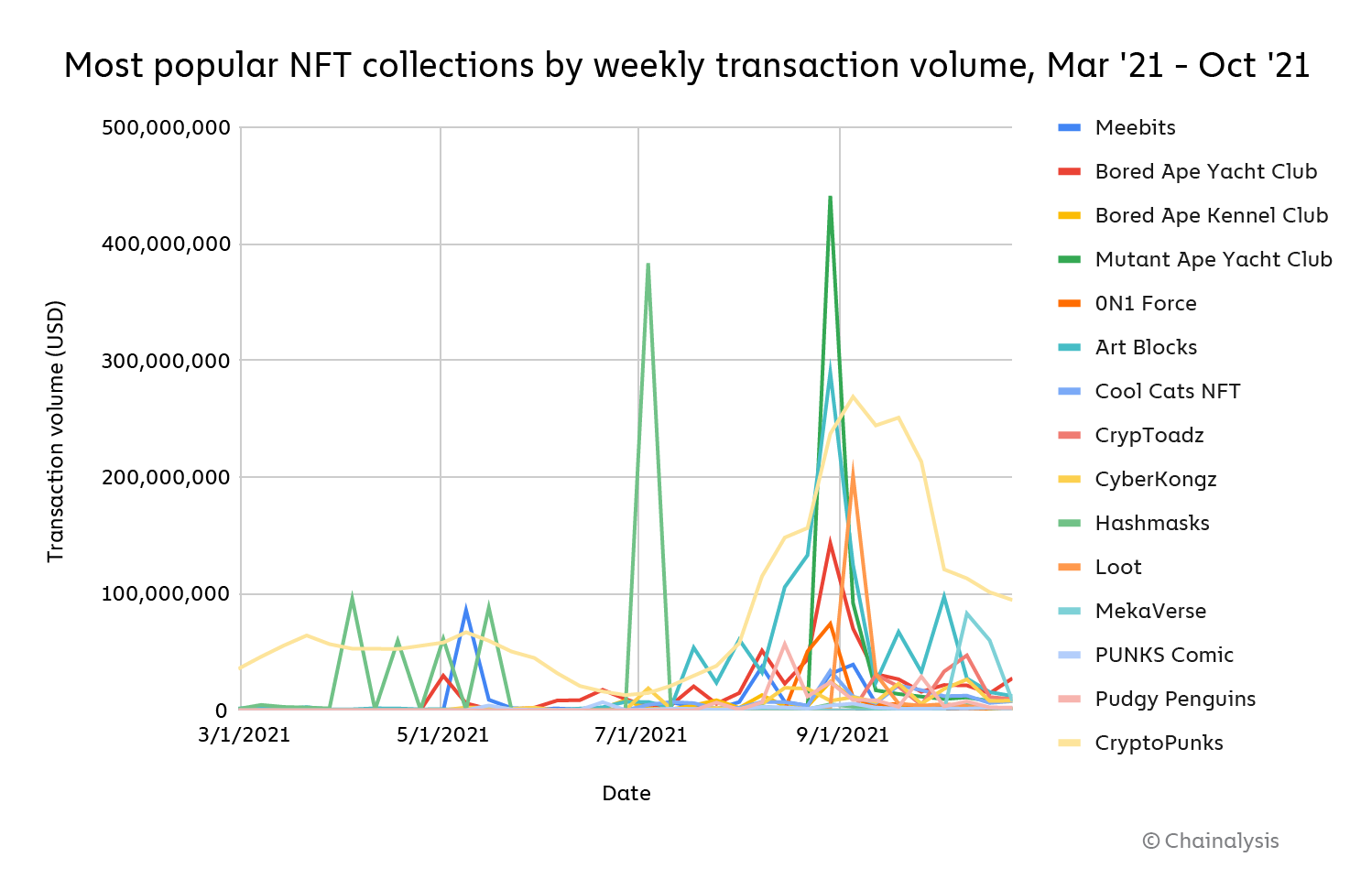

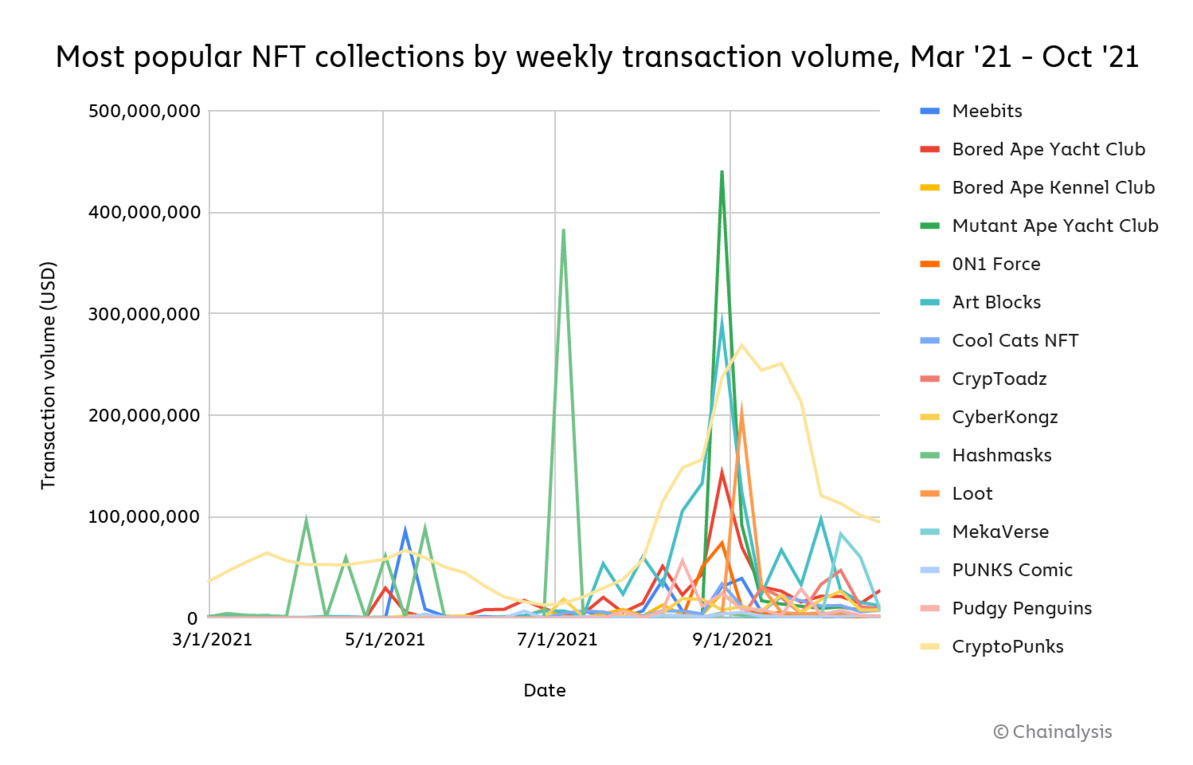

Most users buy NFTs on dedicated marketplaces, similarly to how they might buy conventional cryptocurrencies on an exchange. Many NFT marketplaces, such as OpenSea, don’t custody users’ NFTs for them, instead allowing users to transfer NFTs directly between their own wallets — in this way, those marketplaces are similar to decentralized exchanges or P2P exchanges. Others, however, like Dapper Labs, handle custody on behalf of users. OpenSea is the most popular marketplace by a wide margin, with over $16 billion worth of cryptocurrency received so far in 2021. The chart below shows the most popular NFT collections being traded on these marketplaces over time.

Most users buy NFTs on dedicated marketplaces, similarly to how they might buy conventional cryptocurrencies on an exchange. Many NFT marketplaces, such as OpenSea, don’t custody users’ NFTs for them, instead allowing users to transfer NFTs directly between their own wallets — in this way, those marketplaces are similar to decentralized exchanges or P2P exchanges. Others, however, like Dapper Labs, handle custody on behalf of users. OpenSea is the most popular marketplace by a wide margin, with over $16 billion worth of cryptocurrency received so far in 2021. The chart below shows the most popular NFT collections being traded on these marketplaces over time.

CryptoPunks, which was established in 2017 well before the current NFT craze, has been the most popular NFT collection during the time period studied, with more than $3 billion in transaction volume since March 2021. Interestingly, we see some collections that experienced brief but large spikes in transaction activity without ever gaining consistent popularity. For instance, Hashmasks saw more than $380 million in transaction value during the week of July 4, 2021. In no other week during the time period studied did the collection see more than $95.7 million, and its average weekly transaction volume for the entire time period studied was just under $21 million. We see a similar pattern with Mutant Ape Yacht Club.

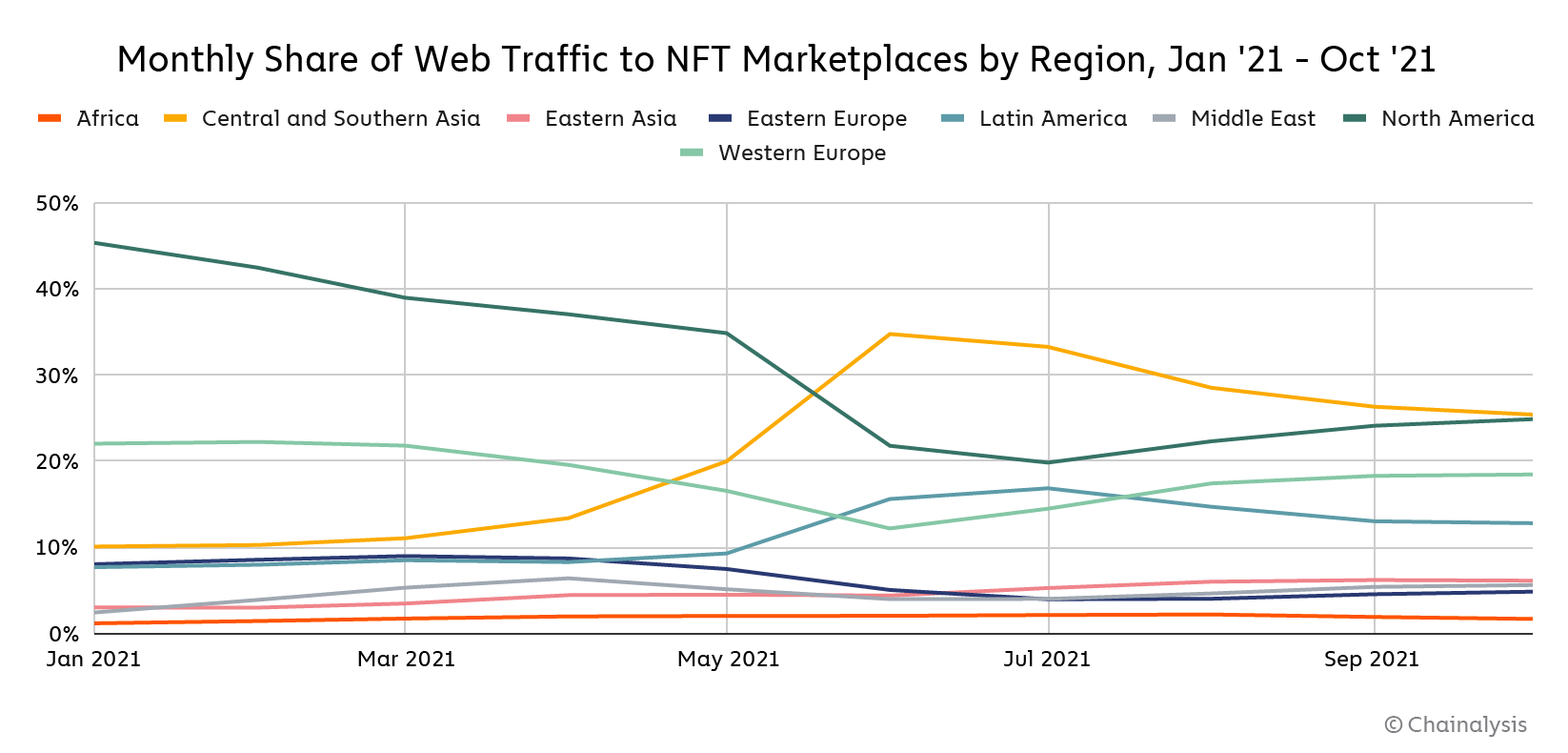

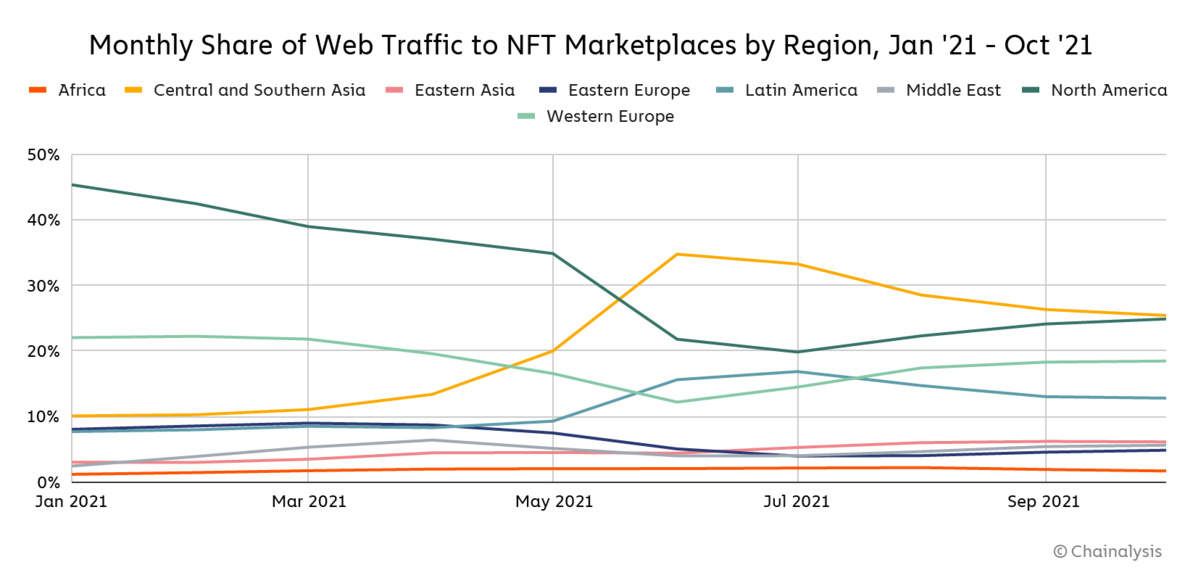

We can also look at web traffic data for popular NFT marketplaces to examine where in the world most NFT users are located.

We can also look at web traffic data for popular NFT marketplaces to examine where in the world most NFT users are located.

We see a strong mix of web visits from several regions, with Central & Southern Asia, North America, Western Europe, and Latin America leading the pack. The numbers suggest that like conventional cryptocurrency, NFTs have achieved global popularity, with no region making up more than 40% of monthly web visits since March 2021.

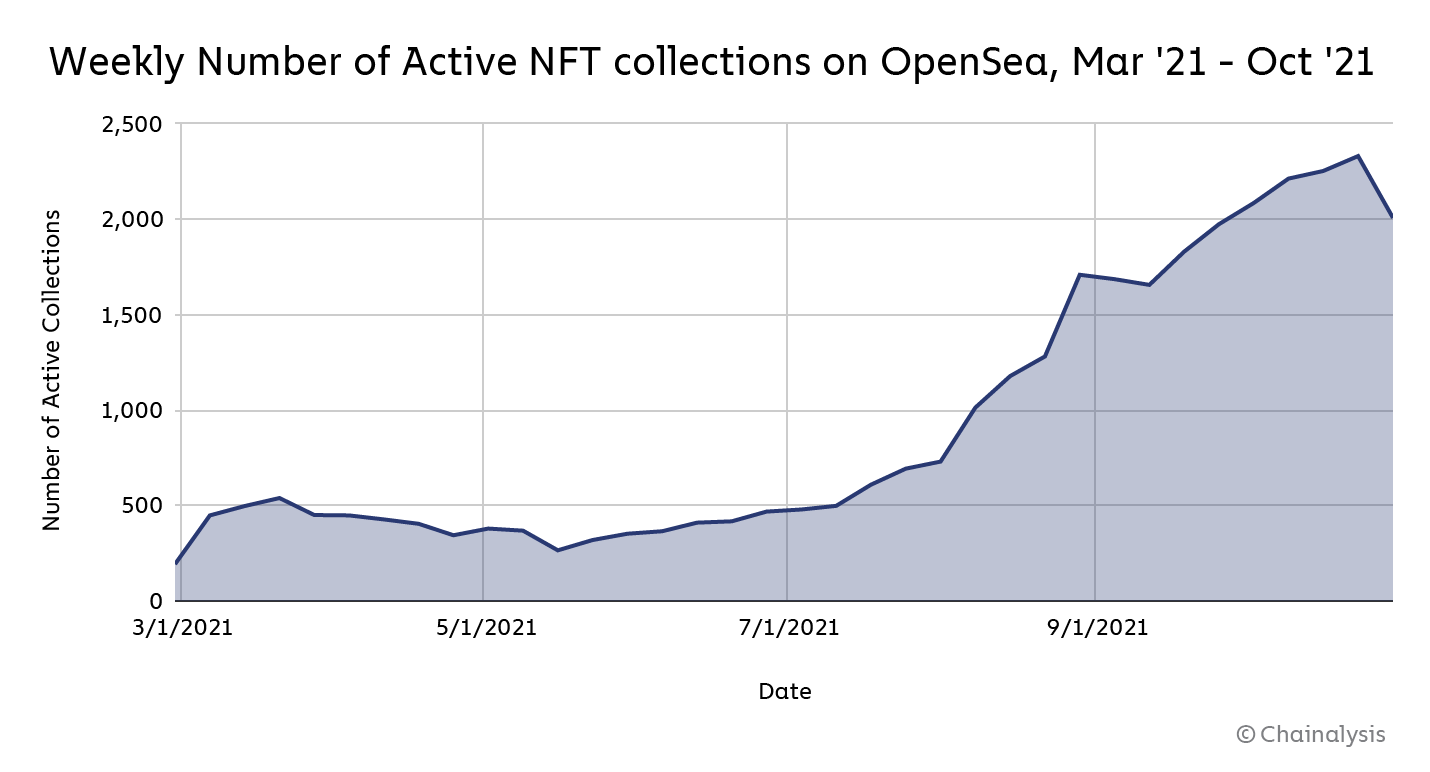

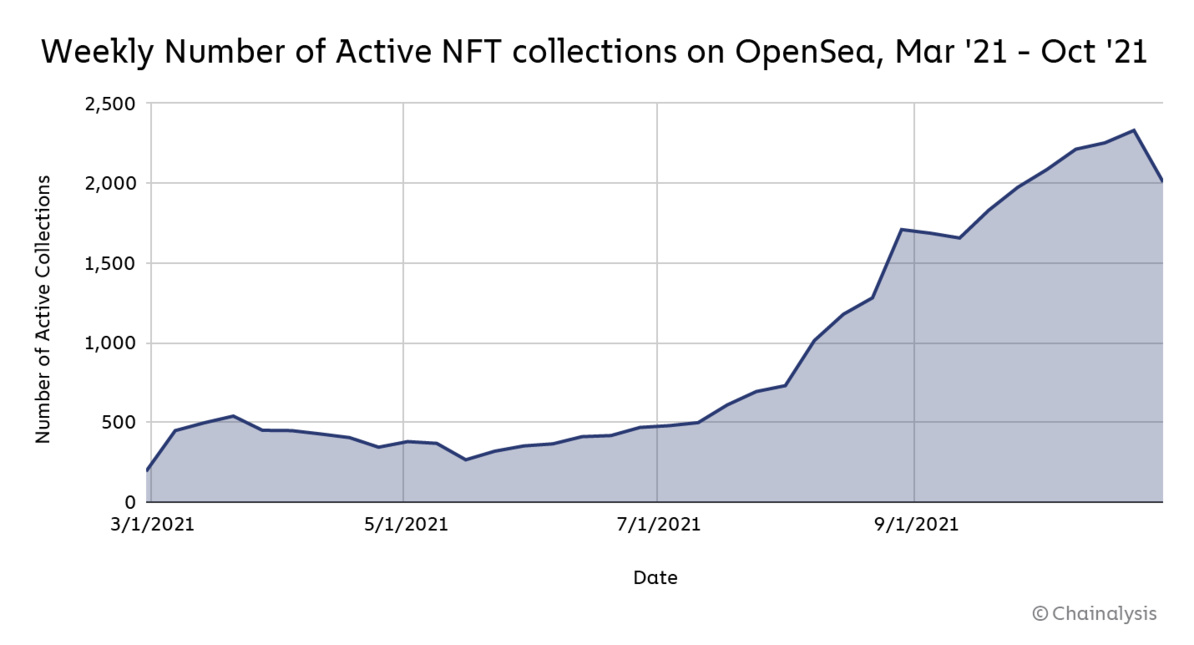

As the most popular NFT marketplace, analysis of OpenSea can tell us a great deal about NFT growth overall. Over 6,000 NFT collections on OpenSea have undergone at least one transaction, including buying, selling, or minting. This activity is trending upwards, as the number of active NFT collections — which we define as those that have undergone at least one transaction in any given week — has risen significantly since March 2021.

As the most popular NFT marketplace, analysis of OpenSea can tell us a great deal about NFT growth overall. Over 6,000 NFT collections on OpenSea have undergone at least one transaction, including buying, selling, or minting. This activity is trending upwards, as the number of active NFT collections — which we define as those that have undergone at least one transaction in any given week — has risen significantly since March 2021.

The data shows that growth began to increase quickly in July 2021, rising steadily through October. The number of active NFT collections peaked at over 2,300 the week of October 24, 2021, up from just 193 at the beginning of March. Web traffic analysis shows that the United States accounts for more OpenSea users than any other country.

NFT trading is more retail-driven than cryptocurrency trading overall

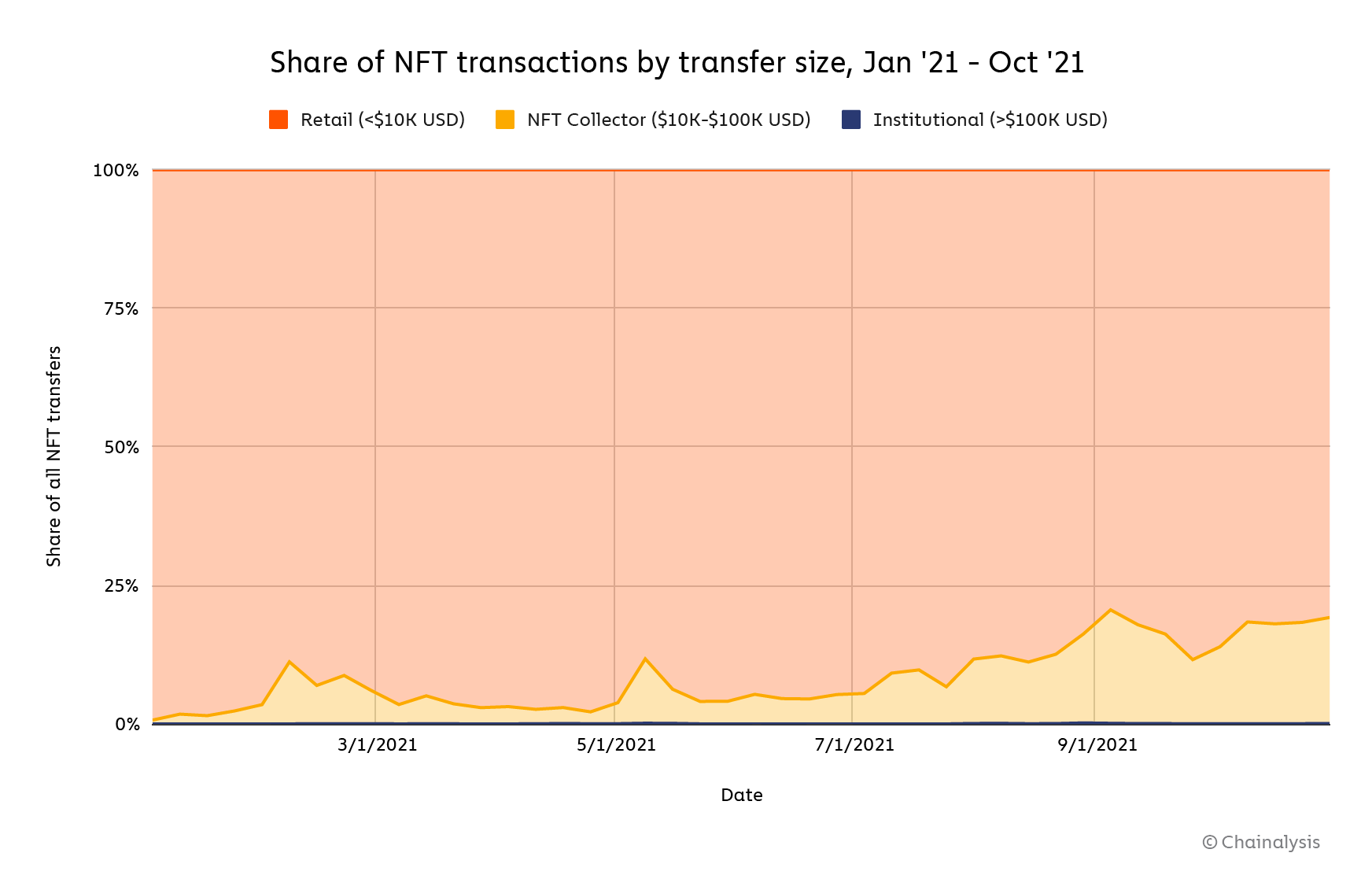

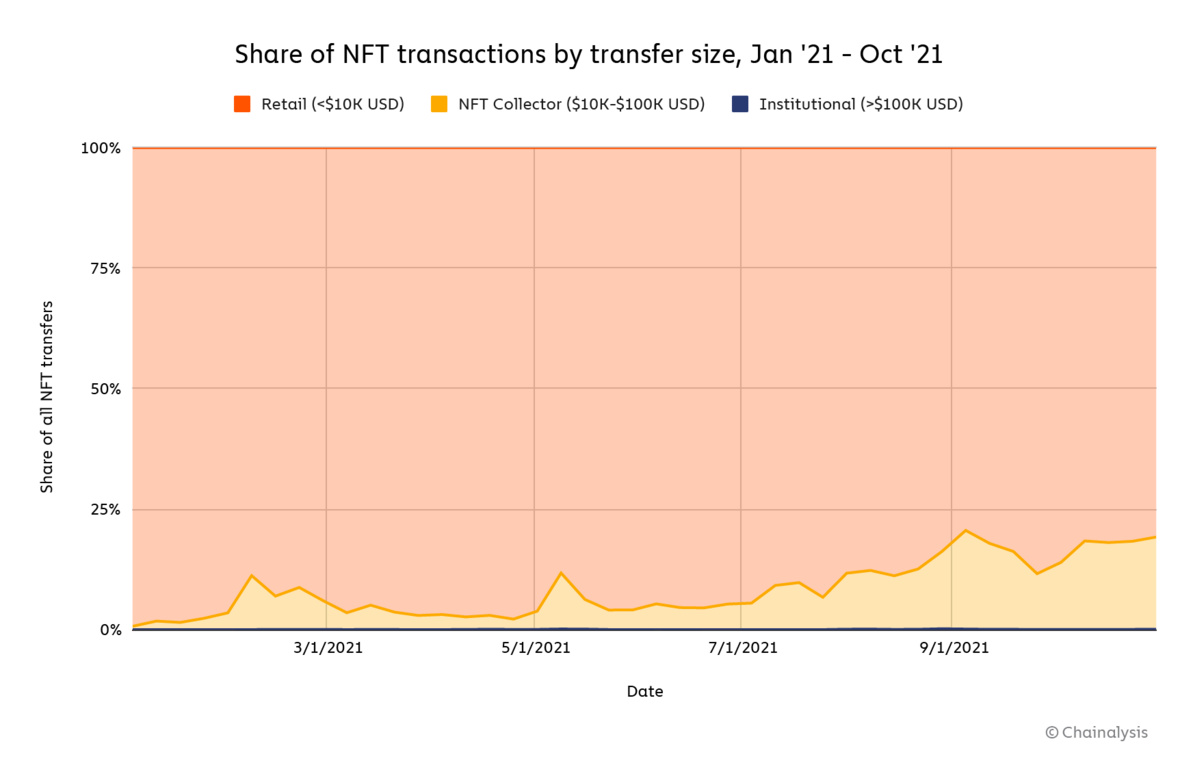

The vast majority of NFT transactions are at the retail level, meaning below $10,000 worth of cryptocurrency.

NFT trading is more retail-driven than cryptocurrency trading overall

The vast majority of NFT transactions are at the retail level, meaning below $10,000 worth of cryptocurrency.

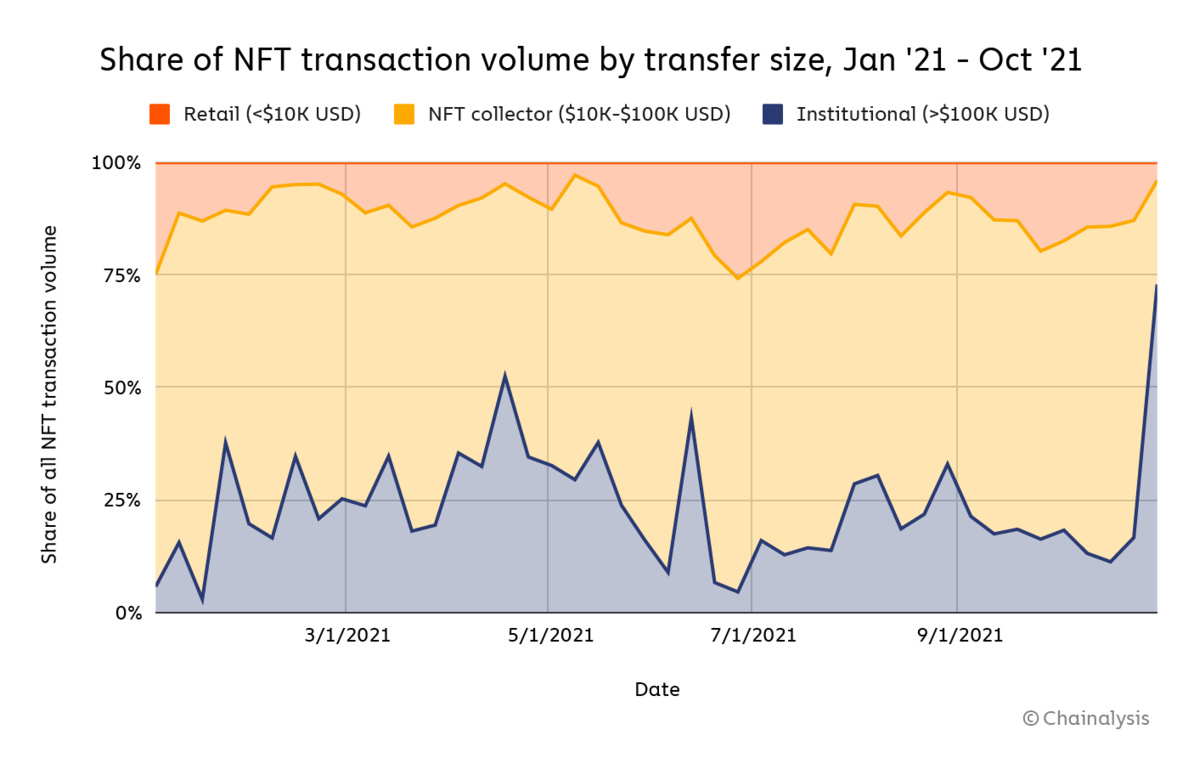

However, as we see above, larger NFT transactions are becoming more and more common. As of the week of October 31, 2021, NFT collector-sized transactions, meaning those between $10,000 and $100,000 worth of cryptocurrency, have risen to account for 19% of all NFT transactions, compared to just 6% at the beginning of March. With an average number of just under 500 per week, institutional-sized transactions account for well under 1% of all transfers.

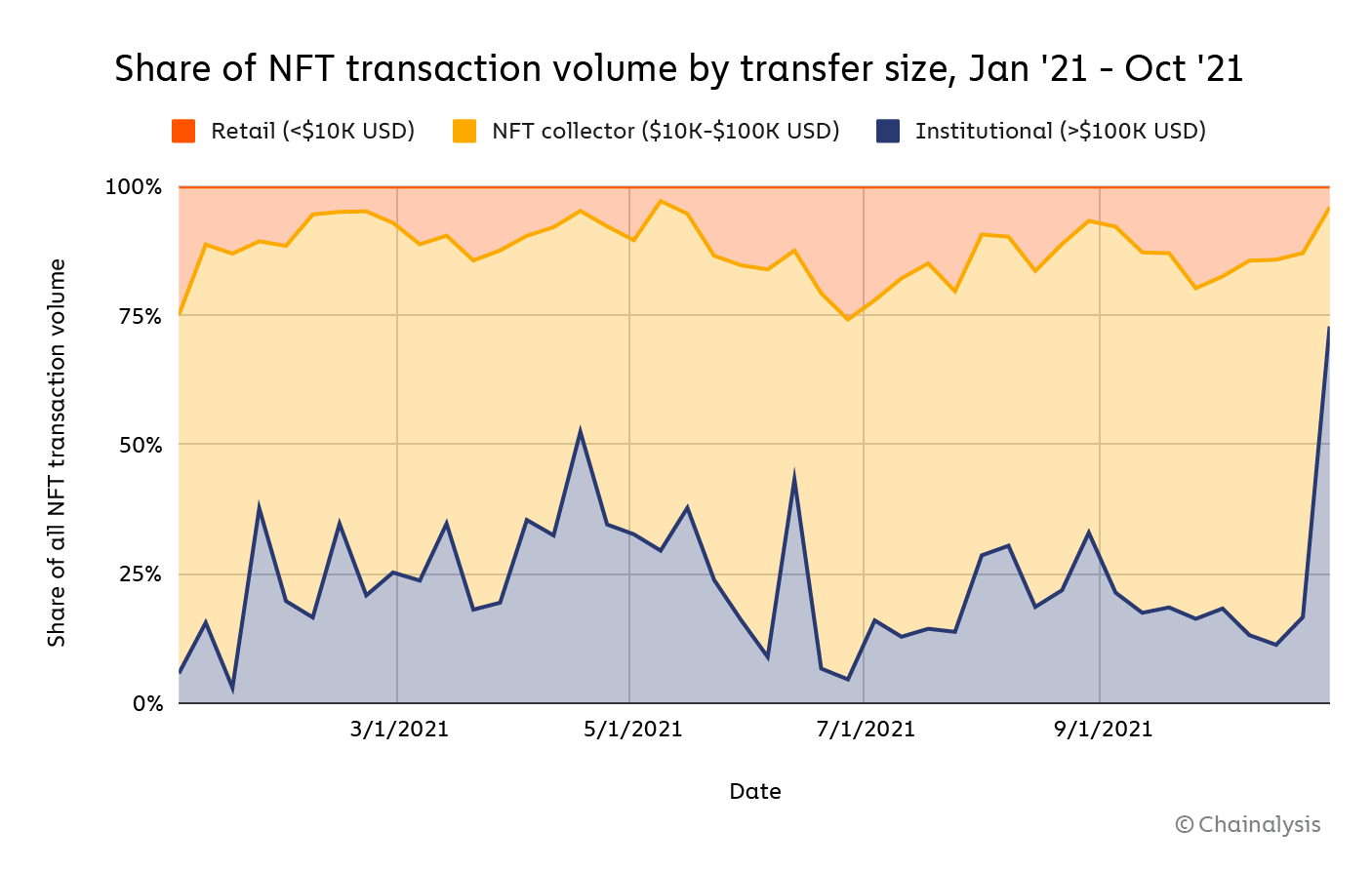

However, if we think in terms of transaction volume rather than raw transfers, NFT collector-sized and institutional-sized transactions have accounted for a significant portion of NFT activity since March 2021. Specifically, NFT-collector-sized transactions account for the majority of NFT transaction volume during the time period studied at 63%. Institutional transactions (above $100,000) make up 26% of activity, while retail-sized transactions make up 11%.

However, if we think in terms of transaction volume rather than raw transfers, NFT collector-sized and institutional-sized transactions have accounted for a significant portion of NFT activity since March 2021. Specifically, NFT-collector-sized transactions account for the majority of NFT transaction volume during the time period studied at 63%. Institutional transactions (above $100,000) make up 26% of activity, while retail-sized transactions make up 11%.

The data shows that the NFT market is far more retail-driven than the traditional cryptocurrency market, where retail transactions make up a negligible share of all transaction volume. But how are NFT investors faring in the market?

NFT investor performance: What makes a good NFT collector?

Anyone paying attention to the NFT market knows that investors have flocked in part because they believe they can achieve a high return on investment by purchasing NFTs — either during the minting process or by purchasing them from another user — and selling them later for a profit. The data suggests that NFTs are far from a surefire investment, however. Transaction data from the OpenSea marketplace shows that just 28.5% of NFTs purchased during minting and then sold on the platform result in a profit. Buying NFTs on the secondary market from other users and flipping them, however, leads to profit 65.1% of the time. Below we’ll dive deeper into the data to analyze what tactics lead to more success for NFT collectors.

Whitelisting is key to success in trading newly-minted NFTs

More than anything else, NFTs run on community and word of mouth growth. Look at virtually any successful NFT project, and you’ll likely find Discord servers and Twitter threads full of enthusiasts promoting the project. This is by design. NFT creators typically begin promoting new projects long before the first assets are released, gathering a core of dedicated followers who help promote the project from the outset. NFT creators will then reward those dedicated followers by adding them to a “whitelist,” allowing them to purchase new NFTs at a much lower price than other users during minting events.

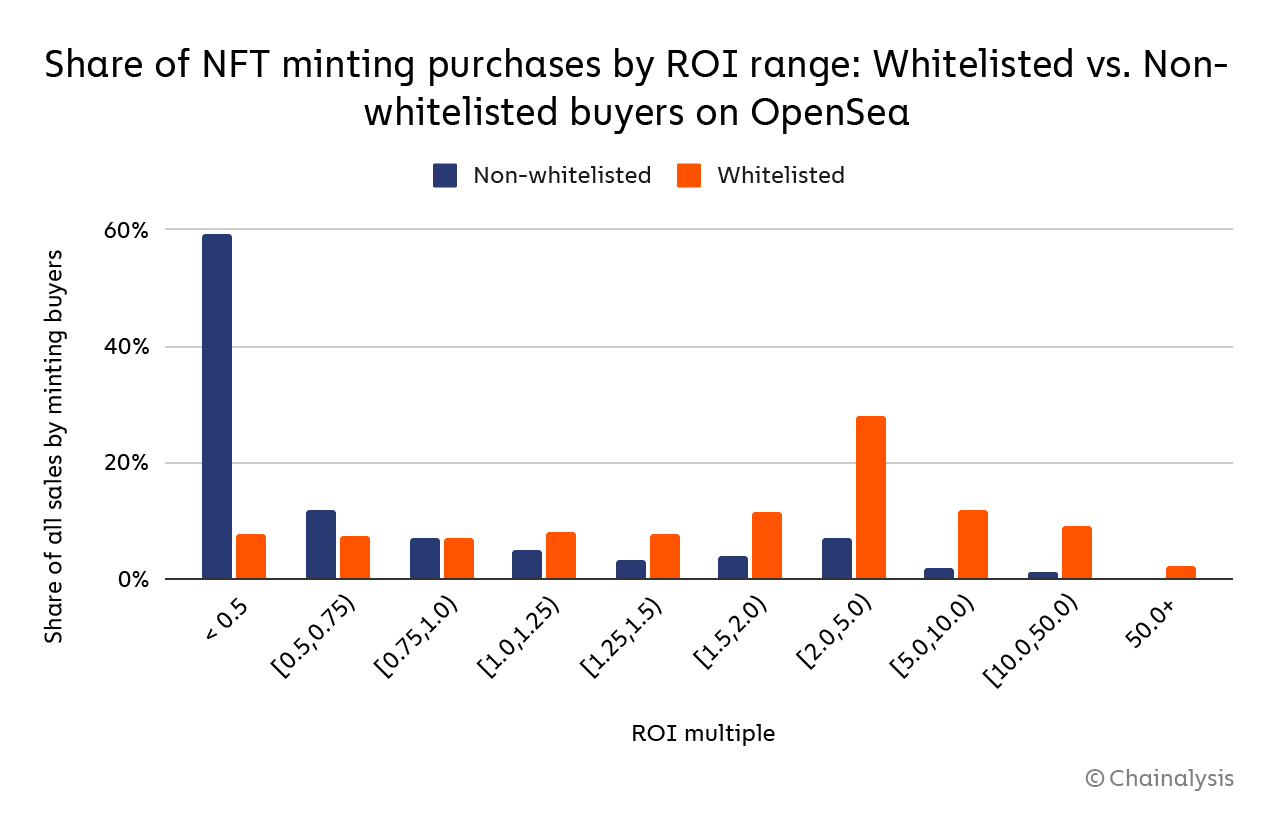

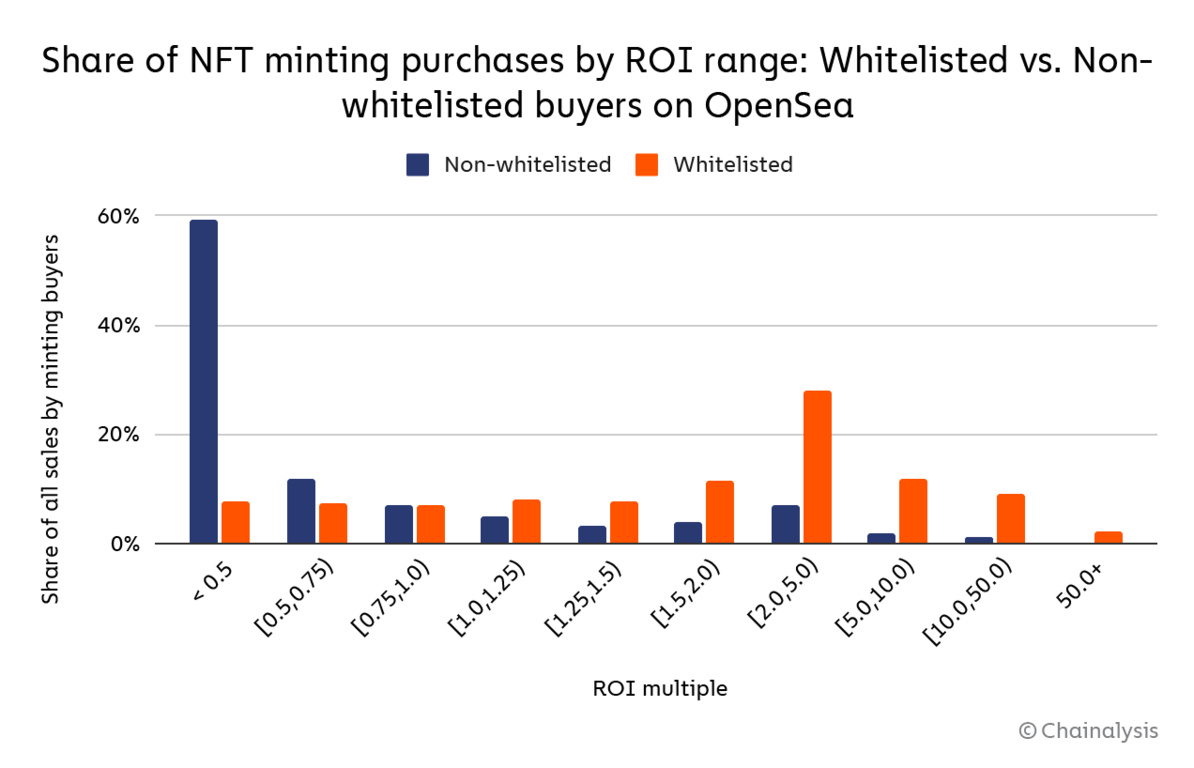

Whitelisting isn’t just some nominal reward — it translates to dramatically better investing results. OpenSea data shows that users who make the whitelist and later sell their newly-minted NFT gain a profit 75.7% of the time, versus just 20.8% for users who do so without being whitelisted. Not only that, but the data suggests it’s nearly impossible to achieve outsized returns on minting purchases without being whitelisted. The chart below breaks down sales of newly-minted NFTs into buckets based on the ROI the collector achieved, expressed in multiples of the original investment, with whitelisted collectors who bought during minting compared to those who did so without being whitelisted.

NFT investor performance: What makes a good NFT collector?

Anyone paying attention to the NFT market knows that investors have flocked in part because they believe they can achieve a high return on investment by purchasing NFTs — either during the minting process or by purchasing them from another user — and selling them later for a profit. The data suggests that NFTs are far from a surefire investment, however. Transaction data from the OpenSea marketplace shows that just 28.5% of NFTs purchased during minting and then sold on the platform result in a profit. Buying NFTs on the secondary market from other users and flipping them, however, leads to profit 65.1% of the time. Below we’ll dive deeper into the data to analyze what tactics lead to more success for NFT collectors.

Whitelisting is key to success in trading newly-minted NFTs

More than anything else, NFTs run on community and word of mouth growth. Look at virtually any successful NFT project, and you’ll likely find Discord servers and Twitter threads full of enthusiasts promoting the project. This is by design. NFT creators typically begin promoting new projects long before the first assets are released, gathering a core of dedicated followers who help promote the project from the outset. NFT creators will then reward those dedicated followers by adding them to a “whitelist,” allowing them to purchase new NFTs at a much lower price than other users during minting events.

Whitelisting isn’t just some nominal reward — it translates to dramatically better investing results. OpenSea data shows that users who make the whitelist and later sell their newly-minted NFT gain a profit 75.7% of the time, versus just 20.8% for users who do so without being whitelisted. Not only that, but the data suggests it’s nearly impossible to achieve outsized returns on minting purchases without being whitelisted. The chart below breaks down sales of newly-minted NFTs into buckets based on the ROI the collector achieved, expressed in multiples of the original investment, with whitelisted collectors who bought during minting compared to those who did so without being whitelisted.

Overall, 78% of sales by unwhitelisted buyers later result in a loss on resale, with 59% resulting in a loss equal to or below 0.5x their initial investment. 78% of sales by whitelisted buyers, on the other hand, result in a profit, with 51% resulting in a profit of 2x or more the initial investment. The data is clear: Whitelisting provides a significant financial reward for those who play a role in an NFT project’s success by seeding its early community growth efforts.

However, if you’re not on the whitelist, it’s significantly harder to turn a profit after buying a newly-minted NFT. Of course, keep in mind that these numbers don’t account for NFTs that have been minted, bought, and never resold. It’s possible that some of those NFTs will be sold and ultimately turn a profit in the future, meaning the 28.5% figure – representing NFTs minted and then sold at a profit – could rise over time.

Want to learn more about the NFT market? Download the full Chainalysis 2021 NFT Market Report here to learn about how the most successful collectors achieve higher ROIs, the effects of failed transaction fees on investor returns, and more!

However, if you’re not on the whitelist, it’s significantly harder to turn a profit after buying a newly-minted NFT. Of course, keep in mind that these numbers don’t account for NFTs that have been minted, bought, and never resold. It’s possible that some of those NFTs will be sold and ultimately turn a profit in the future, meaning the 28.5% figure – representing NFTs minted and then sold at a profit – could rise over time.

Want to learn more about the NFT market? Download the full Chainalysis 2021 NFT Market Report here to learn about how the most successful collectors achieve higher ROIs, the effects of failed transaction fees on investor returns, and more!

Laurent Leloup

Auteur de Blockchain, la révolution de la confiance

"La blockchain n’est pas la révolution tant annoncée, elle n’est que l’outil d’un monde lui-même entré en révolution"

Auteur de Blockchain, la révolution de la confiance

"La blockchain n’est pas la révolution tant annoncée, elle n’est que l’outil d’un monde lui-même entré en révolution"

Autres articles

-

Visa finalise l'acquisition de Featurespace

-

Tether investit dans StablR pour promouvoir l'adoption du stablecoin en Europe

-

Chainalysis acquiert Hexagate, fournisseur de solutions de sécurité WEB3

-

Nomination | Esker annonce la nomination de Dan Reeve en tant que membre du Comité Exécutif

-

Un montant de 1,8 million de dollars levé - La nouvelle ICO de Dogizen étonne les experts avec une approche inédite au monde