The valuation of cryptocurrencies and tokens has been an ever challenging topic in the blockchain space. Numerous methods and formulas have been proposed. However, in my opinion, nothing has yet emerged as being generally accepted or a de-facto standard, in the same way the widely accepted “earnings-per-share” (EPS) is the common metric traditional financial markets adhere to.

Before jumping to devising models and equations, I think we need to have good visibility on the basic units of “input data” that could be used to then construct such formulas or later develop quantitative methods.

Last year, I enumerated a number of Blockchain Metrics for quantifying usage. It was a step in the right direction, but here I’m organizing 9 metrics as the essential ones on top of which valuation frameworks could be constructed. Here, I have focused on bringing visibility to few metrics that have potential characteristics of being absolute in the sense of clarity, and therefore, they could carry little ambiguity when being published.

I believe that the industry needs precise data points that cannot be challenged (similar to the EPS analogy). For example, the number of public shares a company floats or issues is known and can be trusted as the real number. This is why the EPS number is trusted and cannot be debated. The EPS multiples that analysts decide to project for a given stock to derive market capitalization is a subjective number that is chosen later.

That is why, for the blockchain sector, as a starting point, we need fewer, but more essential data points, not a panoply of metrics with no head or tail. Furthermore, the language around the metrics should be clear, non-technical, and easily understandable.

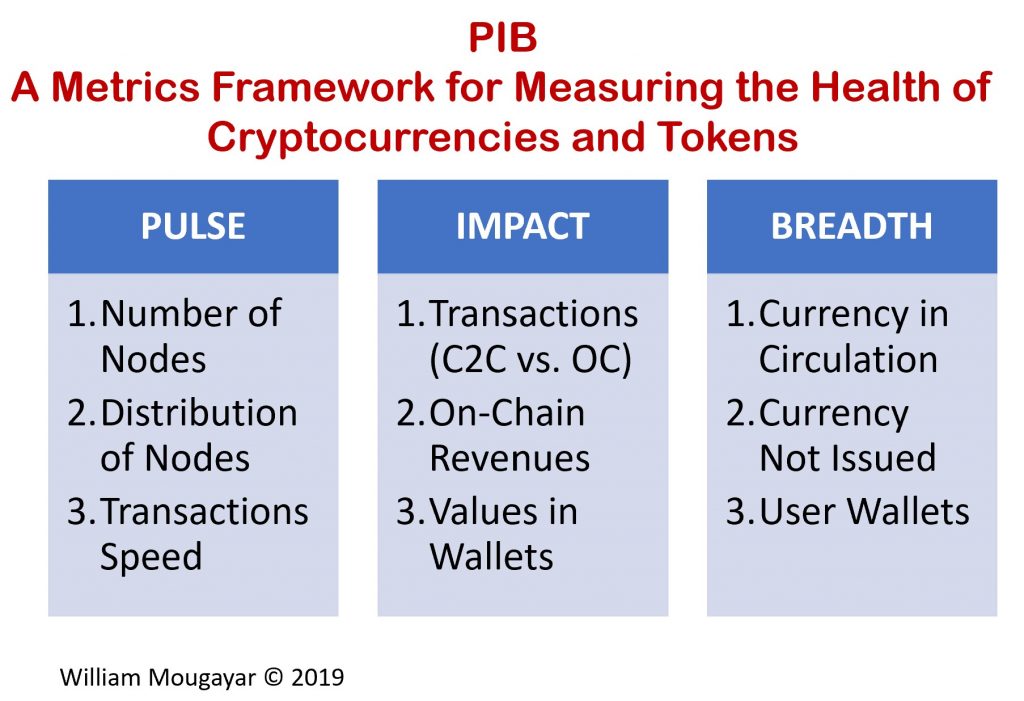

The following is my attempt to list the essential data points organized under the PIB moniker, referencing the following descriptive sub-categories: Pulse, Impact, Breadth.

Before jumping to devising models and equations, I think we need to have good visibility on the basic units of “input data” that could be used to then construct such formulas or later develop quantitative methods.

Last year, I enumerated a number of Blockchain Metrics for quantifying usage. It was a step in the right direction, but here I’m organizing 9 metrics as the essential ones on top of which valuation frameworks could be constructed. Here, I have focused on bringing visibility to few metrics that have potential characteristics of being absolute in the sense of clarity, and therefore, they could carry little ambiguity when being published.

I believe that the industry needs precise data points that cannot be challenged (similar to the EPS analogy). For example, the number of public shares a company floats or issues is known and can be trusted as the real number. This is why the EPS number is trusted and cannot be debated. The EPS multiples that analysts decide to project for a given stock to derive market capitalization is a subjective number that is chosen later.

That is why, for the blockchain sector, as a starting point, we need fewer, but more essential data points, not a panoply of metrics with no head or tail. Furthermore, the language around the metrics should be clear, non-technical, and easily understandable.

The following is my attempt to list the essential data points organized under the PIB moniker, referencing the following descriptive sub-categories: Pulse, Impact, Breadth.

In the field of quantification methods, there are inputs and outputs. There is causal activity and there are resulting effects. These metrics I’m proposing are in the “input” and “causal” categories, which means they can be used to in a variety of analysis methods to derive resulting outputs and effects.

PULSE

The metrics in this category pertain to the dynamics behind the network’s operations.

P1 Number of (active) Nodes

The nodes are an essential native unit for blockchains.

What is the number of nodes that are servicing the underlying peer to peer network?

P2 Ownership distribution of nodes

Decentralization is a key attribute, and it can be argued that a more even distribution of ownership is better for the future health of the network.

What is the ownership distribution of the nodes in operations?

P3 Speed of transactions

Although public blockchains (and many dApps) are not known for their transaction speeds, how quickly are transactions finalized is an important factor that indicates the actual throughput of a blockchain or app.

IMPACT

In this category, we look at the financial and economic aspects behind the cryptocurrency.

I1 Transactions Volumes (in fiat denomination)

Here, we need to make a clear distinction between currency-to-currency transactions (C2C) where the user is just exchanging one cryptocurrency for another (I1a), versus on-chain transactions that are used for a given utility, eg. earning/spending, gas costs, staking costs, etc. (this excludes the native earnings from mining or minting activity (I1b). Here, I1 = I1a + I1b.

I2 On-chain Revenues

These are the revenues from mining, minting, or rewards related distributions.

I3 Values in Wallets

What is the fiat-denominated value of current holdings in all issued wallets? See B3 to also include the segmentation between user vs. non-user wallets. Here, I3 = I3a (users) + I3b (non-users).

BREADTH

Breadth pertains to the available token/cryptocurrency. It is closest to the number of shares (float, restricted, issued) in public stocks.

B1 Units in Circulation

What is the total number of tokens/cryptocurrency units in circulation? (both in the hands of users or investors)

B2 Units Held

What is the number of units that are either un-vested, un-minted or not yet issued? (publishing a vesting schedule is useful)

B3 Number of Wallets

A distinction should be made between the wallets being held by users versus non-users. Users include app end-users or developers that need to use the token or underlying cryptocurrency to run their programs. Here, B3 = B3a (users) + B3b (non-users).

It is my opinion that we need to start with the above metrics before constructing valuation models. Once these numbers are available, any analyst can decide what equations to fit them in, what multiples or weights to give them, and how to construct various methods to derive meaningful comparative metrics. These can apply for blockchain protocols, networks and applications.

I encourage crypto projects, blockchains, analysts and data sites (I provided a list to some of them in this blog post, Where Are All the Decentralized Applications) to help make that data easily available so that we don’t have to spend time finding it. It is the responsibility of each issuer to make sure their data is visible and easily measurable with integrity.

Of course there are other metrics, but I believe these are the ones where a differentiated analysis can be built upon. Almost everything else could be a derivative of the above numbers. Many other blockchain/protocol metrics are table stakes or vanity metrics not worthy of comparative studies.

In a subsequent post, I’m going to propose some meaningful derivative ratios to consider, in the same way that the EPS is a meaningful ratio and reference point. As usual, I welcome suggestions on what these ratios should be, and any feedback on the proposed PIB framework.

PULSE

The metrics in this category pertain to the dynamics behind the network’s operations.

P1 Number of (active) Nodes

The nodes are an essential native unit for blockchains.

What is the number of nodes that are servicing the underlying peer to peer network?

P2 Ownership distribution of nodes

Decentralization is a key attribute, and it can be argued that a more even distribution of ownership is better for the future health of the network.

What is the ownership distribution of the nodes in operations?

P3 Speed of transactions

Although public blockchains (and many dApps) are not known for their transaction speeds, how quickly are transactions finalized is an important factor that indicates the actual throughput of a blockchain or app.

IMPACT

In this category, we look at the financial and economic aspects behind the cryptocurrency.

I1 Transactions Volumes (in fiat denomination)

Here, we need to make a clear distinction between currency-to-currency transactions (C2C) where the user is just exchanging one cryptocurrency for another (I1a), versus on-chain transactions that are used for a given utility, eg. earning/spending, gas costs, staking costs, etc. (this excludes the native earnings from mining or minting activity (I1b). Here, I1 = I1a + I1b.

I2 On-chain Revenues

These are the revenues from mining, minting, or rewards related distributions.

I3 Values in Wallets

What is the fiat-denominated value of current holdings in all issued wallets? See B3 to also include the segmentation between user vs. non-user wallets. Here, I3 = I3a (users) + I3b (non-users).

BREADTH

Breadth pertains to the available token/cryptocurrency. It is closest to the number of shares (float, restricted, issued) in public stocks.

B1 Units in Circulation

What is the total number of tokens/cryptocurrency units in circulation? (both in the hands of users or investors)

B2 Units Held

What is the number of units that are either un-vested, un-minted or not yet issued? (publishing a vesting schedule is useful)

B3 Number of Wallets

A distinction should be made between the wallets being held by users versus non-users. Users include app end-users or developers that need to use the token or underlying cryptocurrency to run their programs. Here, B3 = B3a (users) + B3b (non-users).

It is my opinion that we need to start with the above metrics before constructing valuation models. Once these numbers are available, any analyst can decide what equations to fit them in, what multiples or weights to give them, and how to construct various methods to derive meaningful comparative metrics. These can apply for blockchain protocols, networks and applications.

I encourage crypto projects, blockchains, analysts and data sites (I provided a list to some of them in this blog post, Where Are All the Decentralized Applications) to help make that data easily available so that we don’t have to spend time finding it. It is the responsibility of each issuer to make sure their data is visible and easily measurable with integrity.

Of course there are other metrics, but I believe these are the ones where a differentiated analysis can be built upon. Almost everything else could be a derivative of the above numbers. Many other blockchain/protocol metrics are table stakes or vanity metrics not worthy of comparative studies.

In a subsequent post, I’m going to propose some meaningful derivative ratios to consider, in the same way that the EPS is a meaningful ratio and reference point. As usual, I welcome suggestions on what these ratios should be, and any feedback on the proposed PIB framework.

William Mougayar is a Toronto-based entrepreneur, Ethereum Foundation advisor and advisor to Consensus 2016, CoinDesk's flagship conference. He is also the author of the upcoming book, The Business Blockchain: https://www.kickstarter.com/projects/wmougayar/the-business-blockchain-books

<script async src="//pagead2.googlesyndication.com/pagead/js/adsbygoogle.js"></script>

<!-- FINYEAR 728x90 -->

<ins class="adsbygoogle"

style="display:block"

data-ad-client="ca-pub-8934963473438770"

data-ad-slot="9959667536"

data-ad-format="auto"

data-full-width-responsive="true"></ins>

<script>

(adsbygoogle = window.adsbygoogle || []).push({});

</script>

<!-- FINYEAR 728x90 -->

<ins class="adsbygoogle"

style="display:block"

data-ad-client="ca-pub-8934963473438770"

data-ad-slot="9959667536"

data-ad-format="auto"

data-full-width-responsive="true"></ins>

<script>

(adsbygoogle = window.adsbygoogle || []).push({});

</script>

FINYEAR & CHAINEUM

Lisez gratuitement le quotidien Finyear & sa newsletter quotidienne.

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

------------------------

Chaineum :

Fondée en 2015, Chaineum est une boutique STO offrant une expertise de premier plan en matière d’ICO et STO, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

La division services blockchain de Chaineum, développe la technologie Chaineum Segment, une blockchain privée orientée objets.

About Chaineum:

Founded in 2015, Chaineum is a STO Boutique with a strong expertise in ICO and STO, and a strategic focus on both its clients' business and blockchain technology. As such, Chaineum paved the way in the implementation of certain best practices in this sector (ICO Charter, Security Token Network).

Chaineum's blockchain services division, is developing Chaineum Segment technology, an object-oriented private blockchain.

-------------------------

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

------------------------

Chaineum :

Fondée en 2015, Chaineum est une boutique STO offrant une expertise de premier plan en matière d’ICO et STO, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

La division services blockchain de Chaineum, développe la technologie Chaineum Segment, une blockchain privée orientée objets.

About Chaineum:

Founded in 2015, Chaineum is a STO Boutique with a strong expertise in ICO and STO, and a strategic focus on both its clients' business and blockchain technology. As such, Chaineum paved the way in the implementation of certain best practices in this sector (ICO Charter, Security Token Network).

Chaineum's blockchain services division, is developing Chaineum Segment technology, an object-oriented private blockchain.

-------------------------

No Offer, Solicitation, Investment Advice, or Recommendations

This website is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, nor does it constitute an offer to provide investment advisory or other services by FINYEAR.

No reference to any specific security constitutes a recommendation to buy, sell or hold that security or any other security.

Nothing on this website shall be considered a solicitation or offer to buy or sell any security, future, option or other financial instrument or to offer or provide any investment advice or service to any person in any jurisdiction.

Nothing contained on the website constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed on this website should not be taken as advice to buy, sell or hold any security. In preparing the information contained in this website, we have not taken into account the investment needs, objectives and financial circumstances of any particular investor.

This information has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient of this information and investments discussed may not be suitable for all investors.

Any views expressed on this website by us were prepared based upon the information available to us at the time such views were written. Changed or additional information could cause such views to change.

All information is subject to possible correction. Information may quickly become unreliable for various reasons, including changes in market conditions or economic circumstances.

No reference to any specific security constitutes a recommendation to buy, sell or hold that security or any other security.

Nothing on this website shall be considered a solicitation or offer to buy or sell any security, future, option or other financial instrument or to offer or provide any investment advice or service to any person in any jurisdiction.

Nothing contained on the website constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed on this website should not be taken as advice to buy, sell or hold any security. In preparing the information contained in this website, we have not taken into account the investment needs, objectives and financial circumstances of any particular investor.

This information has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient of this information and investments discussed may not be suitable for all investors.

Any views expressed on this website by us were prepared based upon the information available to us at the time such views were written. Changed or additional information could cause such views to change.

All information is subject to possible correction. Information may quickly become unreliable for various reasons, including changes in market conditions or economic circumstances.

Autres articles

-

Paris Blockchain Week 2025, en avant-première, la short list des premiers speakers

-

Opinion | Simon Peters, eToro "Bitcoin : où va-t-il maintenant ?"

-

Société Générale-Forge : bientôt l'intégration de son stablecoin EURCV sur le réseau Stellar

-

La BCE étend ses projets blockchain pour les MNBC

-

Nomination | Kiln accueille Dan Biton en tant que VP en charge des projets spéciaux