Lately, there has been a huge spike in interest in private blockchains, particularly from banks and financial institutions.

Some of them are already working on their own private blockchains to improve the efficiency of their services. Improving the efficiency of their services is one thing, but to equate the private blockchain to the Bitcoin’s Blockchain is something totally different.

Private blockchains are no different than relational databases, which are centralized. They are like an Intranets to Corporations. While Bitcoin’s Blockchain is like the Internet i.e the World Wide Web.

Private blockchains are centralized. An organization that owns it, can, if they want, alter any transaction at their will. There is absolutely nothing stopping them from doing it. So, private blockchains shouldn’t be seen as transparent, tamper-proof systems.

On the other hand, Bitcoin’s blockchain – The Blockchain – is unique and different precisely because it’s not centralized. It’s not owned by a particular organization. Decentralized nature of The Blockchain is the main value proposition and its competitive advantage over its counterparts – private blockchains. The Blockchain is analogous to a public ledger that is transparent and tamper-proof, and it contains all the transactions that ever happened on its network.

The Blockchain has a reward layer on top, which is the Bitcoin. This reward system makes it interesting for server farms to be a part of the ecosystem – to become third-party, independent bodies – who are willing to sync all the data that the blockchain has, and in return to get a reward in the form of Bitcoins. (As of today, it’s a $5+ billion worth industry) These are literally thousands of servers, also known as full nodes (5,084 nodes as of today)(1). Besides getting paid for fulfilling transactions on the Blockchain, they also mine Bitcoins. How exactly they mine Bitcoins is a topic for a different blog post.

The Blockchain – Nearly Tamper-Proof

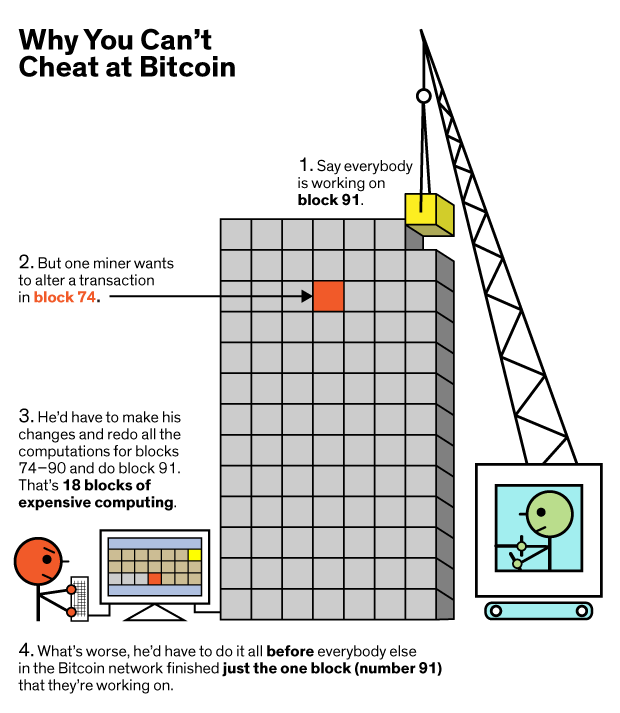

Changing any confirmed past transaction in the blockchain is almost impossible. See the simplified illustration below in order to understand how the Bitcoin system works.

Some of them are already working on their own private blockchains to improve the efficiency of their services. Improving the efficiency of their services is one thing, but to equate the private blockchain to the Bitcoin’s Blockchain is something totally different.

Private blockchains are no different than relational databases, which are centralized. They are like an Intranets to Corporations. While Bitcoin’s Blockchain is like the Internet i.e the World Wide Web.

Private blockchains are centralized. An organization that owns it, can, if they want, alter any transaction at their will. There is absolutely nothing stopping them from doing it. So, private blockchains shouldn’t be seen as transparent, tamper-proof systems.

On the other hand, Bitcoin’s blockchain – The Blockchain – is unique and different precisely because it’s not centralized. It’s not owned by a particular organization. Decentralized nature of The Blockchain is the main value proposition and its competitive advantage over its counterparts – private blockchains. The Blockchain is analogous to a public ledger that is transparent and tamper-proof, and it contains all the transactions that ever happened on its network.

The Blockchain has a reward layer on top, which is the Bitcoin. This reward system makes it interesting for server farms to be a part of the ecosystem – to become third-party, independent bodies – who are willing to sync all the data that the blockchain has, and in return to get a reward in the form of Bitcoins. (As of today, it’s a $5+ billion worth industry) These are literally thousands of servers, also known as full nodes (5,084 nodes as of today)(1). Besides getting paid for fulfilling transactions on the Blockchain, they also mine Bitcoins. How exactly they mine Bitcoins is a topic for a different blog post.

The Blockchain – Nearly Tamper-Proof

Changing any confirmed past transaction in the blockchain is almost impossible. See the simplified illustration below in order to understand how the Bitcoin system works.

Source: spectrum.ieee.org

It’s nearly tamper-proof, because there is still a tiny chance of being able to alter a transaction if you have enough processing power. And this is also known as 51% attack in the Bitcoin community.

Summary

In summary, it would be great if we stopped equating private blockchains with The Blockchain! Thanks

(1) https://bitnodes.21.co/

Original link: http://www.adesblog.com/private-blockchains-vs-bitcoin-blockchain/

It’s nearly tamper-proof, because there is still a tiny chance of being able to alter a transaction if you have enough processing power. And this is also known as 51% attack in the Bitcoin community.

Summary

In summary, it would be great if we stopped equating private blockchains with The Blockchain! Thanks

(1) https://bitnodes.21.co/

Original link: http://www.adesblog.com/private-blockchains-vs-bitcoin-blockchain/

Chaineum est partenaire des rubriques blockchain de votre quotidien Finyear.

Pour lire tous les articles Finyear dédiés Blockchain rendez-vous sur www.finyear.com/search/Blockchain/

Chaineum est partenaire de la conférence Blockchain Business du 10 décembre prochain éditée par Finyear.

Pour participer à la conférence inscrivez-vous sur www.bl0ckcha1n.com

Chaineum est bâtisseur de compagnies autonomes et décentralisées (incubateur new generation de projets blockchain).

Vous êtes investisseur, porteur de projet, développeur ? Rejoignez Chaineum

Vous êtes CEO, commercial, etc... et vous cherchez à rejoindre une équipe pour développer un projet ? Rejoignez Chaineum : nous avons des startups qui recherchent leur(s) futur(s) associé(s).

Pour lire tous les articles Finyear dédiés Blockchain rendez-vous sur www.finyear.com/search/Blockchain/

Chaineum est partenaire de la conférence Blockchain Business du 10 décembre prochain éditée par Finyear.

Pour participer à la conférence inscrivez-vous sur www.bl0ckcha1n.com

Chaineum est bâtisseur de compagnies autonomes et décentralisées (incubateur new generation de projets blockchain).

Vous êtes investisseur, porteur de projet, développeur ? Rejoignez Chaineum

Vous êtes CEO, commercial, etc... et vous cherchez à rejoindre une équipe pour développer un projet ? Rejoignez Chaineum : nous avons des startups qui recherchent leur(s) futur(s) associé(s).

Les médias du groupe Finyear

Lisez gratuitement :

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d'affaires.

Les 6 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The FinTecher

- The Blockchainer

- Le Capital Investisseur

Le magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d'affaires.

Les 6 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The FinTecher

- The Blockchainer

- Le Capital Investisseur

Le magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Autres articles

-

Coinbase et Visa, un partenariat pour des transferts en temps réel

-

Brilliantcrypto, la nouvelle aventure play-to-earn basée sur la blockchain Polygon, arrive sur Epic Game Store

-

Nomination | Truffle Capital promeut Alexis Le Portz en qualité de Partner

-

IPEM Paris 2024 : 5500 participants au Palais des congrès

-

Pomelo annonce une Série A à 35 millions de dollars menée par Vy Capital