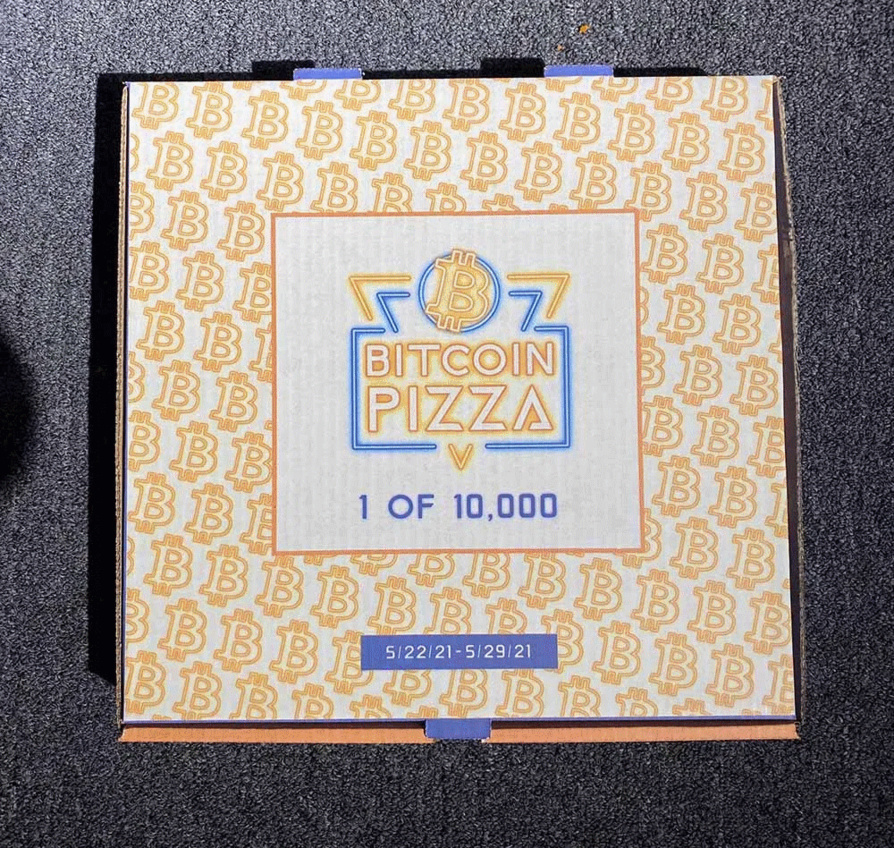

Without a doubt, bitcoin has many memorable stories to share. One of them is the famous Bitcoin pizza story. Eleven years ago Laszlo Hanyecz paid 10,000 BTC for two pizzas from Papa John’s. Today, those two pizzas, often considered the first transaction in bitcoin, are worth millions of dollars. Last Tuesday, Anthony Pompliano announced a bitcoin-themed pizza pop-up to support the development of the digital currency. Pompliano unveiled “Bitcoin Pizza”, which will partner with independent pizzerias in 10 cities in the United States to produce and deliver its pizza pies from May 22-29. Profits from the initiative will be donated to the Human Rights Foundation’s Bitcoin Development Fund, which helps fund improvements to the bitcoin network. When Bitcoin launched in 2009, it was unknown outside of the community of developers and early adopters. In the beginning anyone could mine bitcoins by running a simple computer program. Lacking leaders, Bitcoin’s supporters could disagree on what it represented. Currency traders arbitraging bitcoin prices played on the same team as crypto anarchists who cursed Wall Street’s existence. As a platform bitcoin allows people to trust in an algorithm rather than a central institution. As a currency, it replaces the role of banks in overseeing transactions and controlling the money supply, with a peer to peer system. Bitcoin allows a decentralized network to share information and withstand the attempts of hackers to introduce false information. The best part of owning bitcoin is the feeling of participating in the future.

Bitcoin has come a long way since Laszlo bought those two pizzas. Its first mainstream moment came when the whistleblowing organisation WikiLeaks began to accept donations in Bitcoin, after being banned from other payment platforms. In 2013 it made headlines again, when the price of bitcoin hit $100 for the first time. This milestone was covered by CNBC in a segment called “Can Bitcoin make it as money?”

Today, bitcoin is the main driver of the crypto economy. Every day we find it on the front pages of major news outlets around the globe. Most people are focused on its price rally, and others are taking note of NFTs growth and how they’re changing the worlds of art and music or how DeFi is changing the trade finance sector.

Bitcoin’s rapid growth has caused government and institutions to step in. The US Office of Comptroller of Currency now allows banks and custodians to provide cryptocurrency services. In March, Morgan Stanley offered its wealthy clients access to bitcoin funds. A few weeks later, Goldman Sachs and JP Morgan followed. Hundreds of smaller US banks are signing on. Thirty private and public companies have moved reserves totalling more than $55 billion to bitcoin. Forty six million Americans now own bitcoin. That’s 17% of the US. adult population. The bottom line is that crypto has hit the mainstream, and a lot of people are taking an interest.

This past week has been turbulent for crypto. For newcomers, this crypto crash is probably pretty scary. As I write this post, bitcoin stands at $33.5k, ethereum is a little over $2k. In the last seven days, the former has lost a fifth of its value and the latter more than a third. All together the entire crypto market has lost more than $800 billion in value, since May 12th.

However, this drop isn’t surprising to those who know bitcoin’s history. According to Mike Novogratz the market will go sideways and consolidate “between $40,000 and $55,000“. But bitcoin has a long way to go in this bull market, and the rest of the year looks bright. Why? Coin Days Destroyed (CDD). When strong hands hold, CDD trends lower which suggests their confidence in a new bull market.

For anyone still wondering why so much value was lost, two words come to mind: Elon Musk. Tesla’s “Technoking” sent bitcoin’s price on a roller-coaster ride. You may like him, you may disagree with him, but you can’t ignore him. Like It or not, Elon Musk has become bitcoin’s biggest influencer, at least for now. But as a wrote last week, kings are things of the past. Bitcoin is the king precisely because it has no king and belongs to the people.

Sure, there are still dips in bitcoin’s price. But bitcoin provides a store of value that’s is not just necessary, but increasingly part of the fabric of the global economy. It’s only a matter of “when”, not “if”, it is massively adopted. Bitcoin is simply amazing for transferring value into the future. There will only be 21 million bitcoins ever created, so the prospect of its value increasing, or at least holding steady, is tremendous.

It’s clear that crypto has hit the mainstream, but it’s still a long way from mass adoption. Before it can get there, the technology needs to further develop and general sentiment needs to adjust. But there is no reason to think more and more people won’t continue to be use it and gain in value, as time goes on. Satoshi’s vision will eventually win, but it might not end up being bitcoin. People may adopt different and “greener” alternatives and coins that offer proof of stake like Cardano. Or it could be a coin the offers full anonymity like Dash or a coin like Dogecoin, whose name is based on an Internet meme about Shiba Inu.

Bitcoin’s rapid growth has caused government and institutions to step in. The US Office of Comptroller of Currency now allows banks and custodians to provide cryptocurrency services. In March, Morgan Stanley offered its wealthy clients access to bitcoin funds. A few weeks later, Goldman Sachs and JP Morgan followed. Hundreds of smaller US banks are signing on. Thirty private and public companies have moved reserves totalling more than $55 billion to bitcoin. Forty six million Americans now own bitcoin. That’s 17% of the US. adult population. The bottom line is that crypto has hit the mainstream, and a lot of people are taking an interest.

This past week has been turbulent for crypto. For newcomers, this crypto crash is probably pretty scary. As I write this post, bitcoin stands at $33.5k, ethereum is a little over $2k. In the last seven days, the former has lost a fifth of its value and the latter more than a third. All together the entire crypto market has lost more than $800 billion in value, since May 12th.

However, this drop isn’t surprising to those who know bitcoin’s history. According to Mike Novogratz the market will go sideways and consolidate “between $40,000 and $55,000“. But bitcoin has a long way to go in this bull market, and the rest of the year looks bright. Why? Coin Days Destroyed (CDD). When strong hands hold, CDD trends lower which suggests their confidence in a new bull market.

For anyone still wondering why so much value was lost, two words come to mind: Elon Musk. Tesla’s “Technoking” sent bitcoin’s price on a roller-coaster ride. You may like him, you may disagree with him, but you can’t ignore him. Like It or not, Elon Musk has become bitcoin’s biggest influencer, at least for now. But as a wrote last week, kings are things of the past. Bitcoin is the king precisely because it has no king and belongs to the people.

Sure, there are still dips in bitcoin’s price. But bitcoin provides a store of value that’s is not just necessary, but increasingly part of the fabric of the global economy. It’s only a matter of “when”, not “if”, it is massively adopted. Bitcoin is simply amazing for transferring value into the future. There will only be 21 million bitcoins ever created, so the prospect of its value increasing, or at least holding steady, is tremendous.

It’s clear that crypto has hit the mainstream, but it’s still a long way from mass adoption. Before it can get there, the technology needs to further develop and general sentiment needs to adjust. But there is no reason to think more and more people won’t continue to be use it and gain in value, as time goes on. Satoshi’s vision will eventually win, but it might not end up being bitcoin. People may adopt different and “greener” alternatives and coins that offer proof of stake like Cardano. Or it could be a coin the offers full anonymity like Dash or a coin like Dogecoin, whose name is based on an Internet meme about Shiba Inu.

Ilias Louis Hatzis

Ilias Louis Hatzis is the Founder & CEO at Mercato Blockchain Corporation AG.

Ilias Louis Hatzis is the founder and CEO at Kryptonio wallet. Create your wallet in less than a minute, without seed phrases, private keys, passwords or documents. Keep your bitcoin and digital assets always secure and recoverable: https://kryptonio.com

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Ilias Louis Hatzis is the founder and CEO at Kryptonio wallet. Create your wallet in less than a minute, without seed phrases, private keys, passwords or documents. Keep your bitcoin and digital assets always secure and recoverable: https://kryptonio.com

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Autres articles

-

Visa finalise l'acquisition de Featurespace

-

Tether investit dans StablR pour promouvoir l'adoption du stablecoin en Europe

-

Chainalysis acquiert Hexagate, fournisseur de solutions de sécurité WEB3

-

Nomination | Esker annonce la nomination de Dan Reeve en tant que membre du Comité Exécutif

-

Un montant de 1,8 million de dollars levé - La nouvelle ICO de Dogizen étonne les experts avec une approche inédite au monde