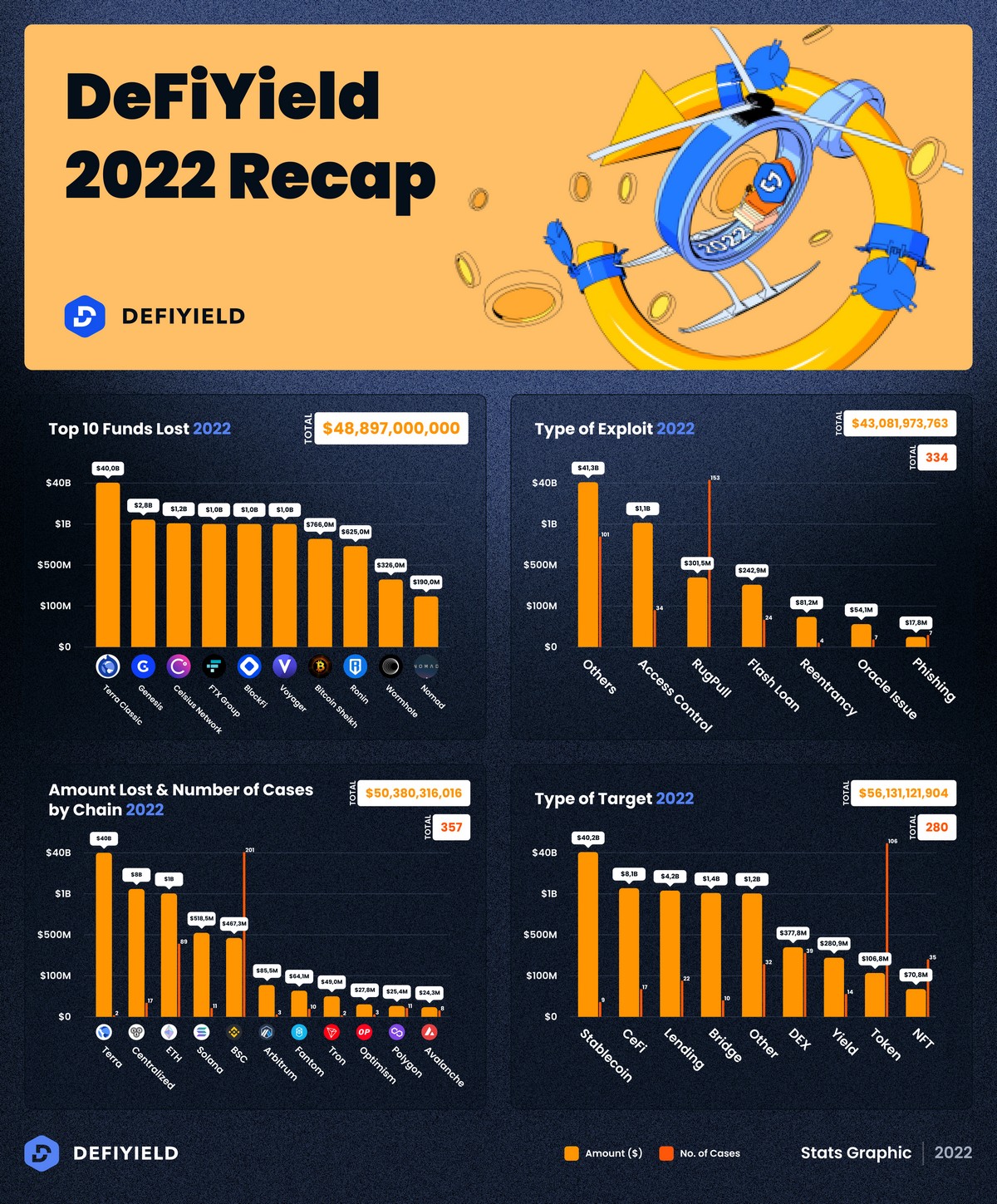

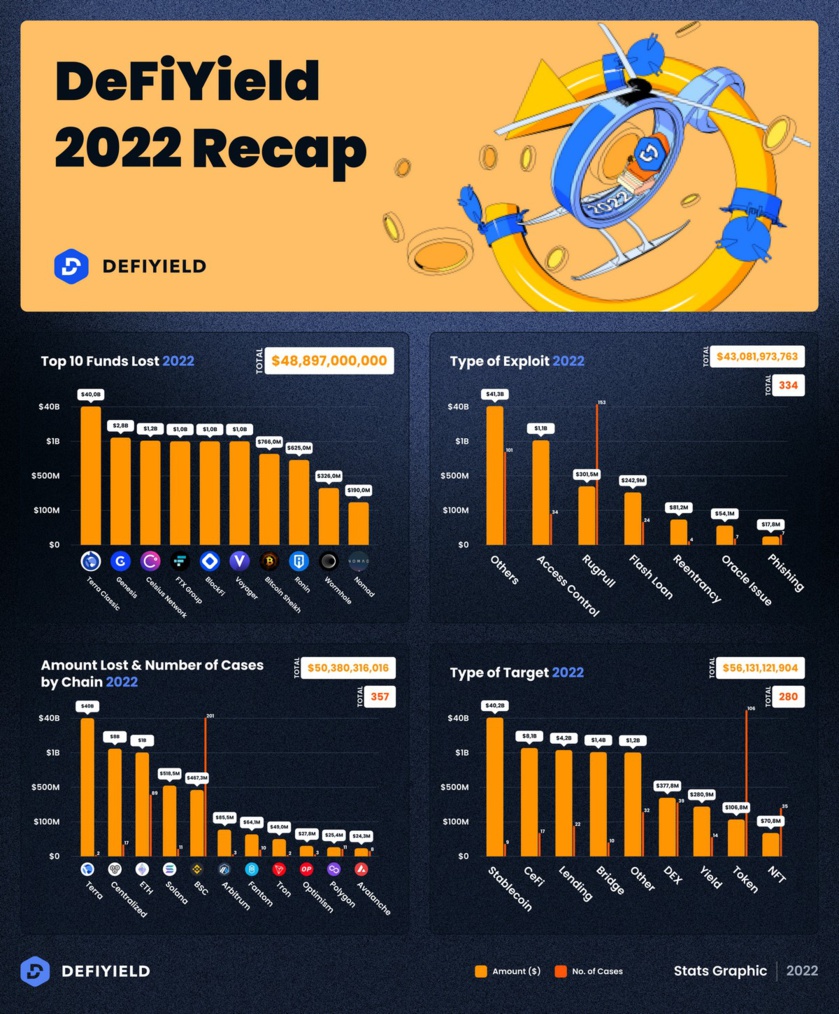

According to DeFiYield’s REKT database, the world’s largest crypto scam database, $48.9b was lost, over 500% increase from 2021. Here are the 5 biggest crypto losses of 2022:

1. Terra Classic — $40b (May 8)

Terra Luna ecosystem one of the largest crypto projects to collabs began in May 2022.

Traders sold off $USTC in a Curve liquidity pool, leading to $USTC depreciating. $LUNC was then minted rapidly as people rushed to redeem their stablecoins. Market cap $LUNC fell below $USTC, preventing redemptions.

2. Genesis — $2.8b (November 10)

Genesis revealed that it had $175m trapped in an FTX account. Withdrawals were halted on the platform.

This included customer funds deposited in Gemini's Earn program and loaned to Genesis.

3. Celsius — $1.19m (CeFi, July 13)

Celsius Network, a centralized exchange and lending protocol, filed for bankruptcy in July. The company revealed a $1.2b balance sheet deficit.

The project halted withdrawals a month prior, citing "extreme market conditions".

4. FTX — $1.0b (November 11)

FTX, Alameda Research, and affiliated companies declared bankruptcy, with funds lost estimated between $1-2b.

November revealed that Alameda’s collateral was dominated by FTX's native token, $FTT. Suspicion that FTX was insolvent, prompted customers to withdraw billions from the exchange. FTX then declared bankruptcy.

5. BlockFi — $1.0b (November 11)

Crypto lending platform BlockFi halted withdrawals and filed for bankruptcy due to exposure to FTX and Alameda.

BlockFi estimated liabilities between $1-10b.

DeFi Exploit Trends

In 2022, greatest losses in Crypto were in CeFi and Stablecoins, with a staggering loss of over $41b. Rugpulls were the most common DeFi exploit, averaging more than one rugpull every 3 days.

Smart contract risk remains a key threat: Almost half of 2022’s exploits were smart contract-related.

Funds recovered this year: $901m, up from $648m last year.

Search for any crypto scam in the DeFiYield’s REKT Database.

2022 Crypto Scam Report

1. Terra Classic — $40b (May 8)

Terra Luna ecosystem one of the largest crypto projects to collabs began in May 2022.

Traders sold off $USTC in a Curve liquidity pool, leading to $USTC depreciating. $LUNC was then minted rapidly as people rushed to redeem their stablecoins. Market cap $LUNC fell below $USTC, preventing redemptions.

2. Genesis — $2.8b (November 10)

Genesis revealed that it had $175m trapped in an FTX account. Withdrawals were halted on the platform.

This included customer funds deposited in Gemini's Earn program and loaned to Genesis.

3. Celsius — $1.19m (CeFi, July 13)

Celsius Network, a centralized exchange and lending protocol, filed for bankruptcy in July. The company revealed a $1.2b balance sheet deficit.

The project halted withdrawals a month prior, citing "extreme market conditions".

4. FTX — $1.0b (November 11)

FTX, Alameda Research, and affiliated companies declared bankruptcy, with funds lost estimated between $1-2b.

November revealed that Alameda’s collateral was dominated by FTX's native token, $FTT. Suspicion that FTX was insolvent, prompted customers to withdraw billions from the exchange. FTX then declared bankruptcy.

5. BlockFi — $1.0b (November 11)

Crypto lending platform BlockFi halted withdrawals and filed for bankruptcy due to exposure to FTX and Alameda.

BlockFi estimated liabilities between $1-10b.

DeFi Exploit Trends

In 2022, greatest losses in Crypto were in CeFi and Stablecoins, with a staggering loss of over $41b. Rugpulls were the most common DeFi exploit, averaging more than one rugpull every 3 days.

Smart contract risk remains a key threat: Almost half of 2022’s exploits were smart contract-related.

Funds recovered this year: $901m, up from $648m last year.

Search for any crypto scam in the DeFiYield’s REKT Database.

2022 Crypto Scam Report

Laurent Leloup

- Fondateur Finyear, une publication du groupe Calmon Partners.

- Fondateur et CEO Leloup Partners (Tokénisation, actifs numériques, STO - Stratégie, conseil, solutions)

- Auteur de Blockchain, la révolution de la confiance

"La blockchain n’est pas la révolution tant annoncée, elle n’est que l’outil d’un monde lui-même entré en révolution"

- Traducteur de La Blockchain pour les Nuls et de Au cœur du bitcoin.

- Fondateur Finyear, une publication du groupe Calmon Partners.

- Fondateur et CEO Leloup Partners (Tokénisation, actifs numériques, STO - Stratégie, conseil, solutions)

- Auteur de Blockchain, la révolution de la confiance

"La blockchain n’est pas la révolution tant annoncée, elle n’est que l’outil d’un monde lui-même entré en révolution"

- Traducteur de La Blockchain pour les Nuls et de Au cœur du bitcoin.

Autres articles

-

Deblock, la fintech s'offre le 2nd agrément PSAN attribué par l'AMF

-

Crypto : Les grands magasins Printemps en partenariat avec Binance Pay et Lyzi pour accepter les paiements en cryptomonnaie

-

Quelles sont les règles concernant le rachat d'un PER ?

-

Tony Fadell, inventeur de l’iPod et de Ledger Stax, rejoint le conseil d’administration de Ledger

-

La loi web 3 vue par ... Arnaud Touati : "La fiscalité des cryptomonnaies en France, mode d’emploi pour particuliers et entreprises"