Blockchain: A legacy of transparency

20/07/2016

Birch, D., R. Brown and S. Parulava. Towards ambient accountability in financial services: shared ledgers, translucent transactions and the legacy of the great financial crisis. Journal of Payment Strategy and Systems* 10(2): 118-131 (2016).

The paper itself is not online (you have to subscribe to the Journal for that) but I’m sure that the fine people from Henry Stewart Publications will have no objection to me reproducing the abstract for you here:

"The consensus in the finance sector seems to be that the shared ledger technology behind Bitcoin, the blockchain, will disrupt the sector, although many commentators are not at all clear how (or, indeed, why). The blockchain is, however, only one kind of shared ledger and the Bitcoin blockchain works in a very specific way. This may not be the best way to organise shared ledgers for disruptive innovation in financial services. So what is? And why would financial services organisations want to do exploit it?"

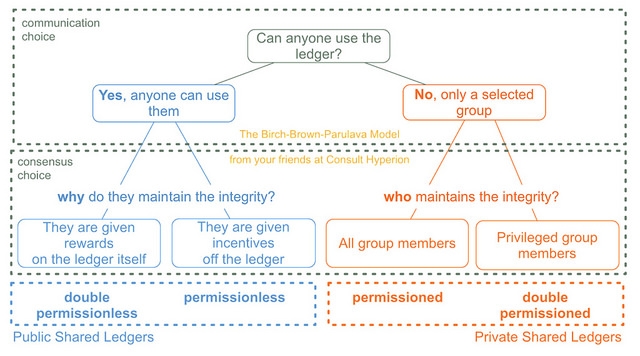

"This paper sets out a simple shared ledger taxonomy and layered architecture designed to facilitate communication between technologists, businesses and regulators in the financial services world and explains why the various forms of shared ledgers might be attractive to financial services organisations, borrowing the phrase “ambient accountability” from architecture to suggest a new way to organise a financial sector."

The paper sets out the “4×4” model that we have used for exploring shared ledger technology with a variety of clients (and have found it to be a very useful tool to help clients develop their strategies around shared ledgers) and then uses this model to discuss the application of shared ledgers to financial services.

What would transparency mean in our context? We envisaged a new kind of financial marketplace where “translucent” transactions that are clear to counterparts, clear in outline to regulators and opaque to others might allow us to set up a transactional environment with ambient accountability. We use the “glass bank” example to create a narrative, and it’s an example that I’ve used before to illustrate the relationship between transparency and trust. Here’s something about it from six years ago:

" Transparency increases confidence and trust. I often use a story from the August 1931 edition of Popular Mechanics to illustrate this point."

The legacy of a crisis is often regulation. If we view the shared ledger not only as a fintech (a technology that changes the cost/benefit landscape around financial services) but also as a regtech (a technology that changes the cost/benefit landscape around the regulation of financial services) then we might be able to make the legacy of the last crisis a better and more effectively regulated financial services sector that is a platform for radically new products and services. At a time when so much money is going on compliance and so much momentum is going into “legacy” regtech we realise that the use of shared ledgers may seem radical, but we are convinced that it is time for a new approach.

* http://www.henrystewartpublications.com/jpss

Dave Birch

David G.W Birch is Director of Consult Hyperion, the secure electronic transactions consultancy. He is an internationally-recognised thought leader in digital identity and digital money; named one of the global top 15 favourite sources of business information (Wired magazine) and one of the top ten most influential voices in banking (Financial Brand); listed in the top 10 Twitter accounts followed by innovators, along with Bill Gates and Richard Branson (PR Daily); named one of the "Fintech Titans" (NextBank), voted one of the European “Power 50” people in digital financial services (FinTech Awards) and ranked Europe’s most influential commentator on emerging payments (Total Payments magazine).

http://www.chyp.com

Participez aux prochaines conférences Blockchain éditées par Finyear Group :

Blockchain Vision #5 + Blockchain Pitch Day #2 (20 septembre 2016)

Blockchain Hackathon #1 (fin 2016).

Les médias du groupe Finyear

Le quotidien Finyear :

– Finyear Quotidien

La newsletter quotidienne :

– Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en Finance innovation, Blockchain révolution & Digital transformation.

Les 6 lettres mensuelles digitales :

– Le Directeur Financier

– Le Trésorier

– Le Credit Manager

– The Chief FinTech Officer

– The Chief Blockchain Officer

– The Chief Digital Officer

Le magazine trimestriel digital :

– Finyear Magazine

Un seul formulaire d’abonnement pour recevoir un avis de publication pour une ou plusieurs lettres