TLDR. After a brutal 2018, it is becoming nearly impossible for investors to lose money this year. A couple of days ago Bitcoin market capitalization broke $100 billion. If it sounds too good to be true, it just might be, especially with IEO’s picking up steam.

It has been almost a year, since the Bitcoin market was at $100 billion. While Bitcoin’s price remains down by 70 percent from its 2017 all-time high, the market cap for the world's most valuable digital asset exceeded $102 billion. It’s certainly time to cheer!

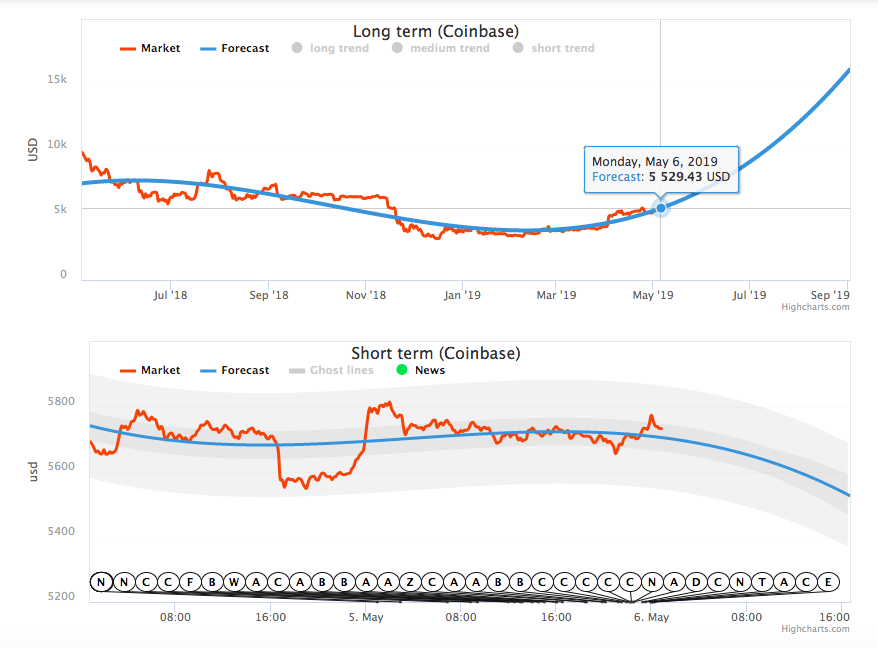

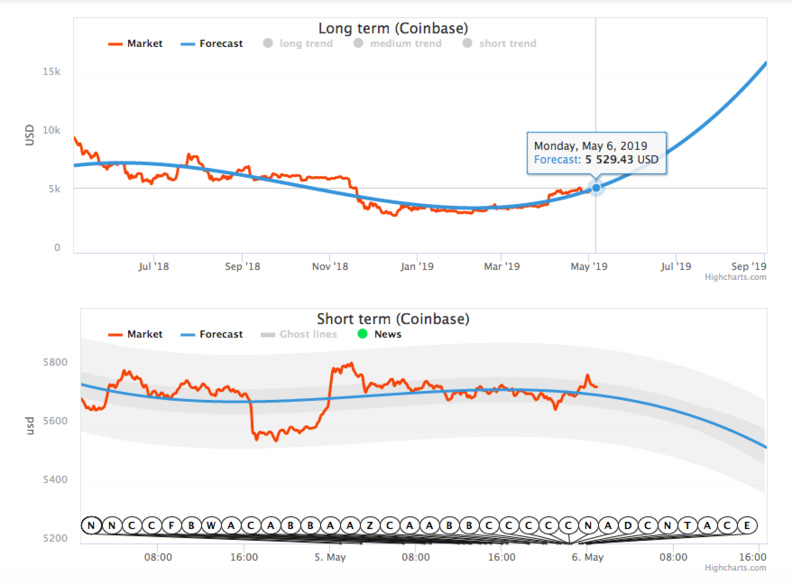

With cryptocurrencies on the move again, everyone is making predictions of what will follow. An online platform called Bitcoin Forest, attempts its own predictions using market data and an AI algorithm to produce forecasts for the prices of cryptocurrencies.

It has been almost a year, since the Bitcoin market was at $100 billion. While Bitcoin’s price remains down by 70 percent from its 2017 all-time high, the market cap for the world's most valuable digital asset exceeded $102 billion. It’s certainly time to cheer!

With cryptocurrencies on the move again, everyone is making predictions of what will follow. An online platform called Bitcoin Forest, attempts its own predictions using market data and an AI algorithm to produce forecasts for the prices of cryptocurrencies.

We are out of the prolonged bear market and prices will start rising, but on much sounder ground.

Since the lows in January, the number of addresses on the Bitcoin network are by 20 percent. In early April, Bitcoin recorded its 400 millionth transaction, in just a year after it passed 300 million transactions, showing continued growth in popularity. Lightning Network’s capacity has increased to over 8000 nodes with a capacity of $5.6 million. This is a 7.8 percent over the last 30 days. Fidelity’s Bitcoin Custody was launched to reel in high profile investors.

A recent survey by Harris Poll for Blockchain Capital, showed that 43% of US Adults are familiar with cryptocurrencies with 20% between the ages 18-35 owning Bitcoin.

Bitcoin is gaining a lot of traction across the board. The report shows that 21% prefer BTC over government bonds, 17% over stocks, 14% over real estate and 12% would invest in BTC before investing in gold.

Along with the rising prices of cryptocurrencies we are also seeing a rising trend in Initial Exchange Offerings (IEOs). It’s becoming clear that will IEOs will be the theme for the cryptocurrency industry in 2019.

In 2017, 875 ICOs raised $6.2 billion. In 2018, 1258 ICOs raised about $7.8 billion USD. Already this year, 12 exchanges have announced IEO platforms and 39 projects have participated in an IEO.

In 2017, ICOs are raised using smart contracts with Ethereum. It was as simple as sending ETH to a smart contract to purchase your tokens in ICO, and immediately you will receive your tokens. In 2018, things changed. Most ICOs performed KYC before a participant could contribute, and the release of tokens usually is not immediate.

IEOs are like ICOs, except that the fund raising takes place on a specific exchange. From exchange to exchange, IEOs may slightly differ, but the basic idea is the same. The exchange performs, marketing, fundraising, and distribution and is paid a fee in the given token. When the IEO completes, the token is listed on the exchange for trading.

Binance was one of the first to introduce IEOs in 2017, and in 2019 reintroduced its Launchpad platform with the success of the Bittorent token generating interest from the crypto community.

IEOs also offer numerous benefits to the parties involved. Investors are theoretically better protected against fraud, because there is an exchange that approved and rejects projects. It’s expected that serious exchanges, will likely conduct better due diligence before offering to act as the counterparty for a project that want to raise money with an IEO.

Crypto is heading towards the same VC and private equity to IPO exclusivity game. The model isn’t all that different to a conventional IPO. Exchanges, like NASDAQ or the New York Stock Exchange, approve listings based on the quality of the offering and a whole host of regulatory compliant guidelines. An IEO merely replaces equity with a digital asset.

Will year 2019 be the year of IEO?

2019 is the year of the IEO. Exchanges will handle project vetting for retail investors and tokens will be tradable in weeks. Being vetted by an exchange and immediately tradable, IEOs address two of the key problems with ICOs. Tokens are immediately listed on the exchange, giving holders immediate access to a trading platform. An exchange that acts as a counterparty, providing an additional layer of assurance for investors.

The new race will be investing in companies that are guaranteed an IEO, which can be interpreted as a very positive signal for the industry, in general.

Since the lows in January, the number of addresses on the Bitcoin network are by 20 percent. In early April, Bitcoin recorded its 400 millionth transaction, in just a year after it passed 300 million transactions, showing continued growth in popularity. Lightning Network’s capacity has increased to over 8000 nodes with a capacity of $5.6 million. This is a 7.8 percent over the last 30 days. Fidelity’s Bitcoin Custody was launched to reel in high profile investors.

A recent survey by Harris Poll for Blockchain Capital, showed that 43% of US Adults are familiar with cryptocurrencies with 20% between the ages 18-35 owning Bitcoin.

Bitcoin is gaining a lot of traction across the board. The report shows that 21% prefer BTC over government bonds, 17% over stocks, 14% over real estate and 12% would invest in BTC before investing in gold.

Along with the rising prices of cryptocurrencies we are also seeing a rising trend in Initial Exchange Offerings (IEOs). It’s becoming clear that will IEOs will be the theme for the cryptocurrency industry in 2019.

In 2017, 875 ICOs raised $6.2 billion. In 2018, 1258 ICOs raised about $7.8 billion USD. Already this year, 12 exchanges have announced IEO platforms and 39 projects have participated in an IEO.

In 2017, ICOs are raised using smart contracts with Ethereum. It was as simple as sending ETH to a smart contract to purchase your tokens in ICO, and immediately you will receive your tokens. In 2018, things changed. Most ICOs performed KYC before a participant could contribute, and the release of tokens usually is not immediate.

IEOs are like ICOs, except that the fund raising takes place on a specific exchange. From exchange to exchange, IEOs may slightly differ, but the basic idea is the same. The exchange performs, marketing, fundraising, and distribution and is paid a fee in the given token. When the IEO completes, the token is listed on the exchange for trading.

Binance was one of the first to introduce IEOs in 2017, and in 2019 reintroduced its Launchpad platform with the success of the Bittorent token generating interest from the crypto community.

IEOs also offer numerous benefits to the parties involved. Investors are theoretically better protected against fraud, because there is an exchange that approved and rejects projects. It’s expected that serious exchanges, will likely conduct better due diligence before offering to act as the counterparty for a project that want to raise money with an IEO.

Crypto is heading towards the same VC and private equity to IPO exclusivity game. The model isn’t all that different to a conventional IPO. Exchanges, like NASDAQ or the New York Stock Exchange, approve listings based on the quality of the offering and a whole host of regulatory compliant guidelines. An IEO merely replaces equity with a digital asset.

Will year 2019 be the year of IEO?

2019 is the year of the IEO. Exchanges will handle project vetting for retail investors and tokens will be tradable in weeks. Being vetted by an exchange and immediately tradable, IEOs address two of the key problems with ICOs. Tokens are immediately listed on the exchange, giving holders immediate access to a trading platform. An exchange that acts as a counterparty, providing an additional layer of assurance for investors.

The new race will be investing in companies that are guaranteed an IEO, which can be interpreted as a very positive signal for the industry, in general.

Ilias Louis Hatzis

Ilias Louis Hatzis is the Founder & CEO at Mercato Blockchain Corporation AG.

He writes the Blockchain Weekly Front Page each Monday.

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

http://dailyfintech.com

He writes the Blockchain Weekly Front Page each Monday.

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

http://dailyfintech.com

Finyear & Chaineum

Lisez gratuitement le quotidien Finyear & sa newsletter quotidienne.

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

----------------

Chaineum - Conseil haut de bilan & stratégie blockchain

Fondée en 2015, Chaineum est un cabinet de conseil en opérations de haut de bilan offrant une expertise de premier plan en matière d’ICOs et STOs, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

Besançon - Paris + réseau international de partenaires.

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

----------------

Chaineum - Conseil haut de bilan & stratégie blockchain

Fondée en 2015, Chaineum est un cabinet de conseil en opérations de haut de bilan offrant une expertise de premier plan en matière d’ICOs et STOs, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

Besançon - Paris + réseau international de partenaires.

Autres articles

-

Coinbase et Visa, un partenariat pour des transferts en temps réel

-

Brilliantcrypto, la nouvelle aventure play-to-earn basée sur la blockchain Polygon, arrive sur Epic Game Store

-

Nomination | Truffle Capital promeut Alexis Le Portz en qualité de Partner

-

IPEM Paris 2024 : 5500 participants au Palais des congrès

-

Pomelo annonce une Série A à 35 millions de dollars menée par Vy Capital