IMAGE SOURCE

In January 2000, global financial markets were on the verge of a meltdown that was expected to destroy both the reputations of investors and the riches of day traders, that invested in companies and tech stocks that weren’t generating any revenue.

The “dotcom” crash caused a stock market meltdown.

Between 1995 and 2000, Nasdaq climbed 400% as internet companies sought to profit from the new technology. It peaked in 2000, and by October 2002, Nasdaq had lost 78% of its value, around $5 trillion.

Big advertising budgets and poor business models were the main reasons why companies like Pets.com, Webvan, eToys, Boo.com, Kozmo, and many others failed to deliver on their promises and support their high share prices and ended up shutting down or being acquired.

However, a few technology companies got it right, demonstrating remarkable growth and earnings. When you look at companies like Google and Amazon they thrived and turned out to be the dominant players in the sectors.

Looking back at the past two decades only proves to us that early internet entrepreneurs and investors were right about the internet and how it would revolutionize the way we live and work.

While most of the world’s technology companies are not 1 trillion dollar companies like Google ($1.56T) and Amazon ($1.18T), the aggregate earnings of tech companies are 2.5 times higher than they were in 2000.

In January 2000, global financial markets were on the verge of a meltdown that was expected to destroy both the reputations of investors and the riches of day traders, that invested in companies and tech stocks that weren’t generating any revenue.

The “dotcom” crash caused a stock market meltdown.

Between 1995 and 2000, Nasdaq climbed 400% as internet companies sought to profit from the new technology. It peaked in 2000, and by October 2002, Nasdaq had lost 78% of its value, around $5 trillion.

Big advertising budgets and poor business models were the main reasons why companies like Pets.com, Webvan, eToys, Boo.com, Kozmo, and many others failed to deliver on their promises and support their high share prices and ended up shutting down or being acquired.

However, a few technology companies got it right, demonstrating remarkable growth and earnings. When you look at companies like Google and Amazon they thrived and turned out to be the dominant players in the sectors.

Looking back at the past two decades only proves to us that early internet entrepreneurs and investors were right about the internet and how it would revolutionize the way we live and work.

While most of the world’s technology companies are not 1 trillion dollar companies like Google ($1.56T) and Amazon ($1.18T), the aggregate earnings of tech companies are 2.5 times higher than they were in 2000.

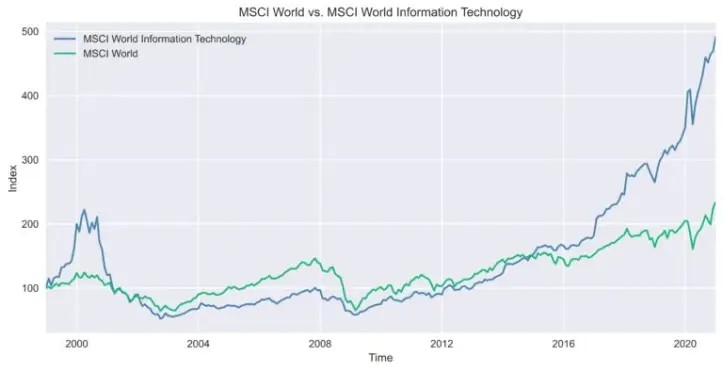

MSCI World Technology Index vs. MSCI World

This incredible growth tells the story of tech over the past two decades and I think tells us what we should expect from crypto.

Yet, the drop in cryptocurrency and NFT prices has raised concerns, finger-pointing, and calls for regulation.

The entire crypto market is feeling the pain.

Bitcoin has lost about 70% of its value since hitting an all-time high of roughly $69,000 in November 2021.

The total market cap of crypto assets has dropped to less than $1 trillion from its November 2021 peak of $3 trillion.

Today 95% of the crypto market is worthless.

There are more than 19,000 cryptocurrencies and dozens of blockchains that exist. Most of what’s out there today doesn’t add any value and some are even scams, just like many of the early internet companies. Eventually, like the dotcom crash, they will go belly up what will be left will be valuable coins and legitimate businesses. In 10 years from now, there’ll be a couple of clear winners for different kinds of applications.

While some things seem similar between this crypto and the dotcom crash, they are very different. The dotcom crash impacted the global economy, while the global economy impacted crypto. Crypto has a long way to go before it becomes the cause of an economic downturn like the dotcom or housing bubbles were.

Crypto is simply a volatile new tech market trying to find its way, also victimized by a global recession.

But the crypto crash is teaching us some valuable lessons about crypto and NFTs and how they work in the economy. Similar to how the dotcom crash claried for internet companies what products and business models are viable, this recent crypto crash is removing our rose-colored glasses about Web3 and the metaverse, and those that survive the crypto crash could become the tech giants of the future.

Crypto has created products that could not have been imagined before, including digital playthings that are often of little practical value, such as nonfungible tokens and meme cryptocurrencies. But there are also some useful ones such as smart contracts that allow financial assets to be bought and sold directly without the intervention of traditional intermediaries. This should, at a minimum, lower costs and improve efficiency by creating competition for entrenched institutions.

Rather than seeing this as the end of bitcoin, we can see it as the next step in the evolution of the market transitioning from a speculative asset to one that creates value by providing useful services to the economy.

This incredible growth tells the story of tech over the past two decades and I think tells us what we should expect from crypto.

Yet, the drop in cryptocurrency and NFT prices has raised concerns, finger-pointing, and calls for regulation.

The entire crypto market is feeling the pain.

Bitcoin has lost about 70% of its value since hitting an all-time high of roughly $69,000 in November 2021.

The total market cap of crypto assets has dropped to less than $1 trillion from its November 2021 peak of $3 trillion.

Today 95% of the crypto market is worthless.

There are more than 19,000 cryptocurrencies and dozens of blockchains that exist. Most of what’s out there today doesn’t add any value and some are even scams, just like many of the early internet companies. Eventually, like the dotcom crash, they will go belly up what will be left will be valuable coins and legitimate businesses. In 10 years from now, there’ll be a couple of clear winners for different kinds of applications.

While some things seem similar between this crypto and the dotcom crash, they are very different. The dotcom crash impacted the global economy, while the global economy impacted crypto. Crypto has a long way to go before it becomes the cause of an economic downturn like the dotcom or housing bubbles were.

Crypto is simply a volatile new tech market trying to find its way, also victimized by a global recession.

But the crypto crash is teaching us some valuable lessons about crypto and NFTs and how they work in the economy. Similar to how the dotcom crash claried for internet companies what products and business models are viable, this recent crypto crash is removing our rose-colored glasses about Web3 and the metaverse, and those that survive the crypto crash could become the tech giants of the future.

Crypto has created products that could not have been imagined before, including digital playthings that are often of little practical value, such as nonfungible tokens and meme cryptocurrencies. But there are also some useful ones such as smart contracts that allow financial assets to be bought and sold directly without the intervention of traditional intermediaries. This should, at a minimum, lower costs and improve efficiency by creating competition for entrenched institutions.

Rather than seeing this as the end of bitcoin, we can see it as the next step in the evolution of the market transitioning from a speculative asset to one that creates value by providing useful services to the economy.

Ilias Louis Hatzis

Ilias Louis Hatzis is the Founder & CEO at Mercato Blockchain Corporation AG.

Ilias Louis Hatzis is the founder and CEO at Kryptonio wallet. Create your wallet in less than a minute, without seed phrases, private keys, passwords or documents. Keep your bitcoin and digital assets always secure and recoverable: https://kryptonio.com

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Ilias Louis Hatzis is the founder and CEO at Kryptonio wallet. Create your wallet in less than a minute, without seed phrases, private keys, passwords or documents. Keep your bitcoin and digital assets always secure and recoverable: https://kryptonio.com

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Autres articles

-

Frogs VS. Dogs - Dogizen offre des rendements 10 fois supérieurs à ceux de Pepe Coin ?

-

Spendesk complète son offre en devenant établissement de paiement

-

Nomination | Swan structure sa direction avec l'arrivée de Camille Tyan au poste de Directeur Général

-

Dogizen, la première ICO sur Telegram, séduit les experts avec une augmentation de 1,4 million de dollars.

-

Klarna affiche sa pleine forme, avant son IPO en 2025 ?