Noam Zeev

This blog will go deeper into the bitcoin algorithm. This is also the place to thank Jean-Paul de Vooght (JP) for his comments, directions and catching passion.

The breakthrough of Bitcoin technology (also known as Crypto currency and Finance 1.0 and 2.0) is its ability to keep a "single source of the truth" in a distributed environment.

The heart of the protocols is the "Block chain" that acts as a shared public ledger.

So what's a "block"? A block holds data of a group of transactions and additional data that include also the previous block ID (hence creating a chain).

But a "block" is meaningless until it is verified. As Bitcoin works in a distributed environment there are many "nodes" in the network that can verify a block (those "nodes" are also referred as "miners"). The miners "compete" with each other to win the verification as there is a reward for the winner! In order to win the competition the miner must first verify that the block keeps integrity internally and with all previous blocks that are already verified (ensuring e.g. no negative balance is allowed, no double spending, etc.).

Now the fun begins. The protocol wants to give the winning miner a slice of a time to publish the new verified block to the entire network. Remember, this is a distributed environment so you can't update all nodes at the same time. This is very important as without this, fraudulent transaction can be processed when part of the network looks at one "certified block" and the other at a different "certify node".

So the protocol requires the miners to solve a riddle in order to complete the verification process (this is where the crypto part plays an important role). The only way to solve the riddle is by guessing randomly the value for a parameter called "Nonce". For a single miner with standard hardware, these computations will take a long time on average to perform (depends how lucky you are), but the combined network will always solve it in 10 minutes give or take (the protocol "harden" the riddle when the network computing power increases to keep the 10 minutes parameter). This process is known as "Proof of Work".

If you got that far you might also start falling in love with the concept. So let's go to the next phase.

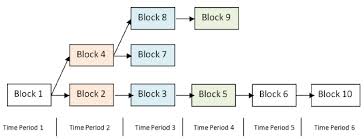

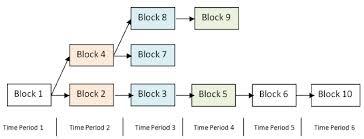

So now, the protocol allowed a slice of time to publish the new authorized block. But what if this is not enough and someone else also certified a block at the same time (either by coincidence or with evil intention)? The network can't take this risk. So, the protocol assumes that two certified blocks can point to the same previous block. This situation is called a "fork" and looks like this:

The breakthrough of Bitcoin technology (also known as Crypto currency and Finance 1.0 and 2.0) is its ability to keep a "single source of the truth" in a distributed environment.

The heart of the protocols is the "Block chain" that acts as a shared public ledger.

So what's a "block"? A block holds data of a group of transactions and additional data that include also the previous block ID (hence creating a chain).

But a "block" is meaningless until it is verified. As Bitcoin works in a distributed environment there are many "nodes" in the network that can verify a block (those "nodes" are also referred as "miners"). The miners "compete" with each other to win the verification as there is a reward for the winner! In order to win the competition the miner must first verify that the block keeps integrity internally and with all previous blocks that are already verified (ensuring e.g. no negative balance is allowed, no double spending, etc.).

Now the fun begins. The protocol wants to give the winning miner a slice of a time to publish the new verified block to the entire network. Remember, this is a distributed environment so you can't update all nodes at the same time. This is very important as without this, fraudulent transaction can be processed when part of the network looks at one "certified block" and the other at a different "certify node".

So the protocol requires the miners to solve a riddle in order to complete the verification process (this is where the crypto part plays an important role). The only way to solve the riddle is by guessing randomly the value for a parameter called "Nonce". For a single miner with standard hardware, these computations will take a long time on average to perform (depends how lucky you are), but the combined network will always solve it in 10 minutes give or take (the protocol "harden" the riddle when the network computing power increases to keep the 10 minutes parameter). This process is known as "Proof of Work".

If you got that far you might also start falling in love with the concept. So let's go to the next phase.

So now, the protocol allowed a slice of time to publish the new authorized block. But what if this is not enough and someone else also certified a block at the same time (either by coincidence or with evil intention)? The network can't take this risk. So, the protocol assumes that two certified blocks can point to the same previous block. This situation is called a "fork" and looks like this:

The rule is: the consensus (or the single source of truth) is in the blocks at the longest chain (In this case, blocks 1, 2, 3, 5, 6 and 10). So now, the entire network ignores the other blocks (4, 7, 8, 9) as if they never existed. If a node tries to promote one of those blocks (perhaps for fraudulent reasons) it will have to compete the entire network and own at least 51% of its processing power. Not likely to happen. As far back as you go in the block chain, the chances that this block will not belong to the longest chain goes down. 3 blocks generation is considered very safe and 6 blocks generation is considered super safe.

There is much more to say about Bitcoin and finance 2.0 but this is really the foundation.

(1) http://blog.ness-ses.com/how-can-bitcoin-technology-disrupt-traditional-banking

By Noam Zeev on Apr 30, 2015

Noam heads Ness SES in Israel. He previously held several senior management positions such as VP of Ness Global Business Development & VP Sales at Ness Israel (for the financial sectors and outsourcing services). Noam joined Ness in 2007 from EDS where he served as a delivery manager and sales executive.

BL0CKCHA1N : The Blockchain Forum 2015 in Paris

Book your place at the conference or access the contents of conferences after the forum.

Vous souhaitez vous joindre à la “Blockchain Revolution” ?

Explorez le futur de la finance, des transactions, de la réputation et de la confiance.

Participez à notre forum dédié BLOCKCHAIN

There is much more to say about Bitcoin and finance 2.0 but this is really the foundation.

(1) http://blog.ness-ses.com/how-can-bitcoin-technology-disrupt-traditional-banking

By Noam Zeev on Apr 30, 2015

Noam heads Ness SES in Israel. He previously held several senior management positions such as VP of Ness Global Business Development & VP Sales at Ness Israel (for the financial sectors and outsourcing services). Noam joined Ness in 2007 from EDS where he served as a delivery manager and sales executive.

BL0CKCHA1N : The Blockchain Forum 2015 in Paris

Book your place at the conference or access the contents of conferences after the forum.

Vous souhaitez vous joindre à la “Blockchain Revolution” ?

Explorez le futur de la finance, des transactions, de la réputation et de la confiance.

Participez à notre forum dédié BLOCKCHAIN

Les médias du groupe Finyear

Lisez gratuitement :

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d'affaires.

Les 4 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- Le Capital Investisseur

Le magazine bimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d'affaires.

Les 4 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- Le Capital Investisseur

Le magazine bimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Autres articles

-

Coinbase et Visa, un partenariat pour des transferts en temps réel

-

Brilliantcrypto, la nouvelle aventure play-to-earn basée sur la blockchain Polygon, arrive sur Epic Game Store

-

Nomination | Truffle Capital promeut Alexis Le Portz en qualité de Partner

-

IPEM Paris 2024 : 5500 participants au Palais des congrès

-

Pomelo annonce une Série A à 35 millions de dollars menée par Vy Capital