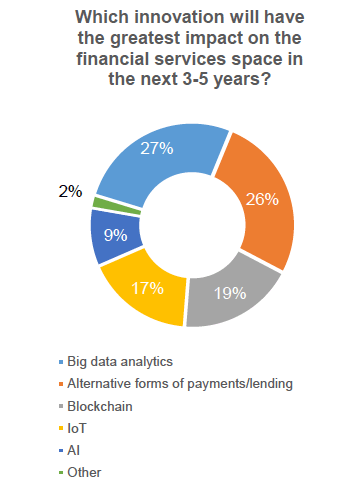

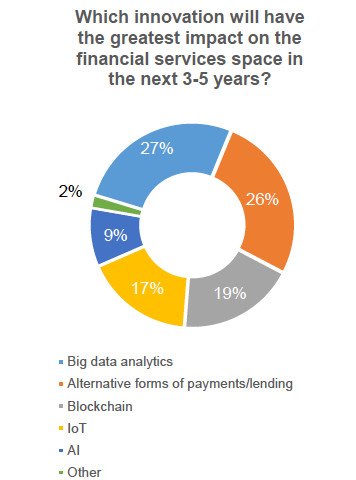

Given this non-random sample of participants, it is probably not surprising that Big Data Analytics and Alternative Payments Platforms were the top two answers (at 27% and 26%, respectively) to the question “Which technology innovation will most impact financial services in the next 3-5 years?”.

The only surprising to me about the number three answer was how “blockchain”, only came in with 16% of the vote. It’s been at the top of the hype curve over the last few months, as I reported from Sibos.

The only surprising to me about the number three answer was how “blockchain”, only came in with 16% of the vote. It’s been at the top of the hype curve over the last few months, as I reported from Sibos.

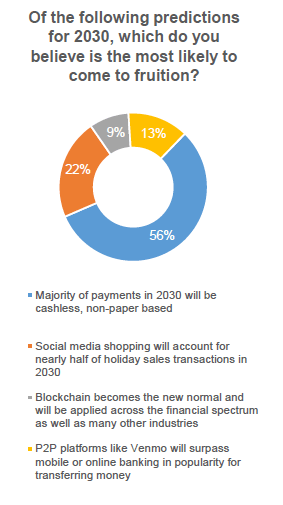

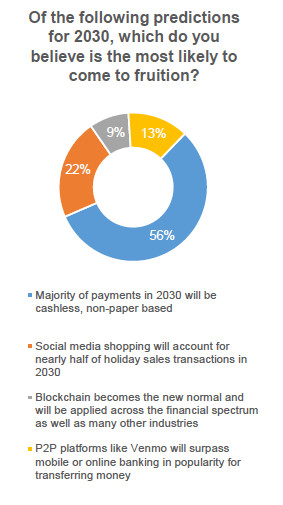

The survey also asked for some predictions about finance in the year 2030.

At the top of this list was the prediction that the majority of payments in 2030 will be cashless, non-paper based (56% of respondents), and that Social media shopping will account for nearly half of holiday sales transactions by 2020 (22%).

At the top of this list was the prediction that the majority of payments in 2030 will be cashless, non-paper based (56% of respondents), and that Social media shopping will account for nearly half of holiday sales transactions by 2020 (22%).

If these predictions are accurate the customer experience gap that banks have with their customers today is only going to get wider. Sounds like a good time to get to work on innovating some new products and new customer experiences.

The survey also has questions on the future of data security and fraud prevention.

The survey also has questions on the future of data security and fraud prevention.

JP Nicols, CFP®

Internationally recognized as a leading voice for innovation, strategy and leadership for the future of financial services, JP combines 20+ years of experience with a fresh perspective on combining high-tech with hightouch. His work has been featured in some of the industry’s top publications, including American Banker, BAI Banking Strategies and Investment News.

He is the founder and CEO of Clientific, and the co-founder of the Bank Innovators Council.

www.clientific.net

www.bankinnovatorscouncil.org/

Internationally recognized as a leading voice for innovation, strategy and leadership for the future of financial services, JP combines 20+ years of experience with a fresh perspective on combining high-tech with hightouch. His work has been featured in some of the industry’s top publications, including American Banker, BAI Banking Strategies and Investment News.

He is the founder and CEO of Clientific, and the co-founder of the Bank Innovators Council.

www.clientific.net

www.bankinnovatorscouncil.org/

Les médias du groupe Finyear

Lisez gratuitement :

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d'affaires.

Les 4 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- Le Capital Investisseur

Le magazine bimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Le quotidien Finyear :

- Finyear Quotidien

La newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d'affaires.

Les 4 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- Le Capital Investisseur

Le magazine bimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour recevoir un avis de publication pour une ou plusieurs lettres

Autres articles

-

Coinbase et Visa, un partenariat pour des transferts en temps réel

-

Brilliantcrypto, la nouvelle aventure play-to-earn basée sur la blockchain Polygon, arrive sur Epic Game Store

-

Nomination | Truffle Capital promeut Alexis Le Portz en qualité de Partner

-

IPEM Paris 2024 : 5500 participants au Palais des congrès

-

Pomelo annonce une Série A à 35 millions de dollars menée par Vy Capital