Co-authored by Aldo de Jong and Yannick Rennhard from Claro Partners and Pascal Bouvier, fintech venture capital investor.

How can companies stay innovative, even when they’ve grown to a size where innovation is slowed down by processes, hierarchies, sounding boards, siloes and that cosy blanket of routine and habit?

Last January, we wrote that trying to innovate like a startup – throwing mud at the wall and seeing what sticks – is not the right approach. Organising hackathons, especially when they’re focused on developers alone, isn’t the right way either. So, how about building an external structure where ideas can emerge and grow… Why not set up an innovation lab?

Innovation labs, corporate accelerators and incubators, or however you call it, are places where corporate intrapreneurs get together – sometimes with additional partners, such as startups or external entrepreneurs – to explore interesting areas unbound by corporate bureaucracy and restrictions. At least that’s the idea. Innovation labs are meant to spark innovation that can be re-integrated into the company’s business, once its value proposition has been validated. They are extremely popular. Almost every large company has some kind of innovation lab these days, or is trying to create one.

Innovation labs should be like a laboratory of ideas, where people have room to experiment, to explore new ways of thinking, to fail and to create breakthrough products and services in the process. Unfortunately, innovation labs often turn out to be a lot more like chemistry shows for kids. There’s a lot of noise, a lot of colourful smoke and people wearing strange glasses. It’s a very enjoyable experience, yes. But apart from some ear-shattering explosions, nothing is really created in the end.

Where’s the innovation in innovation labs?

Let’s have a closer look at where expectations and outcomes for innovation labs diverge. The first and – quite obviously – the biggest problem is that innovation labs don’t seem to trigger innovation. The reality is that, if you define innovation as a new product or service offer that is validated on the market and creates value for the company, then innovation labs have a terrible success rate. Here’s why:

1. Lack of tangible results

Some innovation labs don’t create tangible results at all. They measure their success by the number of new ideas they’ve created, by the number of interesting presentations they held at any of the countless innovation conferences around the globe and the number of “likes” they got for their innovation ideas on social media.

2. Lack of entrepreneurial commitment

One of the big reasons for this lack of output is having the wrong people – more specifically – people who we call corporate experience seekers. These employees get recruited to contribute to the innovation lab on the basis of some misguided incentive or training program. The problem is that they usually lack the mind-set, the right incentives and the vigour needed to be successful in the startup world. They join the innovation lab, have a great experience playing entrepreneur (including table soccer, working with a laptop on a sofa, wearing sneakers and hoodies and whatever other innovation theatre clichés you can imagine) and they might hold interesting talks about their experience BUT they don’t create real, tangible results. The truth is that building a venture is a painful process and you should be in it for the right reasons.

3. Lack of strategic alignment

Another problem with innovation labs is that, if they do create ventures, then the resulting ventures are often not in line with the company’s core business or strategic priorities and therefore very difficult to re-integrate into the corporate offer. They are – quite frankly – a massive waste of time and money. Many innovation lab creators think that rules and limitations are bad for innovation, that people need total freedom to create good results. The opposite is true: the better you define the right area to innovate in, the better the outcome. First, you need to understand what opportunity area is most interesting for the company to explore – not just based on the corporate strategy but also an in-depth understanding of the ecosystem of the company and the current and future needs of its clients. Within those boundaries, though, individual freedom and possibility to make mistakes is important. At Claro, we call this autonomy in alignment, a principle that we used to summarise the new way of working as part of a project for Standard Bank, a South African bank.

4. Lack of a problem

Innovation labs that are focussed on exploring the implications of an emerging technology and creating new offers that leverage it (blockchain is a wildly popular example) often end up creating the wrong results as well. Exploring what a technological disruption means for a company definitely has its value. But if you start with a technology as the basis of your innovation, you’ll often end up creating solutions looking for a problem. If you just want to understand a technology, please call your initiative a “blockchain lab” or something like that. Calling it an innovation lab will raise expectations it will not be able to live up to. If you want to create innovation, think about the right problem to solve first and then select the technology that has the most potential to solve it.

5. Lack of understanding

The single biggest reason though, is that – driven by the need for fast results and the appeal of “just trying something” – innovation labs often practice a very loose methodology with a focus on doing things, rather than thinking about what to do first. This tendency to jump to the second step does lead to fast results, yes. But if you have to throw away your results because they aren’t relevant to your customers or don’t fit your market context, you’ll end up spending a lot more time and money than necessary. So, for example, if you want to create innovative financial services for digital natives, try to base it on understanding banking services for millennials first, instead of just throwing something at the wall and seeing if it sticks.

All of the problems described above are connected to companies trying to cut corners, sometimes just for the sake of looking innovative. At Claro, we have a different approach.

An insight-driven approach to innovation

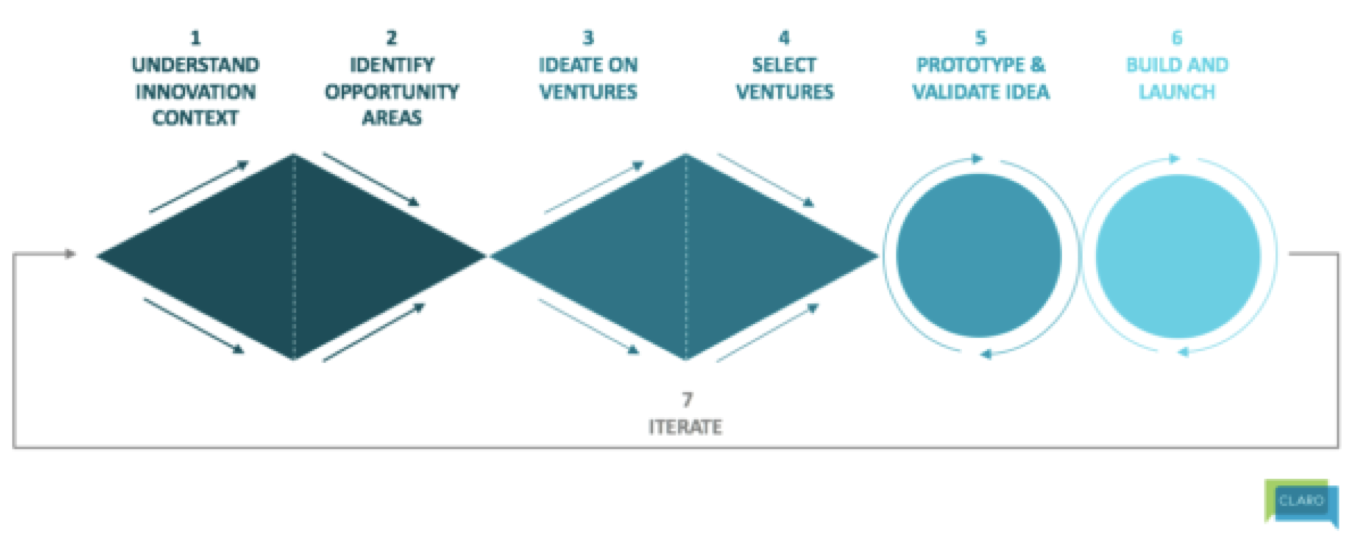

We call it Insights-driven Venture Creation. It ensures sufficient time is spent on thinking and not only on doing. We’ve used this approach successfully with clients over the past year. Essentially, it is a combination of venture design and venture building, with the following key steps:

How can companies stay innovative, even when they’ve grown to a size where innovation is slowed down by processes, hierarchies, sounding boards, siloes and that cosy blanket of routine and habit?

Last January, we wrote that trying to innovate like a startup – throwing mud at the wall and seeing what sticks – is not the right approach. Organising hackathons, especially when they’re focused on developers alone, isn’t the right way either. So, how about building an external structure where ideas can emerge and grow… Why not set up an innovation lab?

Innovation labs, corporate accelerators and incubators, or however you call it, are places where corporate intrapreneurs get together – sometimes with additional partners, such as startups or external entrepreneurs – to explore interesting areas unbound by corporate bureaucracy and restrictions. At least that’s the idea. Innovation labs are meant to spark innovation that can be re-integrated into the company’s business, once its value proposition has been validated. They are extremely popular. Almost every large company has some kind of innovation lab these days, or is trying to create one.

Innovation labs should be like a laboratory of ideas, where people have room to experiment, to explore new ways of thinking, to fail and to create breakthrough products and services in the process. Unfortunately, innovation labs often turn out to be a lot more like chemistry shows for kids. There’s a lot of noise, a lot of colourful smoke and people wearing strange glasses. It’s a very enjoyable experience, yes. But apart from some ear-shattering explosions, nothing is really created in the end.

Where’s the innovation in innovation labs?

Let’s have a closer look at where expectations and outcomes for innovation labs diverge. The first and – quite obviously – the biggest problem is that innovation labs don’t seem to trigger innovation. The reality is that, if you define innovation as a new product or service offer that is validated on the market and creates value for the company, then innovation labs have a terrible success rate. Here’s why:

1. Lack of tangible results

Some innovation labs don’t create tangible results at all. They measure their success by the number of new ideas they’ve created, by the number of interesting presentations they held at any of the countless innovation conferences around the globe and the number of “likes” they got for their innovation ideas on social media.

2. Lack of entrepreneurial commitment

One of the big reasons for this lack of output is having the wrong people – more specifically – people who we call corporate experience seekers. These employees get recruited to contribute to the innovation lab on the basis of some misguided incentive or training program. The problem is that they usually lack the mind-set, the right incentives and the vigour needed to be successful in the startup world. They join the innovation lab, have a great experience playing entrepreneur (including table soccer, working with a laptop on a sofa, wearing sneakers and hoodies and whatever other innovation theatre clichés you can imagine) and they might hold interesting talks about their experience BUT they don’t create real, tangible results. The truth is that building a venture is a painful process and you should be in it for the right reasons.

3. Lack of strategic alignment

Another problem with innovation labs is that, if they do create ventures, then the resulting ventures are often not in line with the company’s core business or strategic priorities and therefore very difficult to re-integrate into the corporate offer. They are – quite frankly – a massive waste of time and money. Many innovation lab creators think that rules and limitations are bad for innovation, that people need total freedom to create good results. The opposite is true: the better you define the right area to innovate in, the better the outcome. First, you need to understand what opportunity area is most interesting for the company to explore – not just based on the corporate strategy but also an in-depth understanding of the ecosystem of the company and the current and future needs of its clients. Within those boundaries, though, individual freedom and possibility to make mistakes is important. At Claro, we call this autonomy in alignment, a principle that we used to summarise the new way of working as part of a project for Standard Bank, a South African bank.

4. Lack of a problem

Innovation labs that are focussed on exploring the implications of an emerging technology and creating new offers that leverage it (blockchain is a wildly popular example) often end up creating the wrong results as well. Exploring what a technological disruption means for a company definitely has its value. But if you start with a technology as the basis of your innovation, you’ll often end up creating solutions looking for a problem. If you just want to understand a technology, please call your initiative a “blockchain lab” or something like that. Calling it an innovation lab will raise expectations it will not be able to live up to. If you want to create innovation, think about the right problem to solve first and then select the technology that has the most potential to solve it.

5. Lack of understanding

The single biggest reason though, is that – driven by the need for fast results and the appeal of “just trying something” – innovation labs often practice a very loose methodology with a focus on doing things, rather than thinking about what to do first. This tendency to jump to the second step does lead to fast results, yes. But if you have to throw away your results because they aren’t relevant to your customers or don’t fit your market context, you’ll end up spending a lot more time and money than necessary. So, for example, if you want to create innovative financial services for digital natives, try to base it on understanding banking services for millennials first, instead of just throwing something at the wall and seeing if it sticks.

All of the problems described above are connected to companies trying to cut corners, sometimes just for the sake of looking innovative. At Claro, we have a different approach.

An insight-driven approach to innovation

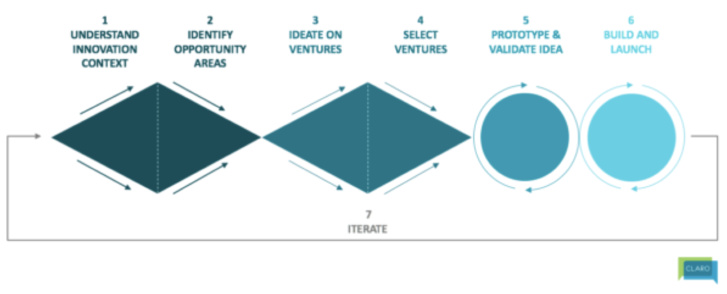

We call it Insights-driven Venture Creation. It ensures sufficient time is spent on thinking and not only on doing. We’ve used this approach successfully with clients over the past year. Essentially, it is a combination of venture design and venture building, with the following key steps:

1. Understand innovation context

Make sure you create a broad understanding of your innovation context by first analysing disruptions, trends and emerging value propositions in relevant and adjacent markets. Then, obtain a deep understanding of your customer’s behaviours, needs and perceptions. Create the right frameworks and tools that summarise all your findings and help your teams innovate from a holistic understanding of your innovation ecosystem.

2. Identify opportunity areas

Based on that shared understanding of your innovation context, select the opportunity area(s) you want to pursue.

3. Ideate on ventures

Ideate on the right ventures to build within the opportunity areas identified, involving all relevant stakeholders in the process.

4. Select ventures

Select the venture idea that fits your innovation context best and recruit the right people (both intra- and entrepreneurs) for each.

5. Prototype & validate idea

Help the selected team define the right value proposition and business model based on an insight-driven product development bias and the corporate’s strategic priorities. Drive for market validation of the product as fast as possible, accepting that disruptive ideas will be more difficult to verify. Paper prototypes or digital “paper prototypes” are usually fine for this purpose. Iterate.

6. Build and launch

If the market validation is successful, grow the venture by planning the scaling of the offer and determining the right level of integration into the corporate’s organisational structure.

7. Iteration

Analyse your innovation process, learn from the past experience and try to adjust your innovation approach to improve it continuously.

Based on our experience, we believe that this approach has the best chances of creating relevant external innovation sparks for corporates because the innovation is in line with both the company’s interests and customer needs from the very beginning.

The right governance structure

But having the right approach alone isn’t going to ensure the sustainability of your efforts. If you’re thinking about upping your innovation game, you will also want to transform the core of your organisation:

1. The right organisation

Innovation thrives in a certain kind of organisational structure. Trying to make your innovation efforts fit the organisational structure of your company will most likely kill it. Allow for flat hierarchies and freedom, but still align the innovation efforts to your goals and strategy.

2. Balanced portfolio

Seek to create a well-balanced innovation portfolio based on short-term initiatives that drive your long-term, strategic innovation vision.

3. Capacity building

Build internal capacity within your organisation to internalise an innovation-friendly culture, and ensure the autonomy in alignment of your innovation department with the rest of your organisation.

4. Timing

Make sure to avoid the danger of killing good ideas too early because of your short-term financial goals, but also don’t miss the right moment to stop a failed venture.

In a project earlier this year with one of Australia’s large financial services providers, Claro did exactly that: First, we used our end-to-end innovation approach to help our client identify and understand the right opportunity areas to explore and transferred our knowledge into the client’s organisation. Then, we developed a toolkit that enabled the identification of the right venture ideas to serve the opportunity areas identified. While building a more resilient strategy, we also helped them develop a partnership engagement model to bring their innovations to market fast by collaborating with external companies. The first new ventures were launched to the market less than year after they created them with this approach.

The end of the innovation theatre

Corporations need to stop setting up siloed innovation departments or innovation labs that are just for show. Too many companies try to check the “innovation box” or – even worse – to make the company appear more innovative in shiny corporate brochures by establishing structures that are unsuited to create true innovation. The painful truth is that creating real innovation will always take time, commitment and the right approach. Even then, it is still a painful process. Unfortunately, it seems much more convenient to listen to the countless innovation gurus preaching “lean” innovation, promising an easy solution to the innovation challenge.

Unfortunately, the truth is, innovation is hard. It requires deep, quality thinking and time. There are efficient and inefficient ways to achieve it, but there are no shortcuts. Yet your ability to innovate will determine if your company is able to survive in a fast-changing world.

So, ask yourself the following:

1. Do you really understand your customers, their problems and unmet needs? Do you know how you’re going to solve these with your innovation efforts?

2. Do you know which area of your business has the most potential to innovative in? And can you explain why this is the right one for your company?

3. Do you have a strong innovation vision and the right portfolio of innovation projects in place to guide your organization in that direction?

4. Is your organization and culture suited for innovation? Do your employees understand where your innovation focus lies, what your customers will ask for in the future and how your company is going to serve those changing needs?

Make sure you create a broad understanding of your innovation context by first analysing disruptions, trends and emerging value propositions in relevant and adjacent markets. Then, obtain a deep understanding of your customer’s behaviours, needs and perceptions. Create the right frameworks and tools that summarise all your findings and help your teams innovate from a holistic understanding of your innovation ecosystem.

2. Identify opportunity areas

Based on that shared understanding of your innovation context, select the opportunity area(s) you want to pursue.

3. Ideate on ventures

Ideate on the right ventures to build within the opportunity areas identified, involving all relevant stakeholders in the process.

4. Select ventures

Select the venture idea that fits your innovation context best and recruit the right people (both intra- and entrepreneurs) for each.

5. Prototype & validate idea

Help the selected team define the right value proposition and business model based on an insight-driven product development bias and the corporate’s strategic priorities. Drive for market validation of the product as fast as possible, accepting that disruptive ideas will be more difficult to verify. Paper prototypes or digital “paper prototypes” are usually fine for this purpose. Iterate.

6. Build and launch

If the market validation is successful, grow the venture by planning the scaling of the offer and determining the right level of integration into the corporate’s organisational structure.

7. Iteration

Analyse your innovation process, learn from the past experience and try to adjust your innovation approach to improve it continuously.

Based on our experience, we believe that this approach has the best chances of creating relevant external innovation sparks for corporates because the innovation is in line with both the company’s interests and customer needs from the very beginning.

The right governance structure

But having the right approach alone isn’t going to ensure the sustainability of your efforts. If you’re thinking about upping your innovation game, you will also want to transform the core of your organisation:

1. The right organisation

Innovation thrives in a certain kind of organisational structure. Trying to make your innovation efforts fit the organisational structure of your company will most likely kill it. Allow for flat hierarchies and freedom, but still align the innovation efforts to your goals and strategy.

2. Balanced portfolio

Seek to create a well-balanced innovation portfolio based on short-term initiatives that drive your long-term, strategic innovation vision.

3. Capacity building

Build internal capacity within your organisation to internalise an innovation-friendly culture, and ensure the autonomy in alignment of your innovation department with the rest of your organisation.

4. Timing

Make sure to avoid the danger of killing good ideas too early because of your short-term financial goals, but also don’t miss the right moment to stop a failed venture.

In a project earlier this year with one of Australia’s large financial services providers, Claro did exactly that: First, we used our end-to-end innovation approach to help our client identify and understand the right opportunity areas to explore and transferred our knowledge into the client’s organisation. Then, we developed a toolkit that enabled the identification of the right venture ideas to serve the opportunity areas identified. While building a more resilient strategy, we also helped them develop a partnership engagement model to bring their innovations to market fast by collaborating with external companies. The first new ventures were launched to the market less than year after they created them with this approach.

The end of the innovation theatre

Corporations need to stop setting up siloed innovation departments or innovation labs that are just for show. Too many companies try to check the “innovation box” or – even worse – to make the company appear more innovative in shiny corporate brochures by establishing structures that are unsuited to create true innovation. The painful truth is that creating real innovation will always take time, commitment and the right approach. Even then, it is still a painful process. Unfortunately, it seems much more convenient to listen to the countless innovation gurus preaching “lean” innovation, promising an easy solution to the innovation challenge.

Unfortunately, the truth is, innovation is hard. It requires deep, quality thinking and time. There are efficient and inefficient ways to achieve it, but there are no shortcuts. Yet your ability to innovate will determine if your company is able to survive in a fast-changing world.

So, ask yourself the following:

1. Do you really understand your customers, their problems and unmet needs? Do you know how you’re going to solve these with your innovation efforts?

2. Do you know which area of your business has the most potential to innovative in? And can you explain why this is the right one for your company?

3. Do you have a strong innovation vision and the right portfolio of innovation projects in place to guide your organization in that direction?

4. Is your organization and culture suited for innovation? Do your employees understand where your innovation focus lies, what your customers will ask for in the future and how your company is going to serve those changing needs?

Bio:

Life and work experiences have given Pascal an unmatched vantage point, seeing things as both venture capitalist and aspiring entrepreneur. He currently is a Venture Partner with Santander Innoventures – Santander Group’s Global Fintech fund. Previously he was General Partner with Route 66 Ventures where he built the firm’s venture arm into a top 20 global fintech investor. Pascal puts his experience to work managing early and late stage equity investments (VC/PE). This perspective and his knowledge of banking, financial services and software services have made Pascal a true innovator in the VC arena. His current focus is on emerging and high-growth FinServ and FinTech companies in consensus ledger technology (his term for blockchain and distributed ledger technology), digital banking and insurance in the U.S., Europe, and Asia.

Pascal launched his career as a commercial banker for Europe’s Banque Paribas, in Paris. During the late 1980s, he moved to managing investments at Dai Ichi Kangyo Bank, the world’s largest commercial bank based in Tokyo. Here, he built a diverse, $500+ million portfolio in senior, subordinated loans, and equity investments. Pascal moved to the U.S. in 1990, where he cemented his passion for operating early stage ventures and investing.

Life and work experiences have given Pascal an unmatched vantage point, seeing things as both venture capitalist and aspiring entrepreneur. He currently is a Venture Partner with Santander Innoventures – Santander Group’s Global Fintech fund. Previously he was General Partner with Route 66 Ventures where he built the firm’s venture arm into a top 20 global fintech investor. Pascal puts his experience to work managing early and late stage equity investments (VC/PE). This perspective and his knowledge of banking, financial services and software services have made Pascal a true innovator in the VC arena. His current focus is on emerging and high-growth FinServ and FinTech companies in consensus ledger technology (his term for blockchain and distributed ledger technology), digital banking and insurance in the U.S., Europe, and Asia.

Pascal launched his career as a commercial banker for Europe’s Banque Paribas, in Paris. During the late 1980s, he moved to managing investments at Dai Ichi Kangyo Bank, the world’s largest commercial bank based in Tokyo. Here, he built a diverse, $500+ million portfolio in senior, subordinated loans, and equity investments. Pascal moved to the U.S. in 1990, where he cemented his passion for operating early stage ventures and investing.

Les médias du groupe Finyear

Lisez gratuitement :

FINYEAR

Le quotidien Finyear :

- Finyear Quotidien

Sa newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en Finance innovation & Digital transformation.

Ses 4 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The Chief Digital Officer

Finyear magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour choisir de recevoir un ou plusieurs médias Finyear

BLOCKCHAIN DAILY NEWS

Le quotidien Blockchain Daily News :

- Blockchain Daily News

Sa newsletter quotidienne :

- Blockchain Daily News Newsletter

Recevez chaque matin par mail la newsletter Blockchain daily News, une sélection quotidienne des meilleures infos et expertises en Blockchain révolution.

Sa lettre mensuelle digitale :

- The Chief Blockchain Officer

FINYEAR

Le quotidien Finyear :

- Finyear Quotidien

Sa newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en Finance innovation & Digital transformation.

Ses 4 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The Chief Digital Officer

Finyear magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour choisir de recevoir un ou plusieurs médias Finyear

BLOCKCHAIN DAILY NEWS

Le quotidien Blockchain Daily News :

- Blockchain Daily News

Sa newsletter quotidienne :

- Blockchain Daily News Newsletter

Recevez chaque matin par mail la newsletter Blockchain daily News, une sélection quotidienne des meilleures infos et expertises en Blockchain révolution.

Sa lettre mensuelle digitale :

- The Chief Blockchain Officer

Autres articles

-

Coinbase et Visa, un partenariat pour des transferts en temps réel

-

Brilliantcrypto, la nouvelle aventure play-to-earn basée sur la blockchain Polygon, arrive sur Epic Game Store

-

Nomination | Truffle Capital promeut Alexis Le Portz en qualité de Partner

-

IPEM Paris 2024 : 5500 participants au Palais des congrès

-

Pomelo annonce une Série A à 35 millions de dollars menée par Vy Capital