IMAGE SOURCE

Let’s look at some activity in in the crypto wallet space for the last two, three months. Earlier this month, Jack Dorsey tweeted that Square is considering developing a crypto hardware wallet that would give users greater control over how they store and spend their bitcoin. French hardware wallet startup Ledger has raised a $380 million Series C funding round bringing the company’s valuation to $1.5 billion; In March ImToken, the crypto wallet developer, announced it raised $30 million in Series B funding; Blockset, the blockchain infrastructure platform for enterprises by BRD, announced early access to its wallet-as-a-service today, providing a white-label solution that gives clients the ability to launch wallets; In April, Exodus, the creator of a popular non-custodial crypto wallet, raised $60 million by selling stock in the company and accepting as payment bitcoin, ethereum, and USDC stablecoin; In March, Coinbase announced that it acquired Cipher Browser, a mobile browser and Ethereum wallet provider; Last but not least, Binance has confirmed that it has acquired Trust Wallet, a mobile Ethereum wallet. Cryptocurrencies have been capturing the attention of investors and users alike, largely driven by their steep increase in value. As a result, the demand for crypto wallets in on the rise. Crypto wallets are interfaces to protocols and services, that enable consumers and merchants to unlock the value of the $1.5+ trillion in digital assets currently held in cryptocurrencies.

Wallets are critical infrastructure for cryptocurrencies. Every crypto behavior, whether buying or selling crypto, hodling crypto, sending crypto, staking crypto, relies on wallets in some way. Given their importance, over $1 billion of funding has gone to crypto wallet businesses to date, like Ledger ($380M), Blockchain ($300M), BRD ($55M), and Abra ($47M).

A cryptocurrency wallet is a secure digital gateway for users to see and transfer their digital currencies. Each crypto wallet has a public address, which can be thought of a bit like a mailbox, with the private key used to unlock the box. A user accesses and spends funds associated with a given address through the corresponding private key. Private keys are stored in crypto wallets, more similar to keychains than to traditional wallets. To be able to use any cryptocurrency for transactions, users are required to set up a cryptocurrency wallet first.

According to their preferences and expertise, users can choose among different types of crypto wallets. To name a few, hardware wallets are similar to USB drives, while desktop, mobile and web wallets are all software applications running on computers, smartphones or provided as a web service. Because private keys grant access to funds, the choice among wallets comes with strings attached in terms of privacy and security. Often wallets are custodial, which means storage and custody are offered as a service by a third party. This is the case of custodial exchanges, such as Coinbase. Alternatively, more skilled users want to retain sole custody of their private keys and use non-custodial wallets, also known as self-hosted or unhosted wallets.

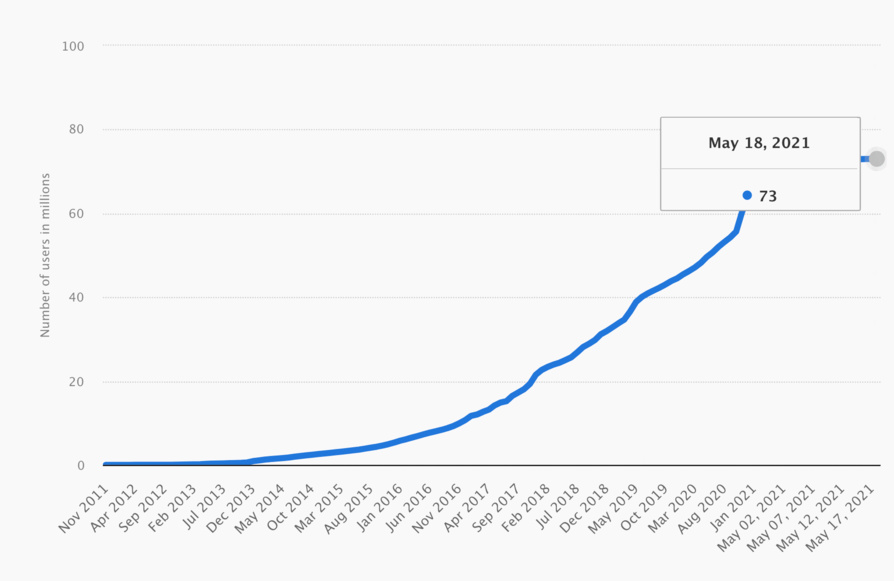

Juniper predicts that the number of people using digital wallets will reach nearly 4 billion, by 2024. According to Statista, 73 million users have been reportedly using wallets for digital transactions, as of May 18, 2021. The number continues to grow as new blockchain wallets and cryptocurrencies are introduced to the market. It is estimated that the global user base for all cryptocurrencies increased by nearly 200 percent between 2018 and 2021.

Let’s look at some activity in in the crypto wallet space for the last two, three months. Earlier this month, Jack Dorsey tweeted that Square is considering developing a crypto hardware wallet that would give users greater control over how they store and spend their bitcoin. French hardware wallet startup Ledger has raised a $380 million Series C funding round bringing the company’s valuation to $1.5 billion; In March ImToken, the crypto wallet developer, announced it raised $30 million in Series B funding; Blockset, the blockchain infrastructure platform for enterprises by BRD, announced early access to its wallet-as-a-service today, providing a white-label solution that gives clients the ability to launch wallets; In April, Exodus, the creator of a popular non-custodial crypto wallet, raised $60 million by selling stock in the company and accepting as payment bitcoin, ethereum, and USDC stablecoin; In March, Coinbase announced that it acquired Cipher Browser, a mobile browser and Ethereum wallet provider; Last but not least, Binance has confirmed that it has acquired Trust Wallet, a mobile Ethereum wallet. Cryptocurrencies have been capturing the attention of investors and users alike, largely driven by their steep increase in value. As a result, the demand for crypto wallets in on the rise. Crypto wallets are interfaces to protocols and services, that enable consumers and merchants to unlock the value of the $1.5+ trillion in digital assets currently held in cryptocurrencies.

Wallets are critical infrastructure for cryptocurrencies. Every crypto behavior, whether buying or selling crypto, hodling crypto, sending crypto, staking crypto, relies on wallets in some way. Given their importance, over $1 billion of funding has gone to crypto wallet businesses to date, like Ledger ($380M), Blockchain ($300M), BRD ($55M), and Abra ($47M).

A cryptocurrency wallet is a secure digital gateway for users to see and transfer their digital currencies. Each crypto wallet has a public address, which can be thought of a bit like a mailbox, with the private key used to unlock the box. A user accesses and spends funds associated with a given address through the corresponding private key. Private keys are stored in crypto wallets, more similar to keychains than to traditional wallets. To be able to use any cryptocurrency for transactions, users are required to set up a cryptocurrency wallet first.

According to their preferences and expertise, users can choose among different types of crypto wallets. To name a few, hardware wallets are similar to USB drives, while desktop, mobile and web wallets are all software applications running on computers, smartphones or provided as a web service. Because private keys grant access to funds, the choice among wallets comes with strings attached in terms of privacy and security. Often wallets are custodial, which means storage and custody are offered as a service by a third party. This is the case of custodial exchanges, such as Coinbase. Alternatively, more skilled users want to retain sole custody of their private keys and use non-custodial wallets, also known as self-hosted or unhosted wallets.

Juniper predicts that the number of people using digital wallets will reach nearly 4 billion, by 2024. According to Statista, 73 million users have been reportedly using wallets for digital transactions, as of May 18, 2021. The number continues to grow as new blockchain wallets and cryptocurrencies are introduced to the market. It is estimated that the global user base for all cryptocurrencies increased by nearly 200 percent between 2018 and 2021.

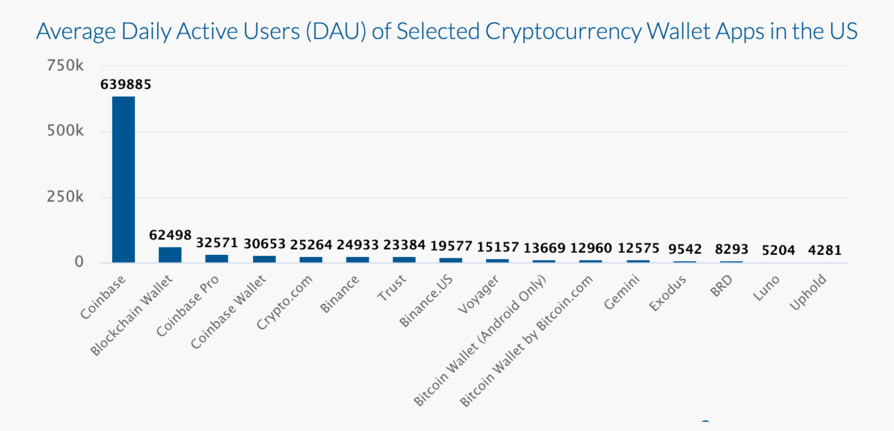

Trading in cryptocurrency is relatively easy compared to other assets. You can begin to trade just by signing up for various wallets on the market. There are different types of wallet apps, that support different cryptocurrencies, each with its own advantages, such as levels of security and accessibility. As of February 2021, there were at least 82 cryptocurrency wallets available (Cryptowisser, 2021). Among the most popular is Coinbase with 639,885 daily active users (DAUs) as of January 2021 (Airnow, 2021).

While wallets on centralized exchanges are really simple to use, the increasing number of crypto hacks have pushed businesses and individuals to non-custodial wallets. A report by the University of Cambridge says that 73% of the wallets do not save or control the private keys and 12% of the wallets let the users decide whether they wish the server to control their keys. It is expected even more users will move to non-custodial wallets, as more simplified approaches become available, that make it easy for users to recover their wallet.

Taking responsibility with a non-custodial wallet confers obvious benefits. For one thing, users are less likely to be hacked. As crypto price and adoption continue to grow, hackers will continue to focus on services with high concentrations of crypto. In 2020 alone, there were billions of dollars stolen during cryptocurrency heists. Storing assets on a big custodial provider, users are are risk of getting caught up in a data breach.

A lot of research and work is being done right now to design better wallet UX. For anyone that has ever written down seed phrases and private keys and stored them in a secret location, they understand that we need a lot more than a piece of paper, to make sure our money is safe. Non-custodial wallets need to become simpler and streamline user experience without compromizing security. They need to provide a simple banking-like experience, while maintaining custody and safety.

The future of crypto wallets is about the ability to provide well-integrated connections to every digital asset and financial service, focused on user experience and security. There will be many versions of wallets that hold various cryptocurrencies. But, unless you’re a digital native, the whole crypto experience feels scary. Most wallets lack the friendliness needed for the market to grow and achieve mass adoption. The first wallet to provide a name based public addresses, like a twitter handle, will get a big share of the market. Simplification of the user experience is the future of crypto wallets. While, crypto wallets can be a bit confusing to new users, riding the learning curve is worth it given the role wallets play in providing users with more financial freedom and economic opportunity.

Taking responsibility with a non-custodial wallet confers obvious benefits. For one thing, users are less likely to be hacked. As crypto price and adoption continue to grow, hackers will continue to focus on services with high concentrations of crypto. In 2020 alone, there were billions of dollars stolen during cryptocurrency heists. Storing assets on a big custodial provider, users are are risk of getting caught up in a data breach.

A lot of research and work is being done right now to design better wallet UX. For anyone that has ever written down seed phrases and private keys and stored them in a secret location, they understand that we need a lot more than a piece of paper, to make sure our money is safe. Non-custodial wallets need to become simpler and streamline user experience without compromizing security. They need to provide a simple banking-like experience, while maintaining custody and safety.

The future of crypto wallets is about the ability to provide well-integrated connections to every digital asset and financial service, focused on user experience and security. There will be many versions of wallets that hold various cryptocurrencies. But, unless you’re a digital native, the whole crypto experience feels scary. Most wallets lack the friendliness needed for the market to grow and achieve mass adoption. The first wallet to provide a name based public addresses, like a twitter handle, will get a big share of the market. Simplification of the user experience is the future of crypto wallets. While, crypto wallets can be a bit confusing to new users, riding the learning curve is worth it given the role wallets play in providing users with more financial freedom and economic opportunity.

Ilias Louis Hatzis

Ilias Louis Hatzis is the Founder & CEO at Mercato Blockchain Corporation AG.

Ilias Louis Hatzis is the founder and CEO at Kryptonio wallet. Create your wallet in less than a minute, without seed phrases, private keys, passwords or documents. Keep your bitcoin and digital assets always secure and recoverable: https://kryptonio.com

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Ilias Louis Hatzis is the founder and CEO at Kryptonio wallet. Create your wallet in less than a minute, without seed phrases, private keys, passwords or documents. Keep your bitcoin and digital assets always secure and recoverable: https://kryptonio.com

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Autres articles

-

Visa finalise l'acquisition de Featurespace

-

Tether investit dans StablR pour promouvoir l'adoption du stablecoin en Europe

-

Chainalysis acquiert Hexagate, fournisseur de solutions de sécurité WEB3

-

Nomination | Esker annonce la nomination de Dan Reeve en tant que membre du Comité Exécutif

-

Un montant de 1,8 million de dollars levé - La nouvelle ICO de Dogizen étonne les experts avec une approche inédite au monde