Financial markets were sent into a tailspin on Thursday on the news that Russia had begun a full-scale invasion of Ukraine, launching land, air and sea attacks on military bases, airfields and many of the country’s major cities.

Despite a whole raft of warnings from world leaders, and President Putin himself, financial markets have been caught wrong-footed by the news, holding onto misplaced optimism that a peaceful solution could be found that would avoid bloodshed. Ukraine has declared martial law, with residents fleeing the capital Kyiv and seeking shelter in metro stations and air raid shelters, while neighbouring countries have already begun taking in refugees. Dozens of both military and civilian fatalities have so far been reported and, unfortunately, the situation looks set to deteriorate before it gets better.

How have financial markets reacted so far?

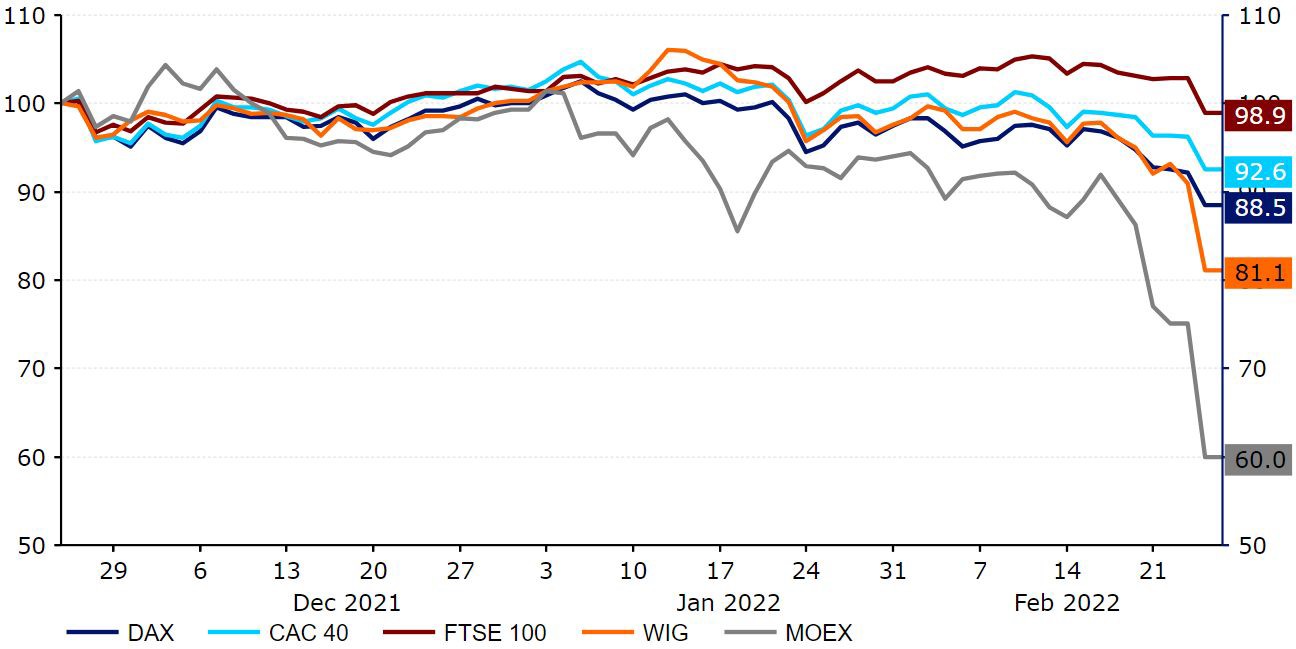

Unsurprisingly, the initial reaction in markets was to pile into the safe-haven assets at the expense of higher-risk ones, a traditional response to periods of intense uncertainty. Equity markets have sold-off across the board, notably in Europe - Germany’s DAX index, for instance, was down by around 5% to its lowest level in nine months, with most of the other major European indices nursing similar losses. Eastern European stocks have been hit particularly hard, down well in excess of 10% for the day in some cases. Russia’s MOEX index declined by 45% at one point, ending the day 34% lower.

Figure 1: European Equity Indices (23/02/2022 - 25/02/2022)

Source: Refinitiv Date: 25/02/2022

Despite a whole raft of warnings from world leaders, and President Putin himself, financial markets have been caught wrong-footed by the news, holding onto misplaced optimism that a peaceful solution could be found that would avoid bloodshed. Ukraine has declared martial law, with residents fleeing the capital Kyiv and seeking shelter in metro stations and air raid shelters, while neighbouring countries have already begun taking in refugees. Dozens of both military and civilian fatalities have so far been reported and, unfortunately, the situation looks set to deteriorate before it gets better.

How have financial markets reacted so far?

Unsurprisingly, the initial reaction in markets was to pile into the safe-haven assets at the expense of higher-risk ones, a traditional response to periods of intense uncertainty. Equity markets have sold-off across the board, notably in Europe - Germany’s DAX index, for instance, was down by around 5% to its lowest level in nine months, with most of the other major European indices nursing similar losses. Eastern European stocks have been hit particularly hard, down well in excess of 10% for the day in some cases. Russia’s MOEX index declined by 45% at one point, ending the day 34% lower.

Figure 1: European Equity Indices (23/02/2022 - 25/02/2022)

Source: Refinitiv Date: 25/02/2022

The sell-off in currencies has been led by the Russian ruble itself, which at one stage collapsed by almost 10% to a record low versus the US dollar, albeit some of these losses were partly recouped as European trading progressed. Most major currencies in the CEE region have followed suit, given both their close economic ties to Russia and physical proximity to the conflict. The Polish zloty and Hungarian forint fell by more-or-less 4% against the USD, with the Czech koruna down in excess of 2% on Thursday. Indeed, few emerging market currencies were spared from rather violent sell-offs. Many were down by more than 1% or more yesterday, with the exception of most of those in Asia, which have managed to hold up reasonably well, notably the Chinese yuan.

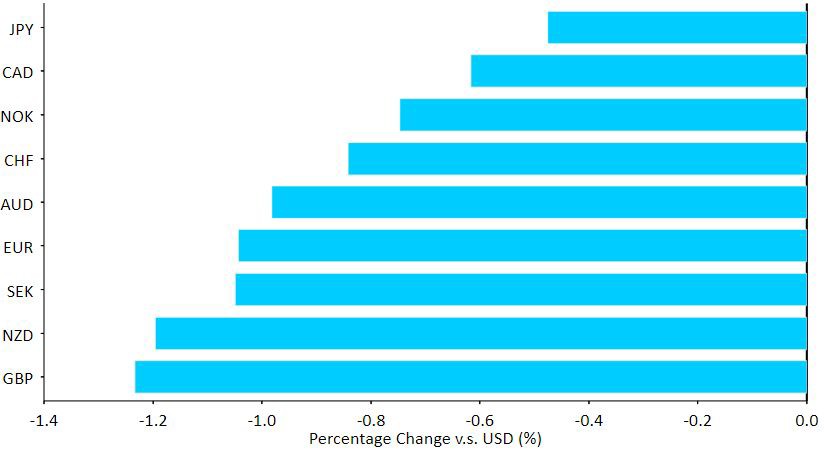

The sell-offs among the major currencies were initially largely contained, although these minor moves quickly turned into rather substantial losses as investors began speculating as to the repercussions of the conflict. As one would expect, the European currencies were hit the hardest, led by the Swedish krona and Norwegian krone. The euro also extended its early losses on Thursday afternoon, falling by more than one percent to its lowest level against the dollar since May 2020. Sterling fared no better, with cable dropping below the 1.33 level for the first time this year. Again, as is customary, the safe-haven currencies have outperformed, primarily the Japanese yen and US dollar - the US dollar index posted its largest one-day gain since the peak of the COVID-19 panic in March 2020 on Thursday.

Figure 2: G10 FX Performance Tracker (24/02/2022)

Source: Refinitiv Date: 25/02/2022

The sell-offs among the major currencies were initially largely contained, although these minor moves quickly turned into rather substantial losses as investors began speculating as to the repercussions of the conflict. As one would expect, the European currencies were hit the hardest, led by the Swedish krona and Norwegian krone. The euro also extended its early losses on Thursday afternoon, falling by more than one percent to its lowest level against the dollar since May 2020. Sterling fared no better, with cable dropping below the 1.33 level for the first time this year. Again, as is customary, the safe-haven currencies have outperformed, primarily the Japanese yen and US dollar - the US dollar index posted its largest one-day gain since the peak of the COVID-19 panic in March 2020 on Thursday.

Figure 2: G10 FX Performance Tracker (24/02/2022)

Source: Refinitiv Date: 25/02/2022

What are the economic implications of the Ukraine crisis?

Leaders around the world have responded to the invasion by imposing tougher sanctions on Russia, with more certain to be on the way. The EU is set to impose its harshest ever sanctions, blocking Russia’s access to key technologies and markets. The UK has announced a host of measures, including a freezing of all Russian bank assets, with US President Biden outlining “severe sanctions” on finance, tech and trade after what he condemned as an “unprovoked and unjustified” attack. The crisis triggered a sharp move higher in oil prices amid fears of a drop in Russian oil supply, the world’s second largest producer of the commodity. Brent crude oil futures have jumped to fresh 8-year highs, and are at around the $100 a barrel mark at the time of writing, with further advances likely. This has clear inflationary implications at a time when central banks around the world are already struggling to rein in rising consumer prices. We’ve also seen significant increases in prices of gas, as well as some other commodities, such as wheat.

Figure 3: Brent Crude Oil Futures (2021 - 2022)

Source: Refinitiv Date: 25/02/2022

Leaders around the world have responded to the invasion by imposing tougher sanctions on Russia, with more certain to be on the way. The EU is set to impose its harshest ever sanctions, blocking Russia’s access to key technologies and markets. The UK has announced a host of measures, including a freezing of all Russian bank assets, with US President Biden outlining “severe sanctions” on finance, tech and trade after what he condemned as an “unprovoked and unjustified” attack. The crisis triggered a sharp move higher in oil prices amid fears of a drop in Russian oil supply, the world’s second largest producer of the commodity. Brent crude oil futures have jumped to fresh 8-year highs, and are at around the $100 a barrel mark at the time of writing, with further advances likely. This has clear inflationary implications at a time when central banks around the world are already struggling to rein in rising consumer prices. We’ve also seen significant increases in prices of gas, as well as some other commodities, such as wheat.

Figure 3: Brent Crude Oil Futures (2021 - 2022)

Source: Refinitiv Date: 25/02/2022

At this stage, we see the impact on global growth as relatively minor. We expect the biggest hit to be felt by those countries that rely most heavily on Russia’s energy and commodity exports. Poland, Hungary and Bulgaria, for instance, rely on the country for more than 50% of their oil imports. With regards to gas, approximately 40% of the EU’s imports come from Russia. Aside from that, a worsening in business and consumer sentiment could have negative growth implications in the near-term, although the magnitude of the economic hit is impossible to predict and highly dependent on the length of the ensuing conflict. Importantly, a further increase in inflation could in itself have a negative impact on growth. Our view may well change as things unfold, but we do at least expect the “stagflation” narrative to become an increasingly more important one in the coming weeks.

We think that the impact of Russia’s invasion on monetary policy is not clear cut. On the one hand, we think that the crisis has inflationary implications, particularly given the move higher in oil prices and commodities in general. That being said, the risks to near-term global growth and significant uncertainty that the invasion has created may trigger caution among ratesetters, particularly in Europe. Ultimately, we think that the escalation in tensions is dovish in the short-term, but hawkish in the medium-term, and we are not necessarily rushing to revise lower our projections for interest rate hikes through the end of 2022.

What’s next for the foreign exchange market?

We expect risk-off trading to dominate the narrative in FX for a little while yet. The Japanese yen and US dollar are likely to receive additional support in the immediate-term, as tends to be the case during periods of worsening sentiment. We also see less of an impact of the crisis on Federal Reserve policy than we do for the European Central Bank, which may weigh further on EUR/USD. Oil-dependent currencies, including the likes of the Canadian dollar, may also receive a bit of support, should oil prices remain elevated or continue to march higher.

In our view, risk currencies appear vulnerable to additional losses for now. As mentioned, all signs suggest that the situation is likely to get worse, before it gets better, and a sharp immediate correction in markets appears highly unlikely. Ultimately, incoming headlines will determine the direction of markets, and we expect currencies to remain highly sensitive to developments in Ukraine as they hit the newswires. Details on the conflict look set to remain the number one driver of currencies for at least a little while yet.

We think that the impact of Russia’s invasion on monetary policy is not clear cut. On the one hand, we think that the crisis has inflationary implications, particularly given the move higher in oil prices and commodities in general. That being said, the risks to near-term global growth and significant uncertainty that the invasion has created may trigger caution among ratesetters, particularly in Europe. Ultimately, we think that the escalation in tensions is dovish in the short-term, but hawkish in the medium-term, and we are not necessarily rushing to revise lower our projections for interest rate hikes through the end of 2022.

What’s next for the foreign exchange market?

We expect risk-off trading to dominate the narrative in FX for a little while yet. The Japanese yen and US dollar are likely to receive additional support in the immediate-term, as tends to be the case during periods of worsening sentiment. We also see less of an impact of the crisis on Federal Reserve policy than we do for the European Central Bank, which may weigh further on EUR/USD. Oil-dependent currencies, including the likes of the Canadian dollar, may also receive a bit of support, should oil prices remain elevated or continue to march higher.

In our view, risk currencies appear vulnerable to additional losses for now. As mentioned, all signs suggest that the situation is likely to get worse, before it gets better, and a sharp immediate correction in markets appears highly unlikely. Ultimately, incoming headlines will determine the direction of markets, and we expect currencies to remain highly sensitive to developments in Ukraine as they hit the newswires. Details on the conflict look set to remain the number one driver of currencies for at least a little while yet.

Autres articles

-

La fintech hero obtient son agrément d'Etablissement de Paiement

-

Les meilleurs meme coins de Solana en novembre 2024 - Les 3 meilleurs choix de l'analyste

-

Initiation de paiement : Une solution innovante pour réduire les coûts et améliorer la sécurité des transactions pour les DAF

-

Leetchi s'émancipe un peu plus de Mangopay avec le rachat d'iRaiser

-

Nominations | Banque Hottinguer renforce ses équipes dédiée à la Gestion privée