As we get into the swing of things after a beautiful Greek summer, I thought I’d touch on a topic that has been on my mind for some time now.

Fifteen years ago, adtech was near and dear to my heart and today I will talk about how crypto may save the day in an industry that is going through some radical changes.

I am sure you’ve heard that third-party cookies are coming to end.

Let’s start with a little bit of history.

Netscape released cookies on October 13, 1994. We had first-party cookies and then third-party cookies. With cookies, a small piece of information would tag us, our browser to be exact, and track us on the web — within a website or across a network of websites.

During the web2 era, you didn’t have any control over your data or how it was stored. Companies would track and save your data without your permission.

How did they do it?

At first, big tech (FAAMG) only had data about what we did on their sites, from the first-party cookies they served us. But that was only a snapshot of us who we were. They need more data to create our complete profile. So they took the logical next step and rolled out ad networks and got every site on the planet to serve their cookies (a site would serve third-party cookies on behalf of Google, Facebook, and others) in return for a percentage of the ad dollars they were getting paid from advertisers.

With that, they had the whole enchilada, everything —who we were, where we’ve been, what we’ve seen, what we purchased, and how much we spent. Not only that, but with mobile phones in our pockets, they could track our behavior, location, and spending habits, and combine our digital profiles with our realworld data. All our little secrets were available to them. They knew exactly who we were and as we searched and browsed, they knew exactly what we were thinking. They took all that data, packaged it, and gave advertisers the tools to slice and dice it and target us with ads. In return, they became trillion-dollar companies.

Last year, just Google, Facebook, and Amazon made over $352 billion from advertising, thanks to our data. The global data broker market is expected to reach a whopping $345 billion by 2026.

They sold our data and became rich. What did we get out of this?

A good experience, relevant and personalized information — some say that we may even be influenced. in ways we were not aware of through our feeds and search results. It seems like everyone else did all the heavy lifting and they made all the money. The information we searched for was created by website owners and the content we shared on social media was created by us.

Last year, Apple and Google started phasing out third-party cookies and the GDPR and CCPA are leaving advertisers no choice but to adapt to a world where data practices are transparent.

Advertiser Perceptions’ latest analysis suggests that campaign performance will drop when cookies are deprecated next year, anywhere from 17-27%. As you can imagine, this is pushing advertisers to ramp up their investments in first-party data and other alternatives.

One of those other alternatives is NFTs.

NFTs are cryptographic assets on blockchain with a unique identification code and metadata that distinguishes them from each other, making them unique. An NFT is a digital record of ownership for an asset — for real-world items like artwork and real estate, or purely digital items like the Bored Ape collection. NFTs are not money, they are tokens that are 100% unique. NFTs are programmable and they can execute predetermined commands set by the issuer, letting the issuer earn money. NFTs will probably be the representation of our physical selves in a digital world. Now everyone will know if you’re a dog or not.

We’ve all heard of NFTs and art and some of the crazy amounts people have paid to buy one. But people are working on many different applications that involve NFTs. Some developers are working on projects that would let us sell our healthcare data to drug companies to cure diseases. Snoop Dogg wants to use NFTs to recreate music creation, and distribution and change how artists get paid. NFTs could power almost anything where authentication is a requirement, and be the “keys” that make our logins and transactions secure and transparent.

I am sure you’ve already figured out what I’m getting at.

Data is the most precious commodity of our time, yet we’ve been giving it away for free. The question is not whether big tech delivers value. The question is whether the economic exchange is fair or not.

NFTs can shift the balance of power in our favor and help us escape from the “Alcatraz” of “surveillance capitalism.”

Each one of us is a factory that continuously produces data — different kinds of data — every minute of the day. By turning the data we emit into NFTs, we can track, manage and sell our data to the highest bidder.

While NFTs in their existing form are leading the conversation for brands who are looking for ways to connect directly with their customers, there may be a wider application for this technology in the advertising ecosystem.

In web3, adtech will not center around massive databases and try to squeeze huge margins out of them, but instead, it will provide a benet to the users, publishers, and advertisers.

We own our browsing data and we will be able to make all of it or part of it available, to anyone we choose, on an exclusive or shared basis, and charge a price for it.

The Brave browser is the perfect example of a technology that let users get paid and be part of the value exchange. Brave is ad-free and allows users to browse without ads. It doesn’t collect or store any browsing and personal information and users can opt to see ads and receive rewards to their crypto wallets, for their attention — BAT tokens (1 BAT is around $0.35.

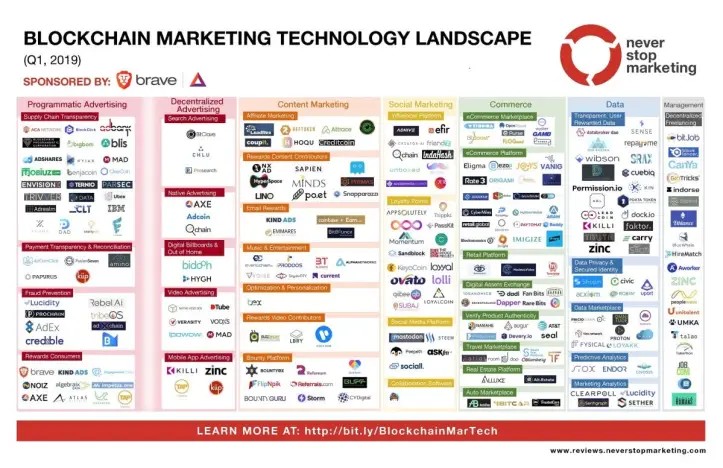

There are a lot of companies going after this space. An article in VentureBeat from 2019, shows there were 290 companies, with the number of companies growing 13x in 18 months.

Fifteen years ago, adtech was near and dear to my heart and today I will talk about how crypto may save the day in an industry that is going through some radical changes.

I am sure you’ve heard that third-party cookies are coming to end.

Let’s start with a little bit of history.

Netscape released cookies on October 13, 1994. We had first-party cookies and then third-party cookies. With cookies, a small piece of information would tag us, our browser to be exact, and track us on the web — within a website or across a network of websites.

During the web2 era, you didn’t have any control over your data or how it was stored. Companies would track and save your data without your permission.

How did they do it?

At first, big tech (FAAMG) only had data about what we did on their sites, from the first-party cookies they served us. But that was only a snapshot of us who we were. They need more data to create our complete profile. So they took the logical next step and rolled out ad networks and got every site on the planet to serve their cookies (a site would serve third-party cookies on behalf of Google, Facebook, and others) in return for a percentage of the ad dollars they were getting paid from advertisers.

With that, they had the whole enchilada, everything —who we were, where we’ve been, what we’ve seen, what we purchased, and how much we spent. Not only that, but with mobile phones in our pockets, they could track our behavior, location, and spending habits, and combine our digital profiles with our realworld data. All our little secrets were available to them. They knew exactly who we were and as we searched and browsed, they knew exactly what we were thinking. They took all that data, packaged it, and gave advertisers the tools to slice and dice it and target us with ads. In return, they became trillion-dollar companies.

Last year, just Google, Facebook, and Amazon made over $352 billion from advertising, thanks to our data. The global data broker market is expected to reach a whopping $345 billion by 2026.

They sold our data and became rich. What did we get out of this?

A good experience, relevant and personalized information — some say that we may even be influenced. in ways we were not aware of through our feeds and search results. It seems like everyone else did all the heavy lifting and they made all the money. The information we searched for was created by website owners and the content we shared on social media was created by us.

Last year, Apple and Google started phasing out third-party cookies and the GDPR and CCPA are leaving advertisers no choice but to adapt to a world where data practices are transparent.

Advertiser Perceptions’ latest analysis suggests that campaign performance will drop when cookies are deprecated next year, anywhere from 17-27%. As you can imagine, this is pushing advertisers to ramp up their investments in first-party data and other alternatives.

One of those other alternatives is NFTs.

NFTs are cryptographic assets on blockchain with a unique identification code and metadata that distinguishes them from each other, making them unique. An NFT is a digital record of ownership for an asset — for real-world items like artwork and real estate, or purely digital items like the Bored Ape collection. NFTs are not money, they are tokens that are 100% unique. NFTs are programmable and they can execute predetermined commands set by the issuer, letting the issuer earn money. NFTs will probably be the representation of our physical selves in a digital world. Now everyone will know if you’re a dog or not.

We’ve all heard of NFTs and art and some of the crazy amounts people have paid to buy one. But people are working on many different applications that involve NFTs. Some developers are working on projects that would let us sell our healthcare data to drug companies to cure diseases. Snoop Dogg wants to use NFTs to recreate music creation, and distribution and change how artists get paid. NFTs could power almost anything where authentication is a requirement, and be the “keys” that make our logins and transactions secure and transparent.

I am sure you’ve already figured out what I’m getting at.

Data is the most precious commodity of our time, yet we’ve been giving it away for free. The question is not whether big tech delivers value. The question is whether the economic exchange is fair or not.

NFTs can shift the balance of power in our favor and help us escape from the “Alcatraz” of “surveillance capitalism.”

Each one of us is a factory that continuously produces data — different kinds of data — every minute of the day. By turning the data we emit into NFTs, we can track, manage and sell our data to the highest bidder.

While NFTs in their existing form are leading the conversation for brands who are looking for ways to connect directly with their customers, there may be a wider application for this technology in the advertising ecosystem.

In web3, adtech will not center around massive databases and try to squeeze huge margins out of them, but instead, it will provide a benet to the users, publishers, and advertisers.

We own our browsing data and we will be able to make all of it or part of it available, to anyone we choose, on an exclusive or shared basis, and charge a price for it.

The Brave browser is the perfect example of a technology that let users get paid and be part of the value exchange. Brave is ad-free and allows users to browse without ads. It doesn’t collect or store any browsing and personal information and users can opt to see ads and receive rewards to their crypto wallets, for their attention — BAT tokens (1 BAT is around $0.35.

There are a lot of companies going after this space. An article in VentureBeat from 2019, shows there were 290 companies, with the number of companies growing 13x in 18 months.

Also, Blockdata has a pretty comprehensive list of adtech companies that are building blockchain and crypto solutions.

Beyond monetizing our data, NFTs could validate the authenticity of both digital and physical goods and purchases, connecting our online searches and research with offiine fulfillment.

For example, when a consumer is looking for a new car, usually he’s targeted with ads by the manufacturer and the dealership. But the loop doesn’t close when the purchase is completed and the advertiser continues to target the user with remarketing campaigns even after the purchase. Had the purchase been validated by an NFT token instead of a paper receipt, this could immediately stop the ads from running, since the customer is no longer looking to buy a car. This would lead to much higher campaign efficiency and accuracy, not to mention less frustrated users who are seeing non-relevant ads.

It’s not just our data. Our content will also be NFTs. We’ll be able to make money from the ad revenue our content generates on different platforms. Twitter has already launched a tipping service that comes from other users and not from their ad revenue.

NFTs can solve intellectual property issues and make sure that content creators are compensated on a performance basis. NFTs could provide a means to measure earned media exposure from all content, which could be a pretty powerful tool.

The Cambridge Analytica data breach presented us with a real problem. NFTs could make massive data hacks a thing of the past.

For now, the biggest barrier is usability which is usually the case with any nascent technology. But we are on the right track. The future of advertising is directly connected to the future of privacy and the future of data ownership and control. If you focus on that, things will be pretty clear beyond specific technologies.

Image Source

Beyond monetizing our data, NFTs could validate the authenticity of both digital and physical goods and purchases, connecting our online searches and research with offiine fulfillment.

For example, when a consumer is looking for a new car, usually he’s targeted with ads by the manufacturer and the dealership. But the loop doesn’t close when the purchase is completed and the advertiser continues to target the user with remarketing campaigns even after the purchase. Had the purchase been validated by an NFT token instead of a paper receipt, this could immediately stop the ads from running, since the customer is no longer looking to buy a car. This would lead to much higher campaign efficiency and accuracy, not to mention less frustrated users who are seeing non-relevant ads.

It’s not just our data. Our content will also be NFTs. We’ll be able to make money from the ad revenue our content generates on different platforms. Twitter has already launched a tipping service that comes from other users and not from their ad revenue.

NFTs can solve intellectual property issues and make sure that content creators are compensated on a performance basis. NFTs could provide a means to measure earned media exposure from all content, which could be a pretty powerful tool.

The Cambridge Analytica data breach presented us with a real problem. NFTs could make massive data hacks a thing of the past.

For now, the biggest barrier is usability which is usually the case with any nascent technology. But we are on the right track. The future of advertising is directly connected to the future of privacy and the future of data ownership and control. If you focus on that, things will be pretty clear beyond specific technologies.

Image Source

Ilias Louis Hatzis

Ilias Louis Hatzis is the Founder & CEO at Mercato Blockchain Corporation AG.

Ilias Louis Hatzis is the founder and CEO at Kryptonio wallet. Create your wallet in less than a minute, without seed phrases, private keys, passwords or documents. Keep your bitcoin and digital assets always secure and recoverable: https://kryptonio.com

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Ilias Louis Hatzis is the founder and CEO at Kryptonio wallet. Create your wallet in less than a minute, without seed phrases, private keys, passwords or documents. Keep your bitcoin and digital assets always secure and recoverable: https://kryptonio.com

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Autres articles

-

Dogizen, la première ICO sur Telegram, séduit les experts avec une augmentation de 1,4 million de dollars.

-

Revolut : ses quatre grands projets pour 2025

-

La fintech Bridge met en place une nouvelle gouvernance

-

Bangk, une ICO pour un projet de néobanque éthique et décentralisée

-

Deblock, la fintech s'offre le 2nd agrément PSAN attribué par l'AMF