A break from the medieval past.

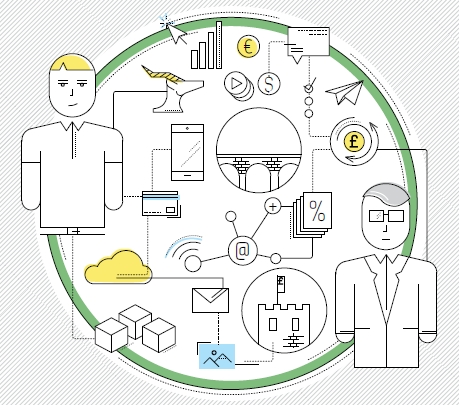

This second edition of our review of fintech trends and perspectives across Europe, the Middle East and Africa reveals the extent of the progress made so far in bridging the divide between new fintech innovators and established financial institutions. It also explains the mutually beneficial reasons for what at times appears an unwieldy alliance.

The report takes in the findings from an industry-wide survey of banks and established financial institutions, fintech start-ups and ecosystem participants alongside insights from over 20 interviews with financial institutions across Europe, fintech founders, investors and enterprise-level technology firms.

Significantly, nearly two years into the “fintech revolution” the report makes clear that the real journey has only just begun. As the fusion of the two sides gathers pace in the years ahead, and the full scale advantages of the agility of new digital entrants penetrate deeper into the old banking fortress, the research reveals widespread recognition that a platform-based approach to financial services delivery will, in time, transform twenty-first century finance, and finally enable the fortress to break free from the constraints of its medieval origins.

There will be several false dawns and plenty of failures, on both sides of the bridge, along the way. McKinsey estimates that there may be as many as 12,000 fintech start-ups out there. A number that will continue to grow as generational adoption patterns in mature markets, and smartphone availability in fast growing ones, peak. For those businesses with the stamina and institutional knowhow to go the distance however, the rewards will be worth the wait.

We hope you find this year’s report a valuable weapon as you weigh your approach to the era of open source innovation and we look forward to hearing more tales from the quest in the year ahead.

MagnaCarta Communications.

Download below the report (PDF 27 pages)

This second edition of our review of fintech trends and perspectives across Europe, the Middle East and Africa reveals the extent of the progress made so far in bridging the divide between new fintech innovators and established financial institutions. It also explains the mutually beneficial reasons for what at times appears an unwieldy alliance.

The report takes in the findings from an industry-wide survey of banks and established financial institutions, fintech start-ups and ecosystem participants alongside insights from over 20 interviews with financial institutions across Europe, fintech founders, investors and enterprise-level technology firms.

Significantly, nearly two years into the “fintech revolution” the report makes clear that the real journey has only just begun. As the fusion of the two sides gathers pace in the years ahead, and the full scale advantages of the agility of new digital entrants penetrate deeper into the old banking fortress, the research reveals widespread recognition that a platform-based approach to financial services delivery will, in time, transform twenty-first century finance, and finally enable the fortress to break free from the constraints of its medieval origins.

There will be several false dawns and plenty of failures, on both sides of the bridge, along the way. McKinsey estimates that there may be as many as 12,000 fintech start-ups out there. A number that will continue to grow as generational adoption patterns in mature markets, and smartphone availability in fast growing ones, peak. For those businesses with the stamina and institutional knowhow to go the distance however, the rewards will be worth the wait.

We hope you find this year’s report a valuable weapon as you weigh your approach to the era of open source innovation and we look forward to hearing more tales from the quest in the year ahead.

MagnaCarta Communications.

Download below the report (PDF 27 pages)

Les médias du groupe Finyear

Lisez gratuitement :

FINYEAR

Le quotidien Finyear :

- Finyear Quotidien

Sa newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en Finance innovation & Digital transformation.

Ses 4 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The Chief Digital Officer

Finyear magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour choisir de recevoir un ou plusieurs médias Finyear

BLOCKCHAIN DAILY NEWS

Le quotidien Blockchain Daily News :

- Blockchain Daily News

Sa newsletter quotidienne :

- Blockchain Daily News Newsletter

Recevez chaque matin par mail la newsletter Blockchain daily News, une sélection quotidienne des meilleures infos et expertises en Blockchain révolution.

Sa lettre mensuelle digitale :

- The Chief Blockchain Officer

FINYEAR

Le quotidien Finyear :

- Finyear Quotidien

Sa newsletter quotidienne :

- Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en Finance innovation & Digital transformation.

Ses 4 lettres mensuelles digitales :

- Le Directeur Financier

- Le Trésorier

- Le Credit Manager

- The Chief Digital Officer

Finyear magazine trimestriel digital :

- Finyear Magazine

Un seul formulaire d'abonnement pour choisir de recevoir un ou plusieurs médias Finyear

BLOCKCHAIN DAILY NEWS

Le quotidien Blockchain Daily News :

- Blockchain Daily News

Sa newsletter quotidienne :

- Blockchain Daily News Newsletter

Recevez chaque matin par mail la newsletter Blockchain daily News, une sélection quotidienne des meilleures infos et expertises en Blockchain révolution.

Sa lettre mensuelle digitale :

- The Chief Blockchain Officer

Autres articles

-

Coinbase et Visa, un partenariat pour des transferts en temps réel

-

Brilliantcrypto, la nouvelle aventure play-to-earn basée sur la blockchain Polygon, arrive sur Epic Game Store

-

Nomination | Truffle Capital promeut Alexis Le Portz en qualité de Partner

-

IPEM Paris 2024 : 5500 participants au Palais des congrès

-

Pomelo annonce une Série A à 35 millions de dollars menée par Vy Capital