On 9 November, Changpeng Zhao, the co-founder and CEO of digital asset trading platform Binance announced he was backing out of a non-binding agreement to acquire rival FTX, announced a day earlier. The failed acquisition of FTX is credit negative for the entire crypto market because it leaves FTX, one of the largest crypto market participants, and its customers in limbo. The price of bitcoin declined by 22% in 48 hours.

The failed acquisition came only a few days after news reports that FTX sister company Alameda Research held substantial amounts of FTT, native tokens FTX issued that Alameda reportedly used as collateral to increase its leverage. Following the news reports, which Alameda challenged as being incomplete, Zhao announced that Binance would liquidate all of its FTT holdings. (Binance did not discuss its motivation for the liquidation.) Before becoming rivals, Binance was an early backer of FTX, which was launched in 2019. When Binance exited its FTX investment in 2021, it received around $2.1 billion in BUSD (Binance USD, a fiat-backed stablecoin launched by Paxos and Binance) and FTT tokens.

These developments reportedly led to a dash for withdrawals from the FTX platform by its customers. The run on FTX echoed events between June and July 2022 that culminated in the bankruptcy of digital asset platforms Celsius Network LLC and Voyager Digital Holdings, among others.

Crypto losses so far by retail and digital asset institutional participants have largely remained contained within the crypto sphere, a credit positive for banks and evidence of banks’ fairly cautious approach to crypto in light of the uncertain regulatory environment. However, should leverage again build substantially in the crypto finance system, it could unsettle the banking system, even if banks continue distancing themselves from direct interaction with the crypto economy.

In crypto finance, it is not uncommon for crypto projects or platforms to issue their own tokens such as FTX’s FTT. The tokens are normally issued as rewards for platform users, and their value reflects the potential of project-offered crypto services as well as the overall user adoption and demand for those tokens. It is also common in crypto finance transactions to use digital assets as loan collateral. Therefore, it would have been possible for holders of FTT, including Alameda, to use it as collateral to increase leverage.

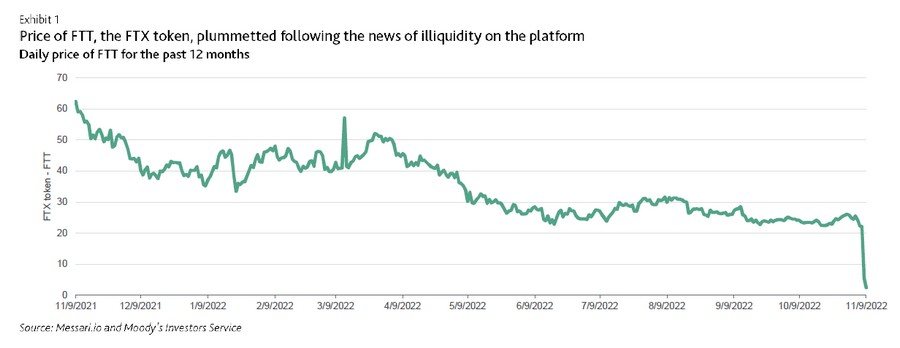

The general risks of crypto finance closely match those of traditional financial institutions, but the sector's opacity makes them harder to measure. The extension of credit in the crypto space is akin to traditional “balance sheet usage.” The “balance sheets” are analogous to classic bank balance sheets and generally carry similar types of credit, liquidity and operational risks to those of traditional bank and non-bank financial institutions, although for now crypto finance operates under different legal and regulatory frameworks than banks. Another important distinction is that the crypto finance system lacks official sector backstops such as a lender of last resort and deposit insurance. The lack of regulatory oversight and the sector's overall opacity facilitate risky financial strategies, exposing firms to an environment in which rumors of illiquidity can become self-fulfilling prophecies (see exhibit).

This publication does not announce a credit rating action. For any credit ratings referenced in this publication, please see the issuer/deal page on https://ratings.moodys.com for the most updated credit rating action information and rating history.

The failed acquisition came only a few days after news reports that FTX sister company Alameda Research held substantial amounts of FTT, native tokens FTX issued that Alameda reportedly used as collateral to increase its leverage. Following the news reports, which Alameda challenged as being incomplete, Zhao announced that Binance would liquidate all of its FTT holdings. (Binance did not discuss its motivation for the liquidation.) Before becoming rivals, Binance was an early backer of FTX, which was launched in 2019. When Binance exited its FTX investment in 2021, it received around $2.1 billion in BUSD (Binance USD, a fiat-backed stablecoin launched by Paxos and Binance) and FTT tokens.

These developments reportedly led to a dash for withdrawals from the FTX platform by its customers. The run on FTX echoed events between June and July 2022 that culminated in the bankruptcy of digital asset platforms Celsius Network LLC and Voyager Digital Holdings, among others.

Crypto losses so far by retail and digital asset institutional participants have largely remained contained within the crypto sphere, a credit positive for banks and evidence of banks’ fairly cautious approach to crypto in light of the uncertain regulatory environment. However, should leverage again build substantially in the crypto finance system, it could unsettle the banking system, even if banks continue distancing themselves from direct interaction with the crypto economy.

In crypto finance, it is not uncommon for crypto projects or platforms to issue their own tokens such as FTX’s FTT. The tokens are normally issued as rewards for platform users, and their value reflects the potential of project-offered crypto services as well as the overall user adoption and demand for those tokens. It is also common in crypto finance transactions to use digital assets as loan collateral. Therefore, it would have been possible for holders of FTT, including Alameda, to use it as collateral to increase leverage.

The general risks of crypto finance closely match those of traditional financial institutions, but the sector's opacity makes them harder to measure. The extension of credit in the crypto space is akin to traditional “balance sheet usage.” The “balance sheets” are analogous to classic bank balance sheets and generally carry similar types of credit, liquidity and operational risks to those of traditional bank and non-bank financial institutions, although for now crypto finance operates under different legal and regulatory frameworks than banks. Another important distinction is that the crypto finance system lacks official sector backstops such as a lender of last resort and deposit insurance. The lack of regulatory oversight and the sector's overall opacity facilitate risky financial strategies, exposing firms to an environment in which rumors of illiquidity can become self-fulfilling prophecies (see exhibit).

This publication does not announce a credit rating action. For any credit ratings referenced in this publication, please see the issuer/deal page on https://ratings.moodys.com for the most updated credit rating action information and rating history.

On the same day as the deal announcement, Coinbase Global, Inc. (Ba3/Ba2 negative)(1) said that it had a $15 million exposure in the form of deposits on FTX, which were there to facilitate business operations and client trades. This exposure is small and, as of 30 September, Coinbase held $5 billion in cash and cash equivalents on its balance sheet in addition to $368 million in USDC (a fiatbacked stablecoin). Coinbase operates a different business model than a number of centralized finance crypto platforms such as FTX, and its client funds (fiat and crypto) are not lent out or used to increase leverage.

Endnotes

(1) The ratings shown are Coinbase's corporate family rating and backed senior unsecured notes rating.

Endnotes

(1) The ratings shown are Coinbase's corporate family rating and backed senior unsecured notes rating.

Autres articles

-

Revolut : ses quatre grands projets pour 2025

-

La fintech Bridge met en place une nouvelle gouvernance

-

Bangk, une ICO pour un projet de néobanque éthique et décentralisée

-

Deblock, la fintech s'offre le 2nd agrément PSAN attribué par l'AMF

-

Crypto : Les grands magasins Printemps en partenariat avec Binance Pay et Lyzi pour accepter les paiements en cryptomonnaie