Blockchain Technology: A game-changer in accounting?

05/04/2016

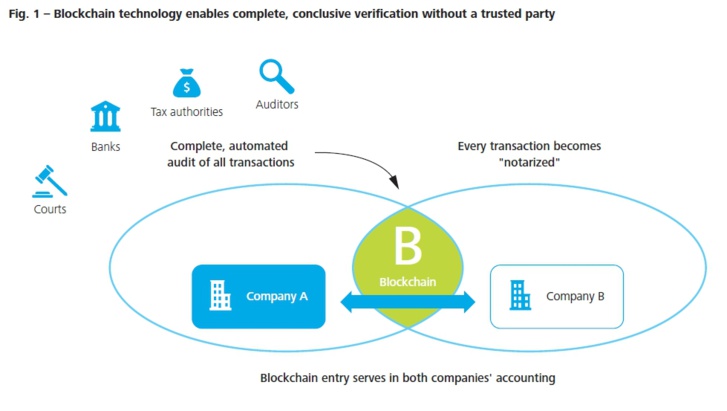

Blockchain technology has the potential to upend entire industries. Especially the financial sector may undergo disruptive change. Although this technology caught the attention of many of the largest financial institutions, use cases still remain in the experimental phase. This whitepaper lays out the benefits of the blockchain technology for specific use-cases in accounting across industries.

Digitalisation of the accounting system is still in its infancy compared to other industries, some of which have been massively disrupted by the advances of technology. Some of the reasons may be found in the exceptionally high regulatory requirements in respect to validity and integrity. The entire accounting system is built, such that forgery is impossible or at least very costly. To achieve this it relies on mutual control mechanisms, checks and balances. This inevitably affects every day’s operations. Among other things there are systematic duplication of efforts, extensive documentations and periodical controls. Most of them are manual, labour intensive tasks and far from being automated. To date, that seemed to be the sacrifice of revealing the truth.

The recently emerged Blockchain is a trustless, distributed ledger that is openly available and has negligible costs of use. The use of the Blockchain for accounting use-cases is hugely promising. From simplifying the compliance with regulatory requirements to enhancing the prevalent double entry bookkeeping, anything is imaginable.

The giant leap: How the Blockchain may enhance today’s accounting practice

Modern financial accounting is based on a double entry system. Double entry bookkeeping revolutionized the field of financial accounting during the Renaissance period; it solved the problem of managers knowing whether they could trust their own books. However, to gain the trust of outsiders, independent public auditors also verify the company’s financial information (1). Each audit is a costly exercise, binding the company’s accountants for long time periods.

The companies would benefit in many ways: Standardisation would allow auditors to verify a large portion of the most important data behind the financial statements automatically. The cost and time necessary to conduct an audit would decline considerably. Auditors could spend freed up time on areas they can add more value, e.g. on very complex transactions or on internal control mechanisms.

First steps towards Blockchain based accounting

It is not necessary to start with a joint register for all accounting-entries. The Blockchain as a source of trust can also be extremely helpful in today’s accounting structures. It can be gradually integrated with typical accounting procedures: starting from securing the integrity of records, to completely traceable audit trails. At the end of the road, fully automated audits may be reality.

At first, let us have a look at the case of keeping immutable records. The regulatory requirements for record keeping in Germany for example urge the proof of immutability over the entire retention period. For paper receipts, the risk of unnoticed modification is seen as comparably low, because of their physical nature. In contrast, electronic files cannot be perceived physically and hence are especially vulnerable. As a consequence, digitalizing paper records introduces the necessity for further preventive measures.

The result is a wide range of organizatory, technological and processual provisions. All preventive measures have to be documented in a conclusive manner for third parties. Unsurprisingly, many companies shy away from introducing a holistic electronic archiving system, although they are aware of the benefits.

Using the Blockchain makes it possible to prove integrity of electronic files easily. One approach is to generate a hash string of the file. That hash string represents the digital fingerprint of that file. Next, that fingerprint is immutably timestamped by writing it into the Blockchain via a transaction.

At any subsequent point in time, one can prove the integrity of that file by again generating the fingerprint and comparing it with the fingerprint stored in the Blockchain. In case the fingerprints are identical, the document remained unaltered since first writing the hash to the Blockchain.

To extend this concept, one may represent the life-cycle of each accounting incident on the Blockchain, including all relevant documents. Entire business processes, spanning over multiple departments or companies become easily traceable.

Finally, blockchain technology allows for smart contracts, i.e. computer programs that may execute under certain conditions. Think of an invoice paying for itself after checking that delivered goods have been received according to specifications and sufficient funds are available on the company’s bank account.

Conclusion

The blockchain technology has the potential to shapeshift the nature of today’s accounting. It may constitute a way to vastly automate accounting processes in compliance with the regulatory requirements. As described above, there are numerous starting points to leverage blockchain technology. A cascade of new applications will likely follow that are built on top of each other, leading way for new, unprecedented services.

(1) Stakeholders place their trust in the auditors retained by management to vouch for them. An obvious problem of agency is created by this arrangement: Do auditors work for the managers who hire and pay them or for the public that relies on their integrity in order to make decisions?

(2) For a more detailed explanation of the concepts also known as “triple entry accounting”, also refer to Ian Grigg’s paper “Triple Entry Accounting” or Bitcoin Magazine’s article authored by Jason M. Tyra.

By Nicolai Andersen

Partner, Leader Innovation

Deloitte Deutschland

http://www.deloitte.de

For more information please visit our website http://www.deloitte.com/de/blockchain

Participez aux conférences Blockchain éditées par Finyear :

Assurchain (6 avril 2016)

Blockchain Vision ( 12 avril 2016)

Blockchain Pitch Day (10 mai 2016)

Blockchain, IoT & IA (projet juin 2016)

Blockchain Hackathon (projet septembre 2016)

Les médias du groupe Finyear

Le quotidien Finyear :

– Finyear Quotidien

La newsletter quotidienne :

– Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d’affaires.

Les 6 lettres mensuelles digitales :

– Le Directeur Financier

– Le Trésorier

– Le Credit Manager

– The FinTecher

– The Blockchainer

– Le Capital Investisseur

Le magazine trimestriel digital :

– Finyear Magazine

Un seul formulaire d’abonnement pour recevoir un avis de publication pour une ou plusieurs lettres