Tokenized Venture Capital

08/10/2019

It was January 2012 on the Bitcoin Talk forum, when a software engineer from Seattle published a white paper with the title: “The Second Bitcoin White Paper“. The paper stated things like: “We claim that the existing Bitcoin network can be used as a protocol layer, on top of which new currency layers with new rules can be built …. We further claim that the new protocol layers … will provide initial funds to hire developers to build software which implements the new protocol layers, and … will richly reward early adopters of the new protocol.”

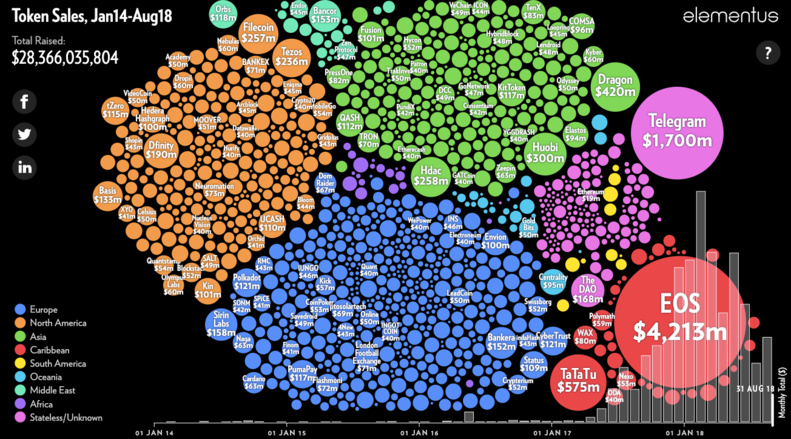

Little did J.R. Willett know that his crazy idea would fuel a the start of a “Cambrian explosion”, that created a couple of thousands tokens and raised over $32 billion in the last seven years during their ICOs, and left venture capitalists trying to figure out the future of their business.

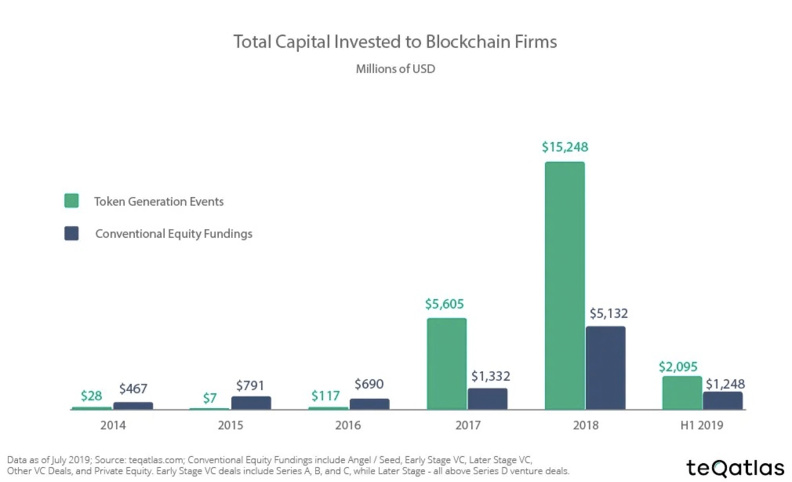

Tokens are a powerful new way of funding companies. The ICO phenomenon presents a huge threat to the traditional VC model. They offer an opportunity for liquid investments and faster exits. In 2017 and 2018, funds raised by blockchain startups through ICOs surpassed VC investments in the sector. The primary reason for the rise of ICOs is the difficulty that startups face, when they try raise a VC round.

While Initial Coin Offerings (ICOs) have had their fair share or problems, they are still here with us. They have matured and morphed into IEOs (initial Exchange Offerings), with cryptocurrency exchanges acting as underwriters.

Token Sales 1.0 were a completely out of control, with the issuer marketing directly to the contributor and raising too much money, far beyond their needs. But with IEOs, we are seeing a much more rational and sane approach. Exchanges are in the middle, acting as underwriters that filter projects, limit the number of projects and the size of the offering. This allows innovators to access capital markets to get the resources they need.

Beyond, IEOs. you can expect that in the future, Security tokens (STOs) are going to be huge. It’s going to be a while before STOs really take off, but when they do everything will be tokenized, including private equity and venture capital markets.

In the last four decades, VCs have helped create some of the greatest companies, like Apple, Microsoft, Google, Amazon and Facebook and in the process made tons of money for themselves and their LPs (Limited Partners).

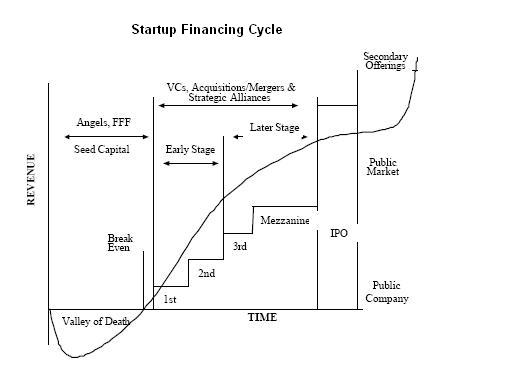

Venture capitalists invest in equity, so they look for startups that have big and fast exit potential. VCs look for startups that can scale quickly, in a few years from initial funding, and will be acquired or go public at high valuations. With nine our ten startups failing in their first three years, venture capital is high risk. From their winning picks, VCs need to recover their loses and make money for their investors. Wins don’t happen a lot, but when they do, they’re huge. Venture capital is a skewed-distribution business, sustained by highly lucrative, but low-probability payoff events. It’s very much like whaling in the nineteenth century.

When you look at the VC market, it’s a very competitive industry. VCs need to raise money to turn on the lights in the office. Limited Partners provide the capital, while General Partners invest it, into multiple startups, based on their investment thesis.

But regardless of the competition and the high risk involved, billions of dollars are poured into VC funds around the world, because of those few, big wins.

The biggest problem that venture capital industry faces is that VC funds are not liquid.

When it comes to investing in private companies, putting money into a venture is often the easy part. It’s getting the money out, hopefully more than what was originally invested, that’s the problem. Limited Partners are locked in for several years and in most cases are restricted from trading or selling their investments to other parties. Invested companies are expected to execute flawlessly for 5–7 years, and provide appreciation on the invested capital, through multiple fundraising rounds. An “exit” through merger or an acquisition is usually the most common way startup investors are able to liquidate their positions. After an exit event, VCs pass back the returns to the Limited Partners.

In the “The Business of Venture Capital”, Mahendra Ramsinghani describes the problem as follows: “A VC partnership is a 10-year blind- pool, a long relationship in which investors have limited ability to exit, and no clarity of outcomes.”

Making VC funds liquid can and will transform the entire industry.

Venture capital funds will become more inclusive, within regulatory frameworks, and potentially attract billions of new dollars. Liquid VC funds, will not only give qualified investors the option to exit early. It may also provide opportunities to increase IRR (Internal Rate of Return). Liquidity can provide a faster feedback loop. If people believe in the fund, the token price will go up. When a company exits, the returns go back into the fund. Smart contracts can seamlessly transfer money and ensure LPs and GPs receive the correct returns instantly. With increased IRR, General Partners will be in a better position to raise a new fund.

Liquidity opens venture capital to new audiences, making funds more inclusive. This is a huge advantage because more investors can afford to participate, without the need to forget about their money for 7-10 years. Tokens will be easily tradable on cryptocurrency exchanges. While secondary markets exist for LP positions, they are illiquid and the process can be very slow. In a tokenized fund, an investors can enter, exit and re-enter a fund as many times as they want. If an investor decides they would rather invest elsewhere, they sell their tokens at the current market price.

Venture capital is a powerful investment vehicle that allows emerging technologies to grow and develop. Tokenizing funds removes rigid positions of GP’s & LPs and allows them to collaboratively map investment efforts, with more liquidity to invest in even more startups. Tokenizing venture capital is even more powerful, and lets early-stage startups, not only survive but thrive.

He writes the Blockchain Weekly Front Page each Monday.I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Subscribe by email to join the 25,000 other Fintech leaders who read our research daily to stay ahead of the curve.

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

http://dailyfintech.com

Finyear & Chaineum

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear’s newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

————————

Chaineum :

Fondée en 2015, Chaineum est un cabinet de conseil en opérations de haut de bilan offrant une expertise de premier plan en matière d’ICO et STO, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

La division services blockchain de Chaineum, développe la technologie Chaineum Segment, une blockchain privée orientée objets.

About Chaineum:

Founded in 2015, Chaineum is a leading corporate finance advisory firm with a strong expertise in ICO and STO, and a strategic focus on both its clients’ business and blockchain technology. As such, Chaineum paved the way in the implementation of certain best practices in this sector (ICO Charter, Security Token Network).

Chaineum’s blockchain services division, is developing Chaineum Segment technology, an object-oriented private blockchain.

————————-

No Offer, Solicitation, Investment Advice, or Recommendations

No reference to any specific security constitutes a recommendation to buy, sell or hold that security or any other security.

Nothing on this website shall be considered a solicitation or offer to buy or sell any security, future, option or other financial instrument or to offer or provide any investment advice or service to any person in any jurisdiction.

Nothing contained on the website constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed on this website should not be taken as advice to buy, sell or hold any security. In preparing the information contained in this website, we have not taken into account the investment needs, objectives and financial circumstances of any particular investor.

This information has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient of this information and investments discussed may not be suitable for all investors.

Any views expressed on this website by us were prepared based upon the information available to us at the time such views were written. Changed or additional information could cause such views to change.

All information is subject to possible correction. Information may quickly become unreliable for various reasons, including changes in market conditions or economic circumstances.