Scientific advice about the blockchain

22/01/2016

In his report, Sir Mark focuses on a particular kind of distributed ledger, the bitcoin blockchain, and attempts to explain it to the general reader and then explore some of the potential uses. I’m particularly interested in his ideas about where it might be used in government, so I took the time to read through the report to examine, and learn from, his exploration.

" A new report from the UK Government Office for Science has recommended a broad government effort to explore and test blockchain and distributed ledger technology. "

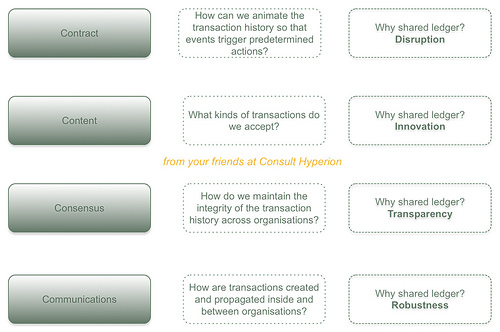

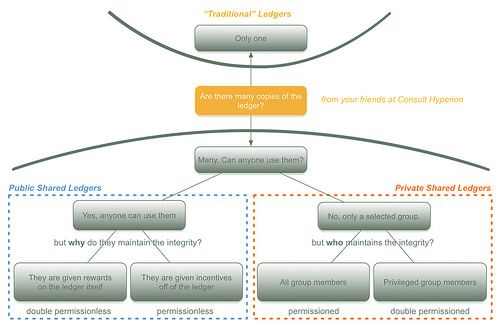

Personally, I found the report slightly confusing because it was jumping between ledgers, blockchains, the bitcoin blockchain and bitcoin almost on a paragraph by paragraph basis. I realise that I read the document from a very technical perspective and that I may see some of these things therefore in the wrong context, but I prefer Richard Brown’s term “shared ledger technology” as a starting point because I feel that the fact that multiple organisations share the ledger is more important than its architecture. I think the report might have benefited from some more description of shared ledgers, and the reasons why Moore’s Law and falling communications costs have made the core idea of everyone storing every transaction a plausible architecture. Here’s the way that we think about these things.

" We agree that blockchains could be used to build confidence in government services, through public auditability, and could also be used for widely distributed data collection and publishing, such as supply chain information. "

[From Comment: Blockchain technology is useful, but not for everything | News | Open Data Institute] (1)

Anyway putting my nerdy criticisms to one side, Sir Mark’s conclusions (which are essentially that the technology is worth exploring in government contexts) are surely correct: shared ledger technology is a genuinely new way of doing things, and it will certainly lead to new solutions for the government just as much as for business. As for the government applications, there report focuses on five areas: protecting critical infrastructure, welfare, international aid, innovation and VAT. As I mentioned before, I am not sure that the areas that relate to payments should be the immediate focus. I can see that using replicated distributed shared ledgers would add robustness to critical infrastructure and there are certainly applications where a robust and immutable public record is highly desirable. I was fortunate to be asked to chair techUK’s “Blockchain 101” session last week, for example, where John Sheridan, the Digital Director at the National Archives explored just this point.

Payments stuff is less clear to me. When it comes to VAT, for example, the report also mentions machine learning and quantum computing as techniques to reduce VAT fraud. I am in no position to judge but I would have thoughts that getting rid of cash would be a decent first step in closing the tax gap while we wait for quantum computing to track down the builders’ baksheesh. I do agree with the point about transparency though because sharing ledgers with regulators (and tax collectors) could help in a number of different ways.

When it comes to welfare I think that’s some of the ideas mentioned relating to digital identity are well worth exploring. There is a clear relationship between social and financial inclusion and this pivots on having a better identity infrastructure in place. It is entirely plausible that some form of bottom-up digital identity infrastructure that is built on shared ledgers could deliver better results than the identity infrastructure that we have at the moment or another attempted a top-down national identity system (while I am wholly in favour of a national entitlement system, that’s another topic).

When it comes to international aid, I suspect that once again the transparency aspect is of more practical use than the payments possibilities although obviously the high cost of international payments is an area where shared ledger technology could make a difference even if bitcoin does not. The idea of some form of cryptocurrency as a financial inclusion mechanism I think is something of a red herring. For the majority of the world’s population, M-PESA and TigoPay, AliPay and Zaad are much better ways to bring financial services to the excluded. Shared ledgers might have more of a role to play in the background, bringing interoperability into this space, something my colleagues have explored in this past.

But on to the last and most important point. Where I do strongly agree with the report is when it talks about market friction and innovation. Sir Mark highlights the potential around smart contracts and asset registration, and in our work for a number of clients (not only in financial services) this is the area that we have identified as most likely to be subject to longer term and more disruptive innovation. Remember the “4Cs” layer model at the beginning of the post? That top layer, the “contracts” layer, is where the unknown unknown lay. The work being done by companies such as Ethereum and Eris is only just beginning to explore the new domain of distributed, trusted applications and I don’t see why the government won’t be able to take as much advantage of this as anyone else.

So. In conclusion. Take the time to read the report (which kindly references my recent book “Identity is the New Money” (2), but that’s not why I think you should read it). There’s a lot of good stuff in there and it touches on many areas where the thinking is only just beginning. It’s great to see the technology being explored and taken seriously. Oh, and by the way, I wrote a piece called “it’s time to take stand against all the blockchain crap out there” for Finextra today, so read that too!

(1) http://theodi.org/blog/comment-blockchains-technology-useful-not-for-everything

(2) http://www.amazon.co.uk/Identity-Is-New-Money-Perspectives/dp/1907994122

(3) http://www.finextra.com/news/fullstory.aspx?newsitemid=28328&utm_medium=NewsFlash&utm_source=2016-1-20

Original link:

http://www.chyp.com/scientific-advice-about-the-blockchain/

Pour lire tous les articles Finyear dédiés Blockchain rendez-vous sur www.finyear.com/search/Blockchain/

Participez à la conférence "Blockchain Leaders" éditée par Finyear.

Pour cela inscrivez-vous sur www.bl0ckcha1n.com

Les médias du groupe Finyear

Le quotidien Finyear :

– Finyear Quotidien

La newsletter quotidienne :

– Finyear Newsletter

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises de la finance d’entreprise et de la finance d’affaires.

Les 6 lettres mensuelles digitales :

– Le Directeur Financier

– Le Trésorier

– Le Credit Manager

– The FinTecher

– The Blockchainer

– Le Capital Investisseur

Le magazine trimestriel digital :

– Finyear Magazine

Un seul formulaire d’abonnement pour recevoir un avis de publication pour une ou plusieurs lettres