In economics, we have market equilibrium when supply equals demand. However, markets are not always in equilibrium. When supply is greater than demand, prices go down. When the opposite occurs, when demand is higher than supply, we have scarcity, which in turn leads to higher prices. Wikipedia states that scarcity is the limited availability of a commodity. Scarcity is the state of being in short supply. But how does scarcity derive value? What does scarcity mean for Bitcoin?

The first Bitcoins were mined in January 2009. It took about 200 days to mine the first one million coins. This past Friday, the 18 millionth Bitcoin was mined. With only three million left to be mined, Bitcoin is the first scarce digital object the world has ever seen.

Bitcoin is scarce digital object, that is very similar and at the same time very different from other software. Usually software creates an abundance. While Bitcoin can be easily sent over the internet and allows fractional ownership, its limited supply makes it scarce, like silver and gold. By design, Softgoza Bitcoin was created to have a limited and finite supply. In fact, there are only 21 million Bitcoins that can ever be mined. When Satoshi Nakamoto published Bitcoin’s white paper, he wrote:

” As a thought experiment, imagine there was a base metal as scarce as gold but with the following properties: boring grey in colour, not a good conductor of electricity, not particularly strong [..], not useful for any practical or ornamental purpose .. and one special, magical property: can be transported over a communications channel”

Gold is mined out of the ground and Bitcoin is mined with by computers, that need a lot of electricity. Bitcoin is created through an energy intensive process, in which miners use high computing power to solve complex mathematical equations. New Bitcoins are created, when miners verify a block of transactions. They receive Bitcoins as a reward, thus putting more Bitcoin into circulation.

As the number of Bitcoins left to be earned continues to decrease, we are seeing the network grow. In September we saw the network hash rate pass a record 102 quintillion hashes, for the first time in Bitcoin’s history. Hash rate refers to the amount of computing power involved in processing Bitcoin transactions. More hashes means more competition, in other words more miners competing to obtain the block reward. Another new cryptocurrency technology on the rise are automatic trading robots like Bitcoin Trader which allow their users to trade with Bitcoin and Cryptocurrencies automatically as the softwares are programmed with algorithms.

Another major development is Bitcoin’s upcoming halving. On 14 May 2020, Bitcoin’s creation process will slow down and the amount of Bitcoin created, with each new block, will be cut in half. The reward for verifying a block will decrease from 12.5 to 6.25 coins.

If you look at previous halvings, you should be buying Bitcoin right now.

Before the halving in November 2012, the price of Bitcoin was $12, 50 Bitcoins being mined per block ($600) and the market was creating $604,800 new Bitcoins per week. After the halving new supply was reduced by $302,400 per week and the market cap to went up by $14 billion over the course of the following year. When the next halving took place in July 2016, Bitcoin was worth $650 per coin, 25 Bitcoins were mined per block ($16,250) and the market was absorbing $16,380,000 new Bitcoin per week. This time after the halving, new supply was reduced by $8,190,000 per week and the market cap grew by $300 billion in 18 months.

Currently, miners are earning 12.5 bitcoins per block, or approximately 1,800 Bitcoins per day. For the upcoming halving in May 2020, you do the math… but it should be big. Just buy a $100 worth of Bitcoin and hold on to it for a few years.

While we don’t for sure how Bitcoin will continue to spread or how quickly more people will start using it, we can be certain that a limited supply of Bitcoin, will cause prices to continue to increase. It will be at least another 100 years before all 21 million Bitcoins are mined. Bitcoin’s limited supply is a good thing, because it gives the coin anti-inflationary properties. Bitcoin‘s finite supply gives it scarcity, preventing it from being devalued by a limitless supply.

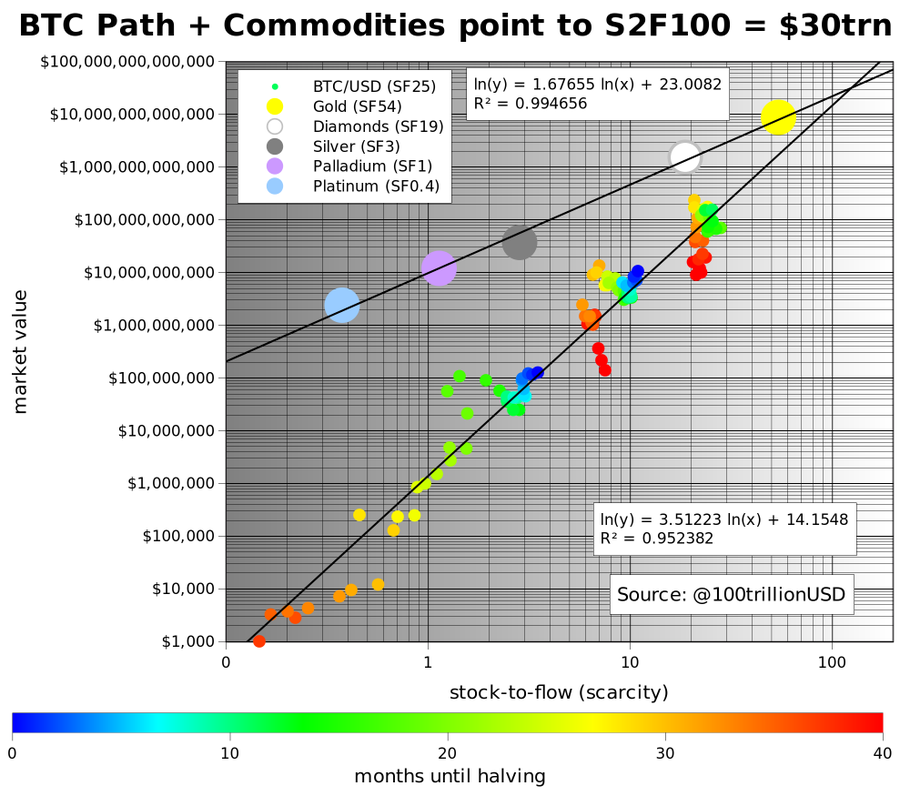

According to a model by PlanB, Bitcoin’s inflation rate, as shown by the stock-to-flow model, determines the price of the asset.

The first Bitcoins were mined in January 2009. It took about 200 days to mine the first one million coins. This past Friday, the 18 millionth Bitcoin was mined. With only three million left to be mined, Bitcoin is the first scarce digital object the world has ever seen.

Bitcoin is scarce digital object, that is very similar and at the same time very different from other software. Usually software creates an abundance. While Bitcoin can be easily sent over the internet and allows fractional ownership, its limited supply makes it scarce, like silver and gold. By design, Softgoza Bitcoin was created to have a limited and finite supply. In fact, there are only 21 million Bitcoins that can ever be mined. When Satoshi Nakamoto published Bitcoin’s white paper, he wrote:

” As a thought experiment, imagine there was a base metal as scarce as gold but with the following properties: boring grey in colour, not a good conductor of electricity, not particularly strong [..], not useful for any practical or ornamental purpose .. and one special, magical property: can be transported over a communications channel”

Gold is mined out of the ground and Bitcoin is mined with by computers, that need a lot of electricity. Bitcoin is created through an energy intensive process, in which miners use high computing power to solve complex mathematical equations. New Bitcoins are created, when miners verify a block of transactions. They receive Bitcoins as a reward, thus putting more Bitcoin into circulation.

As the number of Bitcoins left to be earned continues to decrease, we are seeing the network grow. In September we saw the network hash rate pass a record 102 quintillion hashes, for the first time in Bitcoin’s history. Hash rate refers to the amount of computing power involved in processing Bitcoin transactions. More hashes means more competition, in other words more miners competing to obtain the block reward. Another new cryptocurrency technology on the rise are automatic trading robots like Bitcoin Trader which allow their users to trade with Bitcoin and Cryptocurrencies automatically as the softwares are programmed with algorithms.

Another major development is Bitcoin’s upcoming halving. On 14 May 2020, Bitcoin’s creation process will slow down and the amount of Bitcoin created, with each new block, will be cut in half. The reward for verifying a block will decrease from 12.5 to 6.25 coins.

If you look at previous halvings, you should be buying Bitcoin right now.

Before the halving in November 2012, the price of Bitcoin was $12, 50 Bitcoins being mined per block ($600) and the market was creating $604,800 new Bitcoins per week. After the halving new supply was reduced by $302,400 per week and the market cap to went up by $14 billion over the course of the following year. When the next halving took place in July 2016, Bitcoin was worth $650 per coin, 25 Bitcoins were mined per block ($16,250) and the market was absorbing $16,380,000 new Bitcoin per week. This time after the halving, new supply was reduced by $8,190,000 per week and the market cap grew by $300 billion in 18 months.

Currently, miners are earning 12.5 bitcoins per block, or approximately 1,800 Bitcoins per day. For the upcoming halving in May 2020, you do the math… but it should be big. Just buy a $100 worth of Bitcoin and hold on to it for a few years.

While we don’t for sure how Bitcoin will continue to spread or how quickly more people will start using it, we can be certain that a limited supply of Bitcoin, will cause prices to continue to increase. It will be at least another 100 years before all 21 million Bitcoins are mined. Bitcoin’s limited supply is a good thing, because it gives the coin anti-inflationary properties. Bitcoin‘s finite supply gives it scarcity, preventing it from being devalued by a limitless supply.

According to a model by PlanB, Bitcoin’s inflation rate, as shown by the stock-to-flow model, determines the price of the asset.

The higher the SF ratio, meaning the lower the inflation rate that a commodity has, the higher the value of the asset should be. The PlanB model fits Bitcoin’s valuation to a 99.5% R2, implying that there is a high likelihood that Bitcoin will sky rocket, after the halving next May, and could reach over $100,000 a coin.

Scarcity can mean different things to different people. But scarcity creates value.

The notion of value is relatively subjective and mostly depends on the future demand for the asset. Bitcoin has brought scarcity and value into the realm of digital goods. Unlike music, videos, e-mail or software, that remain with with the sender after sending to someone, a Bitcoin spent is no longer available to the person that spent it. This is not the artificially imposed, legally constructed scarcity or type of DRM that attempts to use technical add-on. Bitcoin has set up a type of scarcity that is inherent and inseparable from the nature of the digital asset itself.

While there is no consensus on what gives cryptocurrencies value, I believe that knowing the current and future supply, is exactly the reason that cryptocurrencies value.

Scarcity can mean different things to different people. But scarcity creates value.

The notion of value is relatively subjective and mostly depends on the future demand for the asset. Bitcoin has brought scarcity and value into the realm of digital goods. Unlike music, videos, e-mail or software, that remain with with the sender after sending to someone, a Bitcoin spent is no longer available to the person that spent it. This is not the artificially imposed, legally constructed scarcity or type of DRM that attempts to use technical add-on. Bitcoin has set up a type of scarcity that is inherent and inseparable from the nature of the digital asset itself.

While there is no consensus on what gives cryptocurrencies value, I believe that knowing the current and future supply, is exactly the reason that cryptocurrencies value.

Ilias Louis Hatzis

Ilias Louis Hatzis is the Founder & CEO at Mercato Blockchain Corporation AG.

He writes the Blockchain Weekly Front Page each Monday.I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Subscribe by email to join the 25,000 other Fintech leaders who read our research daily to stay ahead of the curve.

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

http://dailyfintech.com

He writes the Blockchain Weekly Front Page each Monday.I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Subscribe by email to join the 25,000 other Fintech leaders who read our research daily to stay ahead of the curve.

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

http://dailyfintech.com

Finyear & Chaineum

Lisez gratuitement le quotidien Finyear & sa newsletter quotidienne.

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

------------------------

Chaineum :

Fondée en 2015, Chaineum est un cabinet de conseil en opérations de haut de bilan offrant une expertise de premier plan en matière d’ICO et STO, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

La division services blockchain de Chaineum, développe la technologie Chaineum Segment, une blockchain privée orientée objets.

About Chaineum:

Founded in 2015, Chaineum is a leading corporate finance advisory firm with a strong expertise in ICO and STO, and a strategic focus on both its clients' business and blockchain technology. As such, Chaineum paved the way in the implementation of certain best practices in this sector (ICO Charter, Security Token Network).

Chaineum's blockchain services division, is developing Chaineum Segment technology, an object-oriented private blockchain.

-------------------------

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

------------------------

Chaineum :

Fondée en 2015, Chaineum est un cabinet de conseil en opérations de haut de bilan offrant une expertise de premier plan en matière d’ICO et STO, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

La division services blockchain de Chaineum, développe la technologie Chaineum Segment, une blockchain privée orientée objets.

About Chaineum:

Founded in 2015, Chaineum is a leading corporate finance advisory firm with a strong expertise in ICO and STO, and a strategic focus on both its clients' business and blockchain technology. As such, Chaineum paved the way in the implementation of certain best practices in this sector (ICO Charter, Security Token Network).

Chaineum's blockchain services division, is developing Chaineum Segment technology, an object-oriented private blockchain.

-------------------------

No Offer, Solicitation, Investment Advice, or Recommendations

This website is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, nor does it constitute an offer to provide investment advisory or other services by FINYEAR.

No reference to any specific security constitutes a recommendation to buy, sell or hold that security or any other security.

Nothing on this website shall be considered a solicitation or offer to buy or sell any security, future, option or other financial instrument or to offer or provide any investment advice or service to any person in any jurisdiction.

Nothing contained on the website constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed on this website should not be taken as advice to buy, sell or hold any security. In preparing the information contained in this website, we have not taken into account the investment needs, objectives and financial circumstances of any particular investor.

This information has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient of this information and investments discussed may not be suitable for all investors.

Any views expressed on this website by us were prepared based upon the information available to us at the time such views were written. Changed or additional information could cause such views to change.

All information is subject to possible correction. Information may quickly become unreliable for various reasons, including changes in market conditions or economic circumstances.

No reference to any specific security constitutes a recommendation to buy, sell or hold that security or any other security.

Nothing on this website shall be considered a solicitation or offer to buy or sell any security, future, option or other financial instrument or to offer or provide any investment advice or service to any person in any jurisdiction.

Nothing contained on the website constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed on this website should not be taken as advice to buy, sell or hold any security. In preparing the information contained in this website, we have not taken into account the investment needs, objectives and financial circumstances of any particular investor.

This information has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient of this information and investments discussed may not be suitable for all investors.

Any views expressed on this website by us were prepared based upon the information available to us at the time such views were written. Changed or additional information could cause such views to change.

All information is subject to possible correction. Information may quickly become unreliable for various reasons, including changes in market conditions or economic circumstances.