According to Deutsche Bank the current money system is fragile. Deutsche Bank sees that by 2030 digital currencies will rise to over 200 million users. In the “Imagine 2030” report, Deutsche Bank suggests that digital currency could eventually replace cash one day, as demand for anonymity and a more decentralized means of payment grows.

Ilias Louis Hatzis is the Founder at Mercato Blockchain Corporation AG and a weekly columnist at DailyFintech.com

Usually this time of year, we start to read price predictions about Bitcoin going to a million bucks a coin. I’ve never been a big fan of price predictions. Some get them right, and most get them wrong. Price predictions are about short term gains, that are usually very fickle.

But a week ago, I read an interesting prediction in the news. Deutsche Bank made a very bold statement. The German bank published a research report called Imagine 2030. In this report the bank says that cryptocurrencies are currently just additions to the current money payment system. However, in the next decade they could be replacements.

Deutsche Bank predicts that the number of cryptocurrency users will grow 4x in the next ten years, reaching 200 million. This growth is almost same as that of Internet in its first 20 years.

Ilias Louis Hatzis is the Founder at Mercato Blockchain Corporation AG and a weekly columnist at DailyFintech.com

Usually this time of year, we start to read price predictions about Bitcoin going to a million bucks a coin. I’ve never been a big fan of price predictions. Some get them right, and most get them wrong. Price predictions are about short term gains, that are usually very fickle.

But a week ago, I read an interesting prediction in the news. Deutsche Bank made a very bold statement. The German bank published a research report called Imagine 2030. In this report the bank says that cryptocurrencies are currently just additions to the current money payment system. However, in the next decade they could be replacements.

Deutsche Bank predicts that the number of cryptocurrency users will grow 4x in the next ten years, reaching 200 million. This growth is almost same as that of Internet in its first 20 years.

The parallels between the Internet and crypto are stunning. Until Mosaic, the Internet was publicly funded and primarily used an academic setting. But enlightened policymakers decided to legalize commercial activity on the Internet. While, the Internet’s commercial use started with most people and businesses not knowing how to connect or use the Internet, the rails were put in place that would eventually change the future of everything.

The breakout years of simplified usage and huge user growth are not far away. The talent is abundant, the capital is here and the conditions like economic inclusion and freedom are ripe.

But, for all this to happen, there is one big uncertain x-factor. How will governments approach cryptocurrencies? For Deutsche Bank’s prediction to come true, we need enlightened policymakers that will legitimize cryptocurrencies. The report states: “First, they must become legitimate in the eyes of governments and regulators”. Very, true!

Crypto regulation could be just around the corner. As regulatory hurdles are surmounted, cryptocurrencies may become legitimate substitutes for fiat currency. Many governments will not sit by and lose control of the money supply without a vicious fight. Libra and other stablecoins may ultimately provide the road map to more widespread adoption, with stronger oversight by government regulators.

What’s even more remarkable about the report is a section that’s entitled “The end of fiat money?” That’s pretty wild, when you consider that this report comes from a huge global bank. What people in the cryptocurrency community have known for a while, banks are starting to realize now. But that’s good news!

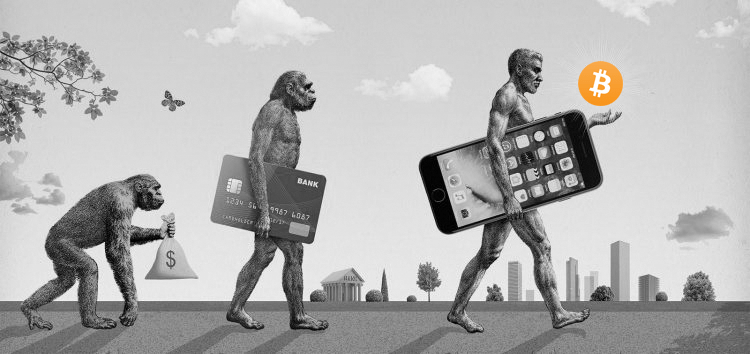

The real victim of crypto may not be fiat, but plastic cards. For decades now, meilleur casino en ligne pour les Canadiens, we’ve been slowly phasing out cash. Cash, credit and debit cards are slowly becoming obsolete and may continue on this course, as crypto acceptance increases. When you think about the evolution, we moved from paper money and coins to online transactions and debit/credit cards. The rise of mobile payments through WeChat Pay, AliPay and Paypal already makes plastic cards redundant. Blockchain offers plenty pf advantages over plastic cards, but the basic difference between the two, is that all payments and transfers are done with the user’s full consent. Deutsche Bank believes that plastic cards could die. As cryptocurrency adoption increases, it’s only logical to assume that credit cards will disappear. We simply won’t need them anymore.

Deutsche Bank is spot on with its prediction.

But, predictions are always tricky. Hindsight is 20/20. Right now, everyone wants to believe. We can taste the decentralized future. Things take time, but the countdown has begun. Cryptocurrencies have become more popular than you think. According to a survey, approximately 18% of students based in the US either own at least one digital currency or have owned one in the past.

Crypto can be both good and evil, like everything else in life. Many people fail to understand the real value of cryptocurrency, because they’re only focused on speculative trading, driven by price and volatility.

Crypto offers a unique solution that renders fiat currency obsolete. Cryptocurrency empowers people to be their own bank and payment method. The primary challenges are regulatory and technical. The deciding factor on whether crypto will replace cash is user-adoption. But, once fully booted and integrated in our lives, cryptocurrency will make the world will look completely different, in ways we can only begin to understand.

The breakout years of simplified usage and huge user growth are not far away. The talent is abundant, the capital is here and the conditions like economic inclusion and freedom are ripe.

But, for all this to happen, there is one big uncertain x-factor. How will governments approach cryptocurrencies? For Deutsche Bank’s prediction to come true, we need enlightened policymakers that will legitimize cryptocurrencies. The report states: “First, they must become legitimate in the eyes of governments and regulators”. Very, true!

Crypto regulation could be just around the corner. As regulatory hurdles are surmounted, cryptocurrencies may become legitimate substitutes for fiat currency. Many governments will not sit by and lose control of the money supply without a vicious fight. Libra and other stablecoins may ultimately provide the road map to more widespread adoption, with stronger oversight by government regulators.

What’s even more remarkable about the report is a section that’s entitled “The end of fiat money?” That’s pretty wild, when you consider that this report comes from a huge global bank. What people in the cryptocurrency community have known for a while, banks are starting to realize now. But that’s good news!

The real victim of crypto may not be fiat, but plastic cards. For decades now, meilleur casino en ligne pour les Canadiens, we’ve been slowly phasing out cash. Cash, credit and debit cards are slowly becoming obsolete and may continue on this course, as crypto acceptance increases. When you think about the evolution, we moved from paper money and coins to online transactions and debit/credit cards. The rise of mobile payments through WeChat Pay, AliPay and Paypal already makes plastic cards redundant. Blockchain offers plenty pf advantages over plastic cards, but the basic difference between the two, is that all payments and transfers are done with the user’s full consent. Deutsche Bank believes that plastic cards could die. As cryptocurrency adoption increases, it’s only logical to assume that credit cards will disappear. We simply won’t need them anymore.

Deutsche Bank is spot on with its prediction.

But, predictions are always tricky. Hindsight is 20/20. Right now, everyone wants to believe. We can taste the decentralized future. Things take time, but the countdown has begun. Cryptocurrencies have become more popular than you think. According to a survey, approximately 18% of students based in the US either own at least one digital currency or have owned one in the past.

Crypto can be both good and evil, like everything else in life. Many people fail to understand the real value of cryptocurrency, because they’re only focused on speculative trading, driven by price and volatility.

Crypto offers a unique solution that renders fiat currency obsolete. Cryptocurrency empowers people to be their own bank and payment method. The primary challenges are regulatory and technical. The deciding factor on whether crypto will replace cash is user-adoption. But, once fully booted and integrated in our lives, cryptocurrency will make the world will look completely different, in ways we can only begin to understand.

Ilias Louis Hatzis

Ilias Louis Hatzis is the Founder & CEO at Mercato Blockchain Corporation AG.

He writes the Blockchain Weekly Front Page each Monday.I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Subscribe by email to join the 25,000 other Fintech leaders who read our research daily to stay ahead of the curve.

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

http://dailyfintech.com

He writes the Blockchain Weekly Front Page each Monday.I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

Subscribe by email to join the 25,000 other Fintech leaders who read our research daily to stay ahead of the curve.

I have no positions or commercial relationships with the companies or people mentioned. I am not receiving compensation for this post.

http://dailyfintech.com

(adsbygoogle = window.adsbygoogle || []).push({});

Finyear & Chaineum

Lisez gratuitement le quotidien Finyear & sa newsletter quotidienne.

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

------------------------

Chaineum :

Fondée en 2015, Chaineum est une boutique STO offrant une expertise de premier plan en matière d’ICO et STO, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

La division services blockchain de Chaineum, développe la technologie Chaineum Segment, une blockchain privée orientée objets.

About Chaineum:

Founded in 2015, Chaineum is a STO Boutique with a strong expertise in ICO and STO, and a strategic focus on both its clients' business and blockchain technology. As such, Chaineum paved the way in the implementation of certain best practices in this sector (ICO Charter, Security Token Network).

Chaineum's blockchain services division, is developing Chaineum Segment technology, an object-oriented private blockchain.

-------------------------

Recevez chaque matin par mail la newsletter Finyear, une sélection quotidienne des meilleures infos et expertises en finance digitale, corporate finance & crypto finance.

Read for free The daily newspaper Finyear & its daily newsletter.

Receive the Finyear's newsletter every morning by email, a daily snapshot of the best news and expertise in digital finance, corporate finance & crypto finance.

------------------------

Chaineum :

Fondée en 2015, Chaineum est une boutique STO offrant une expertise de premier plan en matière d’ICO et STO, avec une vision stratégique orientée tant vers le métier de ses clients que sur la technologie blockchain. A ce titre, Chaineum a participé à la mise en œuvre de bonnes pratiques dans le secteur (ICO Charter, Security Token Network).

La division services blockchain de Chaineum, développe la technologie Chaineum Segment, une blockchain privée orientée objets.

About Chaineum:

Founded in 2015, Chaineum is a STO Boutique with a strong expertise in ICO and STO, and a strategic focus on both its clients' business and blockchain technology. As such, Chaineum paved the way in the implementation of certain best practices in this sector (ICO Charter, Security Token Network).

Chaineum's blockchain services division, is developing Chaineum Segment technology, an object-oriented private blockchain.

-------------------------

No Offer, Solicitation, Investment Advice, or Recommendations

This website is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, nor does it constitute an offer to provide investment advisory or other services by FINYEAR.

No reference to any specific security constitutes a recommendation to buy, sell or hold that security or any other security.

Nothing on this website shall be considered a solicitation or offer to buy or sell any security, future, option or other financial instrument or to offer or provide any investment advice or service to any person in any jurisdiction.

Nothing contained on the website constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed on this website should not be taken as advice to buy, sell or hold any security. In preparing the information contained in this website, we have not taken into account the investment needs, objectives and financial circumstances of any particular investor.

This information has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient of this information and investments discussed may not be suitable for all investors.

Any views expressed on this website by us were prepared based upon the information available to us at the time such views were written. Changed or additional information could cause such views to change.

All information is subject to possible correction. Information may quickly become unreliable for various reasons, including changes in market conditions or economic circumstances.

No reference to any specific security constitutes a recommendation to buy, sell or hold that security or any other security.

Nothing on this website shall be considered a solicitation or offer to buy or sell any security, future, option or other financial instrument or to offer or provide any investment advice or service to any person in any jurisdiction.

Nothing contained on the website constitutes investment advice or offers any opinion with respect to the suitability of any security, and the views expressed on this website should not be taken as advice to buy, sell or hold any security. In preparing the information contained in this website, we have not taken into account the investment needs, objectives and financial circumstances of any particular investor.

This information has no regard to the specific investment objectives, financial situation and particular needs of any specific recipient of this information and investments discussed may not be suitable for all investors.

Any views expressed on this website by us were prepared based upon the information available to us at the time such views were written. Changed or additional information could cause such views to change.

All information is subject to possible correction. Information may quickly become unreliable for various reasons, including changes in market conditions or economic circumstances.